/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

AI infrastructure stocks grab headlines, but not every company rides the same wave. Giants like Nvidia (NVDA) and Amazon (AMZN) fuel the AI boom, yet a handful of niche players stand to benefit disproportionately if GPU demand keeps climbing.

One of those fast-rising contenders is CoreWeave (CRWV), a GPU-as-a-service provider that’s drawing bullish attention from Wall Street. Recently, Raymond James launched coverage with an “Outperform” and a $130 target, and Citizens just bumped its stance to “Market Outperform,” setting a bold $180 price target that implies roughly 50% upside from current levels. Analysts point to a fresh $6.3 billion order arrangement with Nvidia, a path to $20 billion in ARR by 2027, and a booming GPU-as-a-service market that could swell into the hundreds of billions.

For investors hunting high-growth exposure to the AI cloud layer, CoreWeave’s founder-led team, hyperscaler partnerships, and scalable GPU stack make it a name worth watching.

About CRWV Stock

Valued at $65 billion by market cap, CoreWeave is a fast-growing “neocloud” provider specializing in GPU-as-a-service for AI workloads. Backed by exclusive partnerships with Nvidia, it delivers cutting-edge compute capacity faster than traditional hyperscalers. With strategic acquisitions, global data center expansion, and deep ties to enterprises and governments, CoreWeave is positioning itself as a critical backbone of next-generation AI infrastructure.

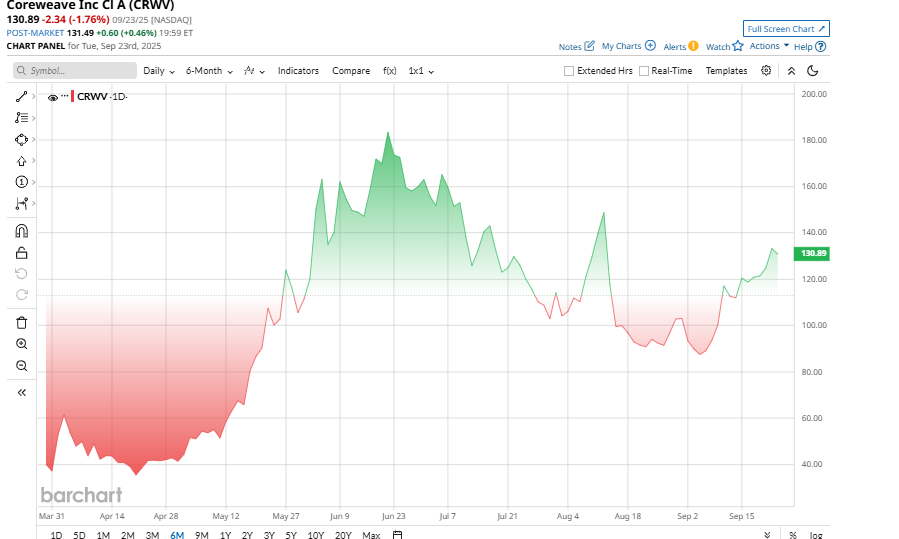

CoreWeave’s stock has been among the market’s top performers in 2025. Since its March IPO, CRWV has roughly tripled, up about 200% year-to-date (YTD), as investors bet on its AI cloud platform. That surge came despite a summer pullback that saw CRWV fall roughly 50% from its June highs.

CoreWeave’s valuation is a subject of debate. On a forward basis, the stock trades at roughly 10–12 times 2025 revenue, lower than peers like Palantir (PLTR), but reflecting its rapid growth and cash burn. Its price-to-sales (P/S) multiple is actually below Nvidia’s and Palantir’s, while its growth rate is much higher. Citi notes that its 6 times 2027 revenue and 22 times 2027 EBIT multiples are well below legacy cloud peers. Critics argue the current market cap (in the tens of billions) implies very long-term growth, given CoreWeave’s losses and high debt.

AI Strategy and UK Expansion

CoreWeave’s bullish case rests on its role as a “hyperscaler” AI infrastructure provider, renting Nvidia GPU capacity to AI labs, enterprises, and hyperscalers. It was the first to deploy Nvidia’s Blackwell GB200 and Grace Blackwell GPUs at scale, which shows its exclusive hardware access. Strategic acquisitions, including Core Scientific and Weights & Biases, expand both data center capacity and AI development tools, positioning CoreWeave as a one-stop AI compute platform.

Internationally, it has committed £15 billion ($20 million) to UK AI data centers with Nvidia and DataVita, aligning with the UK’s AI strategy. Further global expansions highlight its growing influence in AI infrastructure.

CRWV Beats Q2 Earnings Estimate

CoreWeave’s latest earnings underpinned the bullish views. In Q2 2025, revenue was $1.212 billion, up over 200% from $395.4 million a year earlier, about +207% YoY. That marked the company’s first $1 billion quarter. Key drivers included massive new customer wins, e.g., a $4 billion OpenAI expansion on top of an earlier $11.9 billion deal, and expanded capacity at hyperscalers and labs. CoreWeave ended the quarter with about 470 megawatts of active data center power (contracted up to 2.2 gigawatts), reflecting aggressive build-out to meet surging AI demand.

Despite the revenue surge, Q2 net loss and EPS missed analyst expectations. CoreWeave reported a $0.54 diluted loss per share, wider than the street estimate for a $0.49 loss. The shortfall was largely due to heavy investments: R&D, facilities, and stock-based pay. Operating expenses jumped in line with growth, yielding a 2% GAAP operating margin vs. 20% a year ago, highlighting the scaling costs.

Turning to the balance sheet, CoreWeave ended Q2 with about $1.153 billion in unrestricted cash and roughly $900 million in restricted cash, versus $1.361 billion a year prior. The company is burning cash: Q2 operations used $251 million, while capex was $2.453 billion, yielding negative free cash flow of about $2.7 billion for the quarter. Management says this aggressive reinvestment is necessary to relieve supply constraints in the AI cloud.

Looking ahead, CoreWeave raised its full-year revenue forecast on the earnings call. It now expects 2025 revenue of $5.15 to 5.35 billion, up from the prior range of $4.9 to 5.1 billion, and well above last year’s $1.9 billion.

What Analysts Say About CRWV Stock

Wall Street’s analysts are divided but generally positive on CoreWeave. As noted above, Citizens JMP now rates CRWV “Outperform” with a $180 target, seeing CoreWeave as a “GPU-as-a-Service” cloud leader and low-multiple valuation play.

Similarly, H.C. Wainwright's Kevin Dede also upgraded to “Buy” with a price target of $180, highlighting the stock’s 50% pullback as an attractive buying opportunity.

Most recently, Wells Fargo upgraded CoreWeave to “Overweight” from “Equal Weight,” lifting its price target to $170 from $105. Analyst Michael Turrin cited strong demand signals, ongoing AI infrastructure buildouts, and supply shortages through 2026, noting CoreWeave’s expansion into major AI compute consumers positions it for potential share gains.

By contrast, Morgan Stanley is more cautious, “Equal Weight” with a price target of $91, citing customer concentration and reserving judgment on diversification.

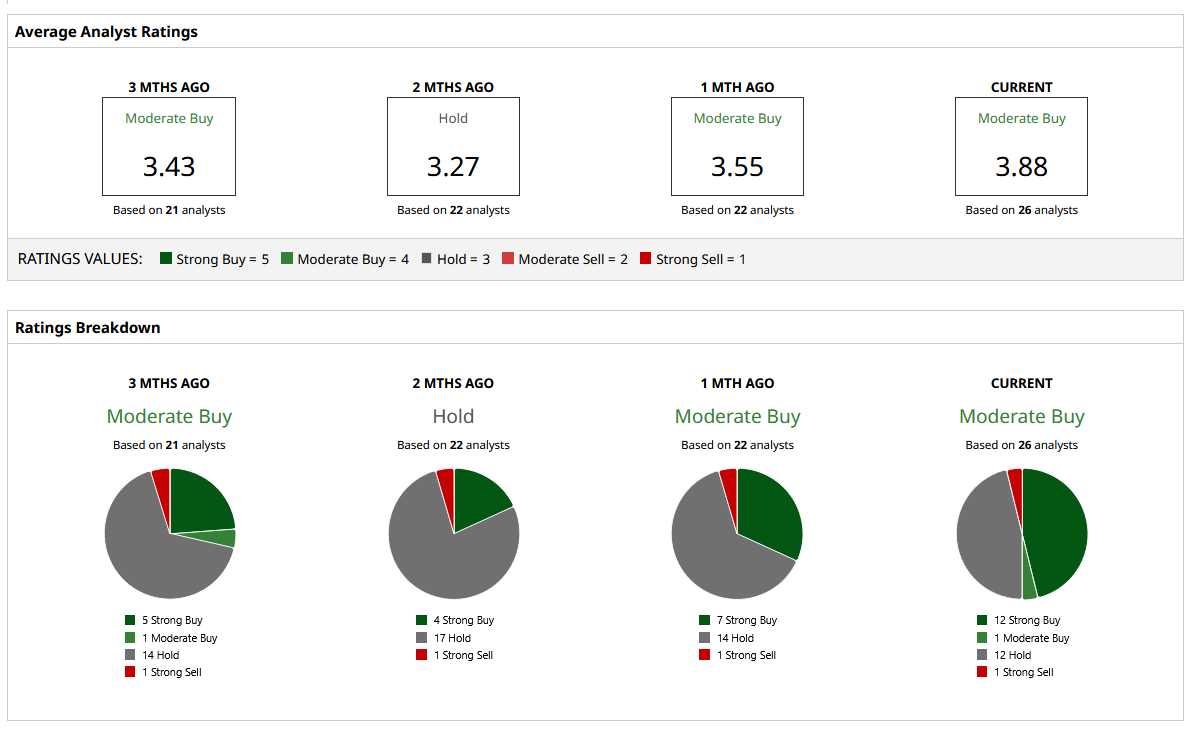

Overall, analysts have taken a tentatively positive stance with a consensus “Moderate Buy” rating. Among 26 analysts covering CRWV stock, 12 give it a “Strong Buy,” one a “Moderate Buy,” 12 a “Hold,” and only one a “Strong Sell” rating. Despite the recent pullback, CoreWeave stock trades near its price target of $131. However, its street high target of $180 implies more than 54% upside potential from current levels.