/AI%20(artificial%20intelligence)/Hands%20of%20robot%20and%20human%20touching%20on%20big%20data%20network%20connection%20by%20PopTika%20via%20Shutterstock.jpg)

A single earnings report can transform market sentiment, but it’s rare to see an analyst nearly double their target overnight. That’s precisely what played out for Applied Digital (APLD), as a Needham analyst hiked the stock's price target from $21 to $41 following APLD’s impressive fiscal first-quarter results. This propelled APLD stock up by 27% in just one trading session, with a year-to-date (YTD) gain of 375%.

This momentum is no surprise, given how quickly the market is changing for digital infrastructure. U.S. hyperscale data center investments are projected to hit $290 billion by 2030, growing at a solid 7.47% CAGR. The rise of AI and cloud technologies is fueling this expansion, but it's also drawing new scrutiny. By 2030, US data centers are expected to consume nearly 8% of global electricity, spurring operators to invest heavily in renewables and energy efficiency to stay ahead of national decarbonization goals.

With capital flowing in, long-term contracts being signed, and bullish analyst sentiment, investors have ample reason to take notice of Applied Digital’s rapid ascent. Let’s dive into the stock and see what it has to say.

APLD’s Earnings Surge

Applied Digital designs and operates large-scale data centers, providing critical infrastructure for artificial intelligence (AI), cloud computing, and high-performance digital workloads across the United States.

The YTD return is 375.07%, the 52-week performance stands at 380.73%, and the price is $35.51.

This $9.31 billion company is valued at a price-sales (P/S) multiple of 55.65x and a price-book (P/B) of 13.25x, both well above the sector medians of 3.48x and 3.70x.

Its October 2025 earnings report marks substantial progress for Applied Digital. This period saw revenue climb to $64.2 million, an 84% increase from a year earlier. It highlights that top-line growth benefited from $26.3 million in tenant fit-out services and additional data center business.

The cost of revenues grew 144% to $55.6 million, mostly from fit-out expenses and the ongoing hosting business. The selling, general, and administrative expenses reached $29.2 million, reflecting a 165% jump, with higher stock-based compensation and staff costs driving the increase.

This net loss attributable to shareholders registered at $27.8 million, which was sharply down 275% compared to the same period last year. The net loss per basic and diluted share fell to $0.11, meaning Applied Digital is narrowing losses on a per-share basis. It also reported an adjusted net loss of $7.6 million and an adjusted net loss per diluted share of $0.03, a visible sign of operational improvement even before accounting for interest, taxes, and non-cash expenses. The adjusted EBITDA for the quarter came in at $0.5 million, underscoring positive shifts in underlying profitability as the company scales.

Applied Digital’s Infrastructure Push

Applied Digital secured a $112.5 million initial funding milestone on Oct. 7 as part of a massive $5 billion infrastructure partnership with Macquarie Asset Management. This capital is earmarked for the Polaris Forge 1 data center campus in Ellendale, North Dakota. The campus is built out for AI workloads, and CoreWeave (CRWV) has leased the entire 400-megawatt capacity currently under construction. This single facility is designed to scale up to a staggering one gigawatt, giving Applied Digital deep market reach.

Expansion didn’t stop with a single campus. The company increased its contracted capacity with CoreWeave from 250 megawatts to 400 megawatts at the Ellendale campus. That expansion carries a total contract value estimated at $11 billion. This move is a pivotal step forward for Applied Digital’s growth strategy, locking in future revenues and strengthening its position as a go-to developer for high-performance infrastructure.

Development is also underway for Polaris Forge Two near Harwood, North Dakota. This upcoming campus will launch with two buildings totaling 300 megawatts. If demand persists, there’s room to scale up to one gigawatt across the site. Early funding for this project is already secured, and construction crews have broken ground, reflecting strong momentum not only for current projects but for the broader pipeline as well.

Analysts Upgrade APLD’s Targets

Applied Digital’s Q1 earnings release set the tone for what analysts expect in the coming months. The next earnings’ consensus targets indicate an average earnings estimate of -$0.10 per share for this quarter and -$0.34 for the fiscal year ending May 2026.

This compares favorably to prior-year results of -$0.66 for the quarter and -$0.80 for the year. It translates to anticipated year-over-year (YoY) growth rates of 84.85% and 57.50%, respectively.

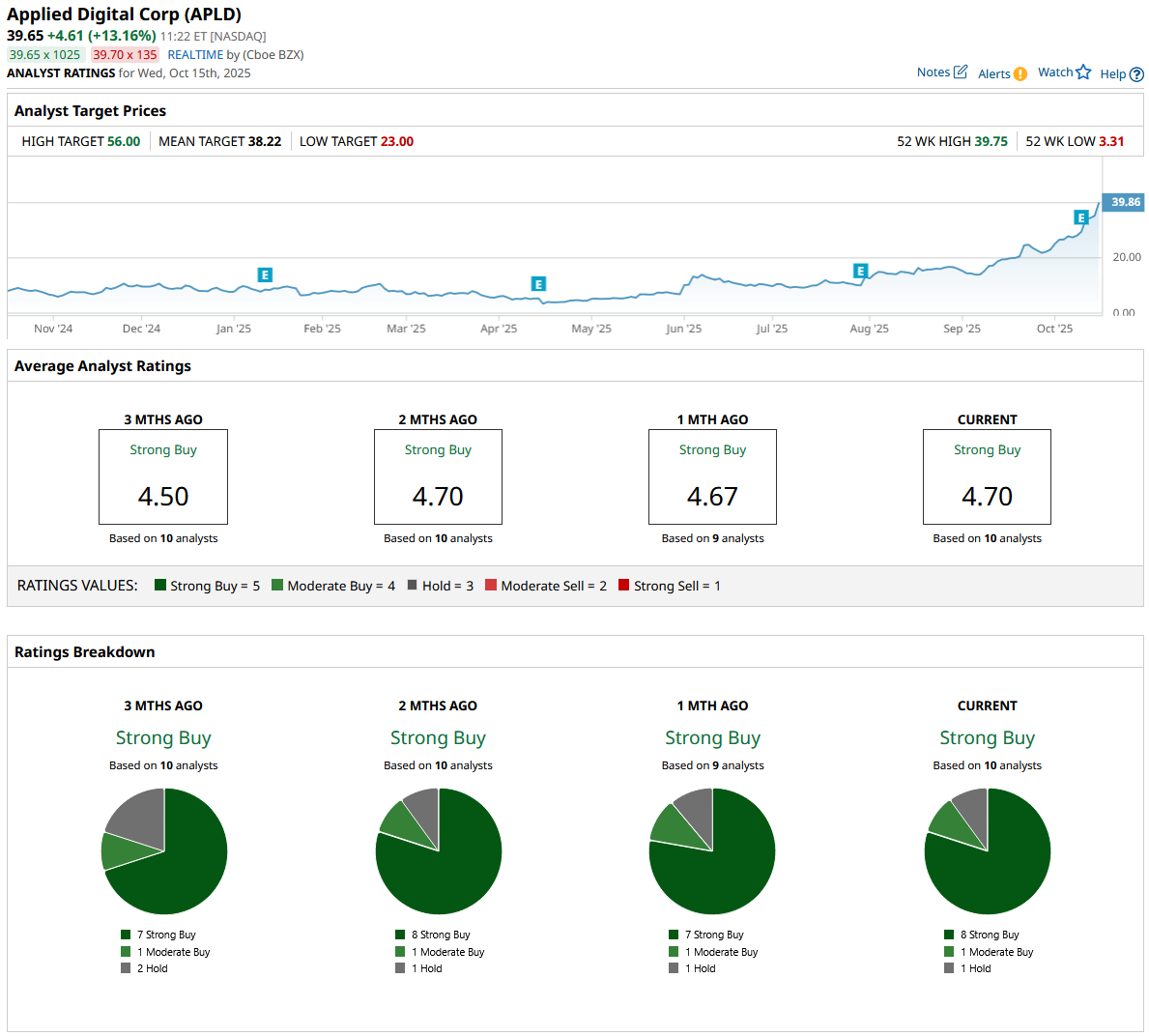

Analyst sentiment remains strongly positive. Ten analysts surveyed call for a consensus “Strong Buy” rating on APLD, showing broad conviction in the company’s future trajectory. The average price target currently sits at $38.22. That reflects an implied downside of roughly 4% from current levels.

Meanwhile, Craig-Hallum’s George Sutton kept his “Buy” rating on Applied Digital and moved his price target up to $37.00. With the current price at $39.65, Sutton’s target suggests a modest downside of roughly 7% from here, showing renewed confidence after the last earnings report.

Conclusion

The recent run-up in Applied Digital has priced in plenty of optimism, and analyst targets reflect mixed expectations. Most still expect strong forward growth, but current valuations limit near-term upside. If fundamentals and contract wins keep coming, momentum should continue. Given how quickly the story is evolving, the next few quarters are likely to decide if shares move higher or finally cool off.