/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

HSBC recently downgraded Intel (INTC) to “Reduce” from “Hold,” warning that the chipmaker's impressive 50% rally since August lacks a solid foundation. The analysts point out that Intel's recent momentum stems from three major investment announcements: a $2 billion stake from SoftBank (SFTBY), $11.1 billion from the U.S. government for a 9.9% stake, and a $5 billion investment from Nvidia (NVDA), representing roughly 4% ownership.

However, HSBC argues these deals are merely band-aids that don't fix Intel's fundamental problems. The real issue lies in Intel's struggling foundry division, which continues to face operational setbacks and hasn't gained meaningful customer support.

HSBC believes only a technology-sharing partnership with Taiwan Semiconductor Manufacturing (TSM) could turn things around, but that scenario seems unlikely given TSMC's own expansion plans in the U.S.

Even Intel's recent collaboration with Nvidia lacks clarity, as the latter plans to stick with Arm-based (ARM) processors in its servers until 2029. With a new price target of $24, HSBC warns investors that the current optimism may fade without concrete evidence of manufacturing improvements.

Intel Stock Continues to Rise Due to Big-Ticket Partnerships

Intel has been on a remarkable run lately, with shares jumping 85% this year and trading at their highest level in 18 months. The chipmaker has attracted a parade of major investors, including the U.S. government, SoftBank, and Nvidia, which have collectively poured billions into the company.

The recent momentum in INTC stock stems largely from these investment deals rather than operational improvements. The U.S. government took a 10% stake worth $8.9 billion in August, with that position now valued at roughly $16 billion.

SoftBank added $2 billion, and Nvidia announced a $5 billion investment as part of a collaboration to co-develop data center and PC products. These endorsements have certainly boosted confidence, but they haven't solved Intel's core manufacturing challenges.

Intel's foundry business remains the biggest question mark, as new CEO Lip-Bu Tan has made it clear the company won't invest in its 14A manufacturing node without securing significant external customers.

While Intel is in early talks with AMD (AMD) to potentially manufacture chips for its longtime rival, nothing has been finalized yet. The company desperately needs a major foundry customer to validate its technology and justify the massive capital investments required.

On the product side, Intel just announced its new Panther Lake processor, built with 18A technology at its Arizona facility. The chip represents the most advanced node made on U.S. soil and will debut in laptops next year.

Intel is also producing Xeon 6+ servers with 18A processors, set to launch in the first half of 2026. These milestones are important, but Intel still lags competitors in cutting-edge chip technology, especially for artificial intelligence (AI) applications.

Is INTC Stock Still Undervalued Right Now?

Analysts tracking INTC stock forecast revenue to increase from $52 billion in 2025 to $70 billion in 2029. Comparatively, adjusted earnings are estimated to expand from $0.12 per share to $2.65 per share in this period. This expansion indicates Wall Street forecasts the chipmaker to grow its net income margin from 1% in 2025 to 18.4% in 2029.

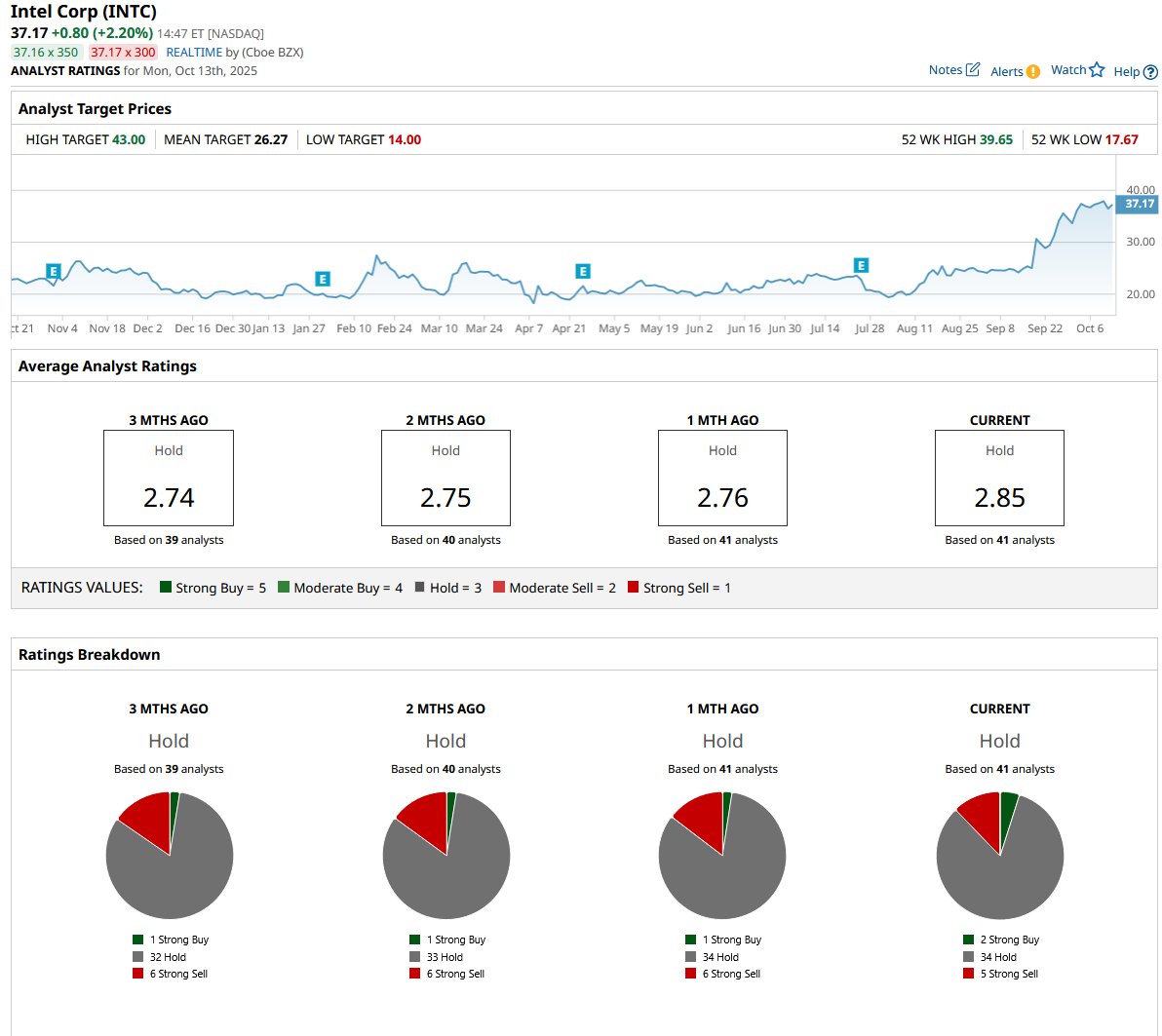

If INTC stock trades at 20 times forward earnings, which is reasonable, it should trade around $53 in early 2029, indicating an upside potential of 45% from current levels. Out of the 41 analysts covering INTC stock, two recommend “Strong Buy,” 34 recommend “Hold,” and five recommend “Strong Sell.” The average INTC stock price target is $26, below the current price of $38.