/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

Micron (MU) shares have already more than doubled over the past five months, but a senior Citi analyst remains convinced they can push further up from here through the remainder of 2025.

On Thursday, Christopher Danely reiterated his “Buy” rating on the computer memory chips maker and increased his price target to $175, signaling potential for another 15% rally from current levels.

Micron stock extended gains on Citi’s bullish call today and is now up 150% versus its year-to-date low in early April.

Micron Stock Could Rally After Q4 Earnings

Micron is scheduled to report its Q4 earnings on Sept. 23. Consensus is for the semiconductor company to earn $2.67 a share basis in its current financial quarter, up 170% versus last year.

According to Christopher Danely, MU will “report in-line results but guide well above consensus driven by higher DRAM and NAND sales and pricing.”

In his research note, Danely said demand will likely outpace supply through the end of next year, helping Micron expand margins and sustain pricing power.

Note that MU stock currently pays a small dividend yield of 0.30% as well, which makes it even more attractive to own for income-focused investors.

AI Inference to Send MU Shares Higher

Citigroup recommends owning Micron shares mostly because the artificial intelligence (AI) boom is now moving beyond training and into inference.

Micron specializes in high density NAND and mobile DRAM memory chips, crucial for handling inference workloads.

“DRAM upturn is intact, and our checks indicate demand from AI sector increased sharply as C25 CSP capex rose by $18 billion during earnings season,” Danely wrote, adding this could unlock further upside in MU shares.

Earlier this week, Oracle Chairman Larry Ellison also called inference “the next frontier” for enterprise AI.

Micron Remains a ‘Buy’-Rated Stock

What’s also worth mentioning is that other Wall Street analysts are also currently bullish on Micron stock for the next 12 months.

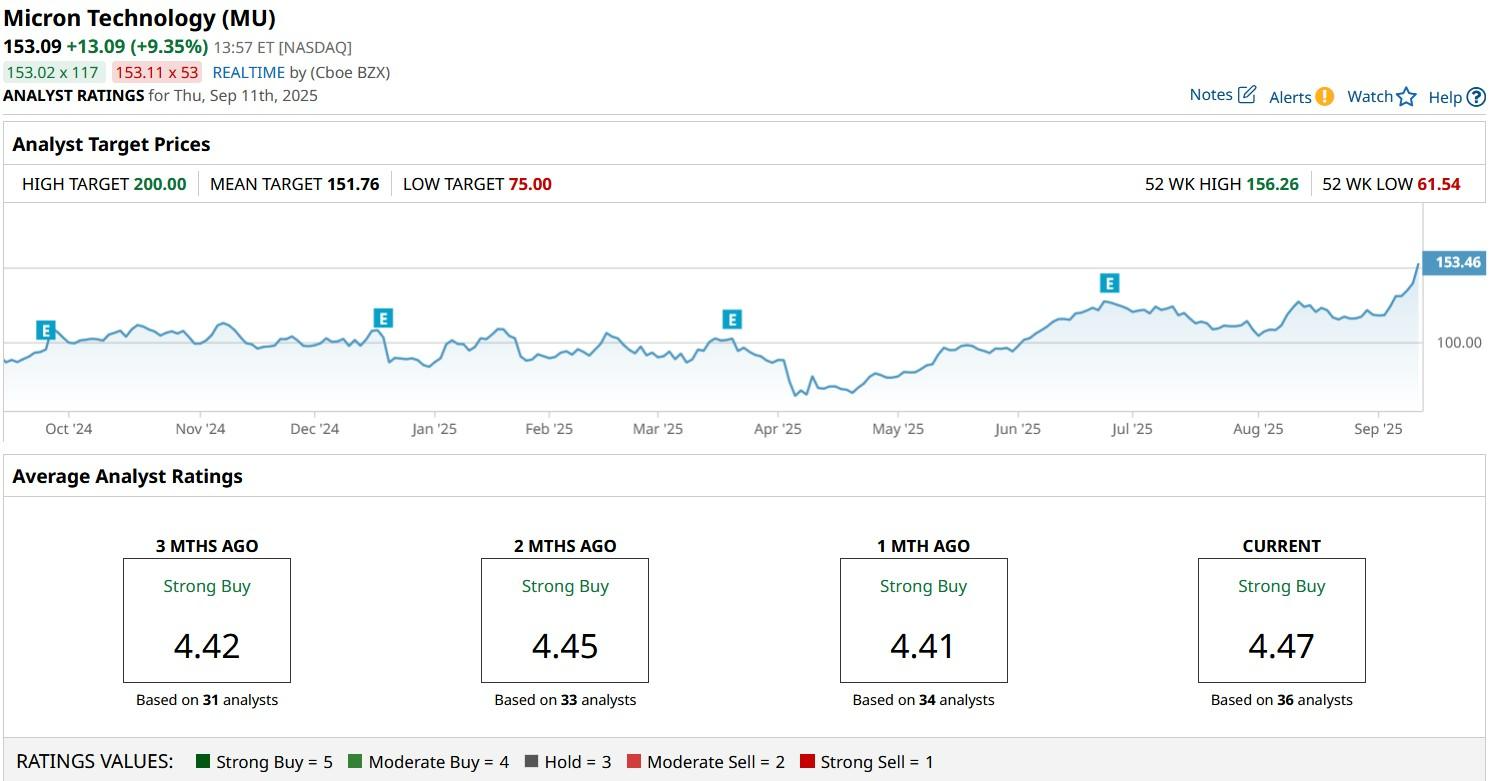

According to Barchart, the consensus rating on MU shares currently sits at “Strong Buy” with price targets going as high as $200, indicating potential for over 30% upside from here.