/AI%20(artificial%20intelligence)/Artificial%20Intelligence%20technology%20concept%20by%20NicoEINino%20via%20Shutterstock.jpg)

Soaring quietly past Wall Street’s usual favorites, an unassuming stock has captured the spotlight in the AI revolution. Over the last 52 weeks, Credo Technology's (CRDO) stock has surged over 500%, a performance that eclipses most technology peers.

Credo engineers high-speed connectivity solutions, technology that forms the backbone for modern data centers and AI applications. Its systems help data flow faster, enabling next-generation networks to keep up with a digital world hungry for more speed and reliability.

Just last quarter, Credo reported revenue growth above 270%, signaling increasing traction among customers that build and operate today’s most demanding digital infrastructure. This financial strength has helped CRDO stand out as the need for robust, scalable connectivity climbs ever higher.

In fact, the global market for AI-driven data centers is projected to grow at a 30% compound annual rate, potentially hitting $100 billion by 2030. That kind of exponential expansion sets the stage for Credo to become an indispensable player in next‑gen connectivity. As AI infrastructure goes mainstream, is this quiet innovator just getting started? Let’s find out.

The Numbers Behind a 500% Rally

Credo Technology released its latest earnings for the first quarter of fiscal 2026 on Sept. 3, 2025, delivering a performance that has become impossible to ignore. The company reported revenue of $223.1 million, marking a remarkable 274% year-over-year (YoY) increase and 31% growth quarter-over-quarter (QoQ).

In the same span, CRDO is sitting around $160, with shares up about 140% year-to-date (YTD) and 501% over the last 52 weeks.

Investors have pushed CRDO’s total value above $25 billion, with a forward price-to-earnings (P/E) multiple of 122.81x versus the sector’s median of 23.71x and a price-to-sales (P/S) ratio of 55.78x compared to 3.27x. This shows how much belief the market is placing in its future growth.

Gross margins remain a highlight, with GAAP at 67.4% and non-GAAP at 67.6%, both reflecting operational excellence and pricing power. Operating expenses, tightly managed, came in at $89.6 million on a GAAP basis and $54.5 million on a non-GAAP basis, leaving plenty of room for profitability.

The bottom line showed GAAP net income of $63.4 million and non-GAAP net income of $98.3 million. On a per-share basis, that’s $0.34 GAAP and $0.52 non-GAAP diluted net income, reinforcing how the company has converted top-line momentum into real shareholder value.

Credo exited the quarter with $479.6 million in cash and short-term investments, a war chest that provides flexibility for continued innovation and growth. With results like these, it’s no surprise that Credo has blasted past much larger tech companies.

Credo Finds Its Growth Edge

Credo’s trajectory traces directly to fundamentals where product leadership meets real customer traction. The company’s PCIe retimer segment is winning business as AI data centers outgrow traditional network speeds and distances. In 2025, multiple design wins set the stage for production revenue ramping up in 2026, leveraging advanced SerDes technology that delivers lower latency, longer reach, and improved power efficiency.

The PILOT telemetry software streamlines development and monitoring for customers, delivering advanced diagnostics and predictive insights that help keep high-speed links reliable and efficient. This innovation is especially crucial as the PCIe retimer market, valued at $1.2 billion in 2024, is projected to reach $2.8 billion by 2033, a compound annual growth rate of 11.5% that puts Credo in a key next-gen position.

Progress on the optical front is just as sharp. In August, Credo announced a significant 800G transceiver design win, with the first deployments set for FY2026. The company also rolled out ultra-low-power 100G-per-lane and 3nm 200G-per-lane DSPs at the OFC Conference, keeping latency low and efficiency high. Management forecasts optical revenue will more than double in fiscal 2026, expanding the company’s ecosystem in active electrical cables, optics, and retimers.

This momentum is matched in the AEC business. Double-digit sequential growth marked the fourth quarter of fiscal 2025, with three major hyperscalers each accounting for more than 10% of quarterly revenues. ZeroFlap AECs consistently outperform lasers for reliability, over 100 times more, and offer better signal integrity than legacy direct-attached cables. These technical advantages make AECs increasingly attractive to data center operators scaling up for AI.

Experts Believe the Runway Is Still Long

Analysts are keeping their eyes squarely on Credo’s momentum. For the current second quarter ending October 2025, Wall Street forecasts average earnings of $0.31 per share, a dramatic swing from just $-0.03 a year prior. Looking at the full fiscal year ending April 2026, the consensus points to $1.31 per share versus $0.29 last year, an eye-popping growth rate of 1,133% for the quarter and 351.72% for the year.

Meanwhile, the company expects revenue to reach between $230 million and $240 million. This guidance puts GAAP gross margins in a 63.5% to 65.5% range, with non-GAAP expected to be a bit higher. The expectation for GAAP operating expenses is $96–$98 million. Non-GAAP operating expenses should be between $56 and $58 million. This disciplined cost control supports ongoing earnings power while the company continues to invest in growth.

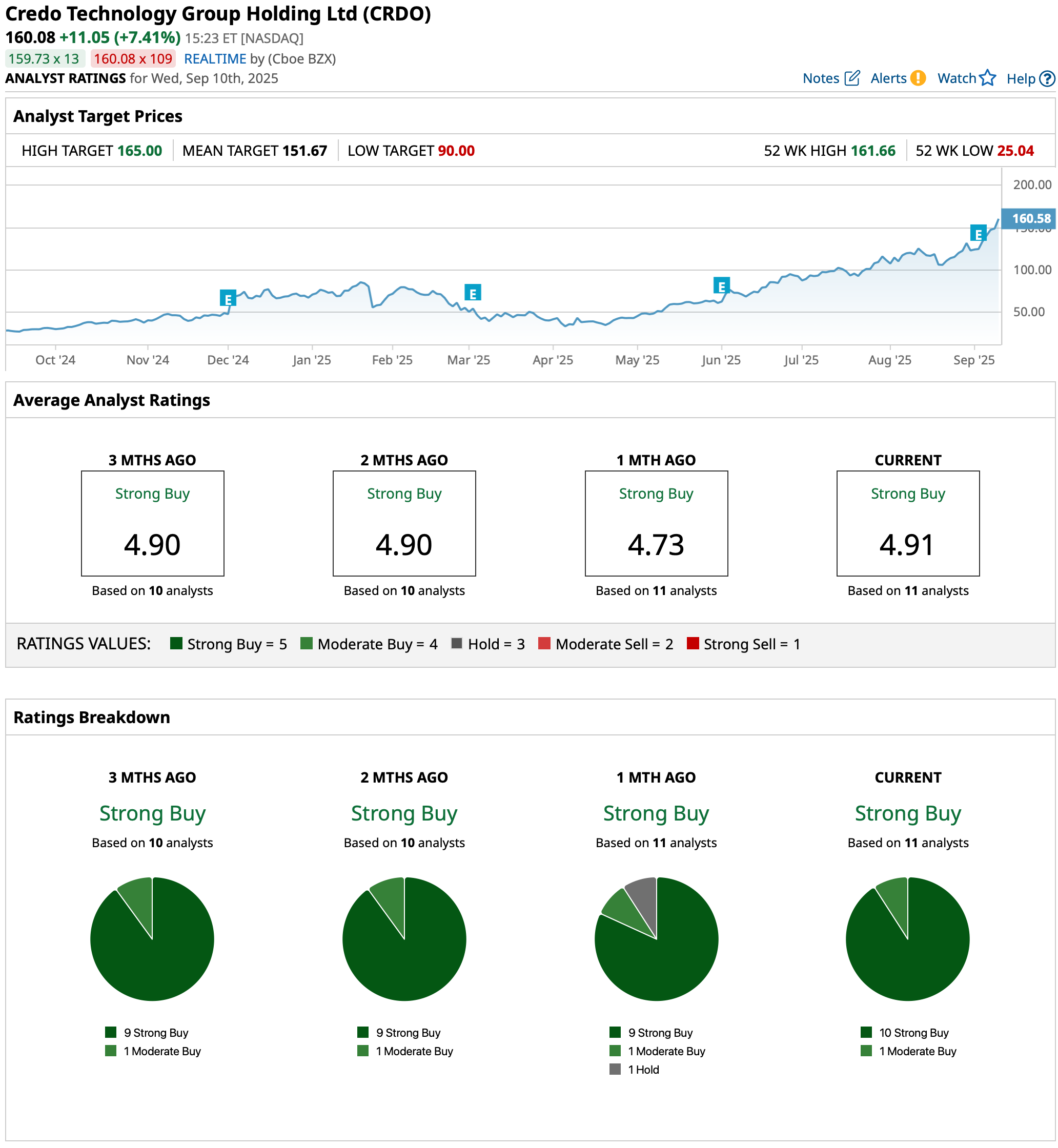

But what really jumps out is how the analyst community rates the stock’s prospects. All 11 analysts following CRDO assign it a “Strong Buy” rating, a rare consensus that signals high conviction. The group’s average target price is $151.67, which implies a roughly 1.8% upside from the current price of $149.03.

No question this stock has made a name for itself this year. Credo’s tech is landing major wins, earnings are exploding upward, and the analyst crowd still calls it a “Strong Buy” even after this epic run. Given the robust fundamentals, expanding contracts, and management’s sky-high growth projections, odds are shares will keep trending higher, though expect plenty of bumps on the way.