/AI%20(artificial%20intelligence)/Close-%20up%20of%20computer%20chip%20with%20AI%20sign%20by%20YAKOBCHUK%20V%20via%20Shutterstock.jpg)

Let’s make one thing clear about the iShares Robotics and Artificial Intelligence ETF (ARTY). With a ticker symbol like that, I could have a lot of “pun” with it. Nearing a 100% up move since April, it has been the life of the “arty.”

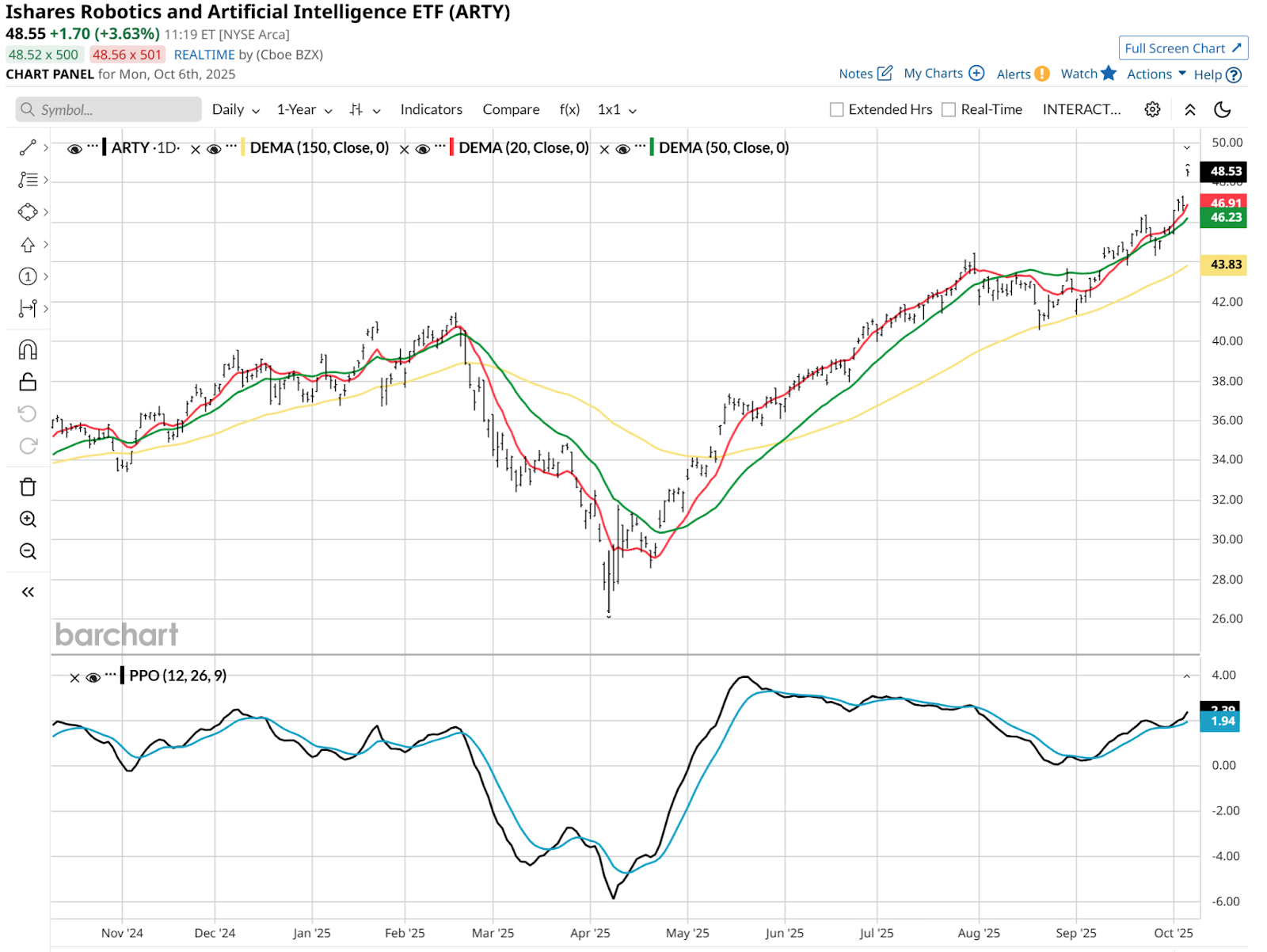

Here is what that looks like, via the daily price chart, which shows indications of being a lot like the broad Nasdaq-100 Index ($IUXX).

The Nasdaq reference is my view that ARTY may not be done with this move, but it is reaching nosebleed territory.

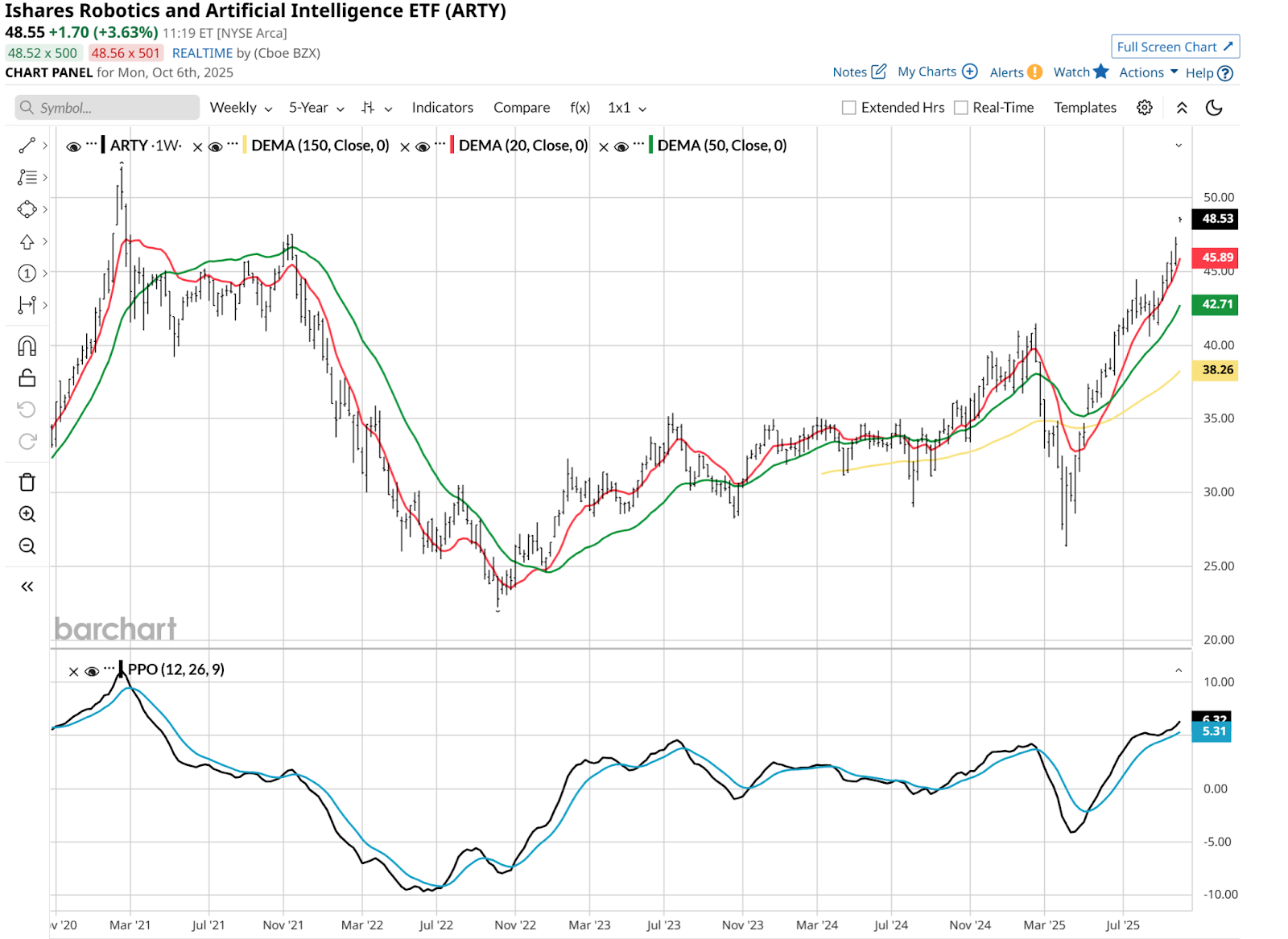

And, when we look at the weekly chart below, ARTY needed every bit of that 2x move the past 6 months just to get back to where it traded in early 2021.

So, a quick recap:

- This ETF is up nearly 100% in 6 months

- This ETF is flat for more than 4.5 years

Can both be true at the same time? In AI and robotics, as well as high-tech investing in general, absolutely. And that is the quandary for holders of this or any other ETF in the space. So let’s take a look under the hood, and see if the ARTY party is close to last call, or just getting interesting.

What We Know – And Don’t – About This AI ETF

My middle initial is A, which makes my full initials RAI. And that makes me about as qualified to be an expert on the future revenue and earnings potential of artificial intelligence companies as anyone else. In other words, no one knows with any certainty.

And with the way Sam Altman is running around the globe trying to hoard capital to make his OpenAI sustainable, I think it is clear that there’s both a bright future here, but also a big risk of counting chickens before they are hatched. And profitable long term. This is dot-com bubble 2.0 to me, just without assurance the finale will be as rough as 2000-2003 was.

ARTY is “only” at $1.8 billion in assets, which says a lot about the market’s love affair with investing in the major market index ETFs versus those that cherry-pick within a hot theme. And it has an expense ratio of 0.47%, higher than a straight market index ETF.

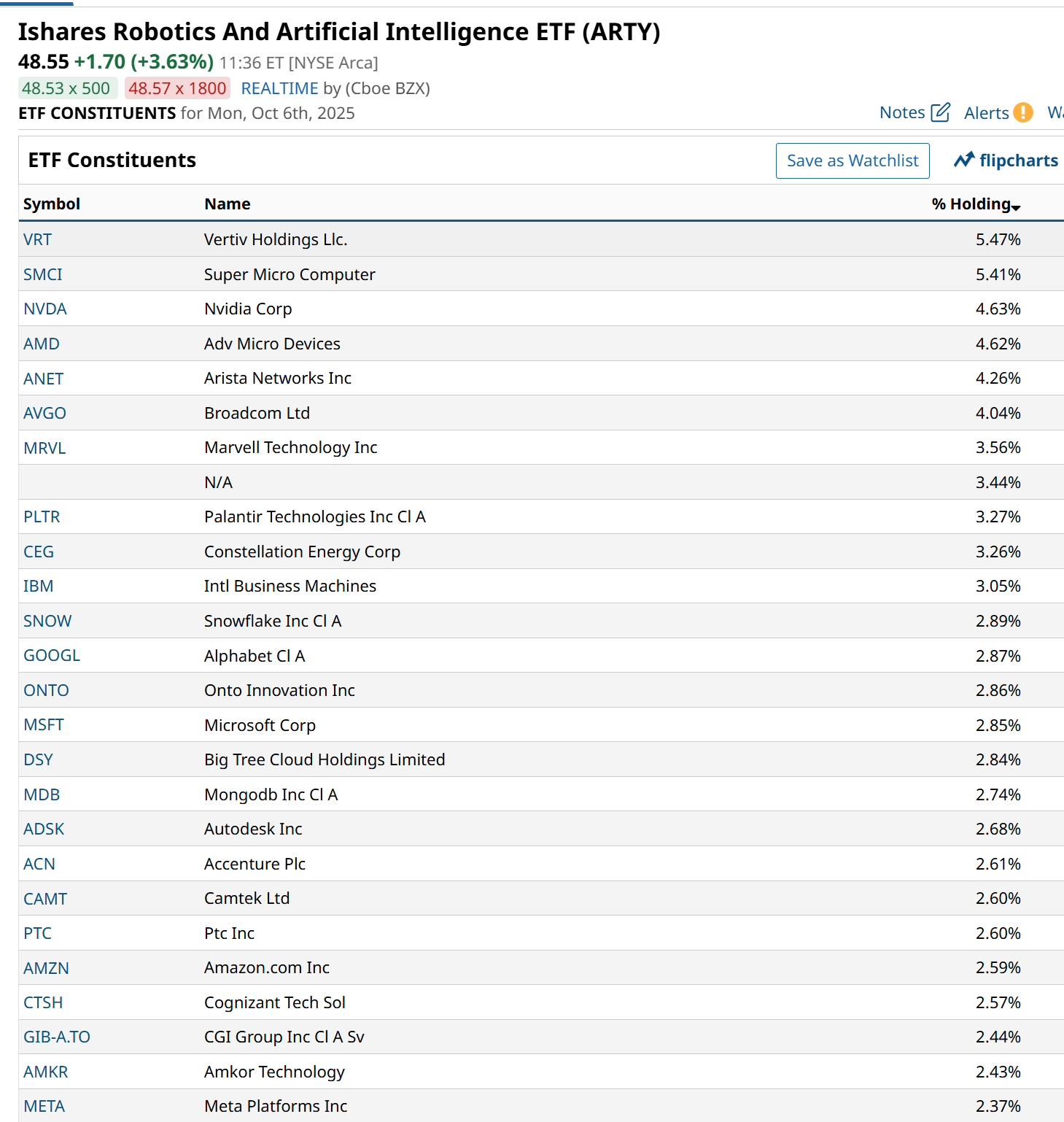

However, as I like to remind folks when looking at focused ETFs like ARTY, it is two things in one. It was created to be a basket of stocks, more than 65 of them currently.

And, it is also a shopping list for those who think “I’d like to own some AI stocks. But what stocks are AI stocks?” While ARTY may not be the definitive list, you can decide if it represents the first step in filtering down to stocks to consider. And Barchart makes it so easy to take an ETF’s holdings, turn it into a watchlist, chart them, and research them individually (watch this video to learn how to create a watchlist).

And that’s exactly what I did. Here are a few charts I like from within this basket of ARTY party favorites. Note that while this ETF includes some of the very biggest U.S. stocks, at each rebalancing and reconstitution of its benchmark, the Morningstar Global Artificial Intelligence Index, each stock that is in the ETF is capped at 4.5%. So if you see holdings above that, it means the stock is up since the last scheduled adjustment date.

AI Stock #1: Vertiv

And that is the case with Vertiv (VRT), ARTY’s largest current holding until Advanced Micro Devices’ (AMD) major move on Monday. A former SPAC from back in 2020, VRT looks a lot like ARTY, chart-wise. There’s upside room but it is starting to look “tired” to me. There was a time where I’d look at this chart and say “breakout,” but those don’t work for nearly as long as they used to. Not with the speed of information flow now.

AI Stock #2: Nvidia

The stock everyone loves no matter what, Nvidia (NVDA), has been the life of the ARTY party for some time. But it looks more neutral than bullish to me here.

AI Stock #3: Onto Innovation

And finally, late to the party, here’s a chart of Onto Innovation (ONTO). This looks like it has some big potential follow-through here, although the Percentage Price Oscillator (PPO) indicator at bottom is currently in flux.

This AI stock reminds me why I am an ardent chartist, and why I respect the work of fundamental analysts so much. Here’s what I mean. The first part of ONTO’s corporate description reads like this:

Onto Innovation operates as the leading global manufacturer of avant-garde process control tools that perform macro defect inspections and metrology, and lithography systems. Its products are used in a number of high technology industries like silicon wafer substrates, power device and data storage. It plays a significant role in the design, manufacture and marketing of process control systems for 2D/ 3D macro inspection, optical critical dimension metrology and wafer inspection.

While I do not understand perhaps two-thirds of the words above, when you believe that technical analysis is what drives markets more than just about anything, understanding the details of the business model and sales trends is much less important. That’s been my take for about 30 years of managing money professionally.

Like I said, I have great admiration for those who can. But I also think that today’s AI-fueled bull market, which ARTY proxies quite well, is more about people wanting to own AI stocks, rather than understanding the intricacies beneath the surface.