/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)

Artificial intelligence (AI) is the future, and investors who haven't gotten aboard the AI train may be feeling left out. Whether it's the incredible rise seen in chipmakers such as Nvidia (NVDA) or the surge we've seen in a host of data center and utilities stocks, there are multiple ways for investors to play this trade outside of tech companies building the next world-class AI applications and user-facing technologies.

Within the picks-and-shovels space, Teradyne (TER) is one of the more interesting companies I've started to look at as a potential long-term winner. It turns out I'm not the only one assessing this company for its long-term growth potential.

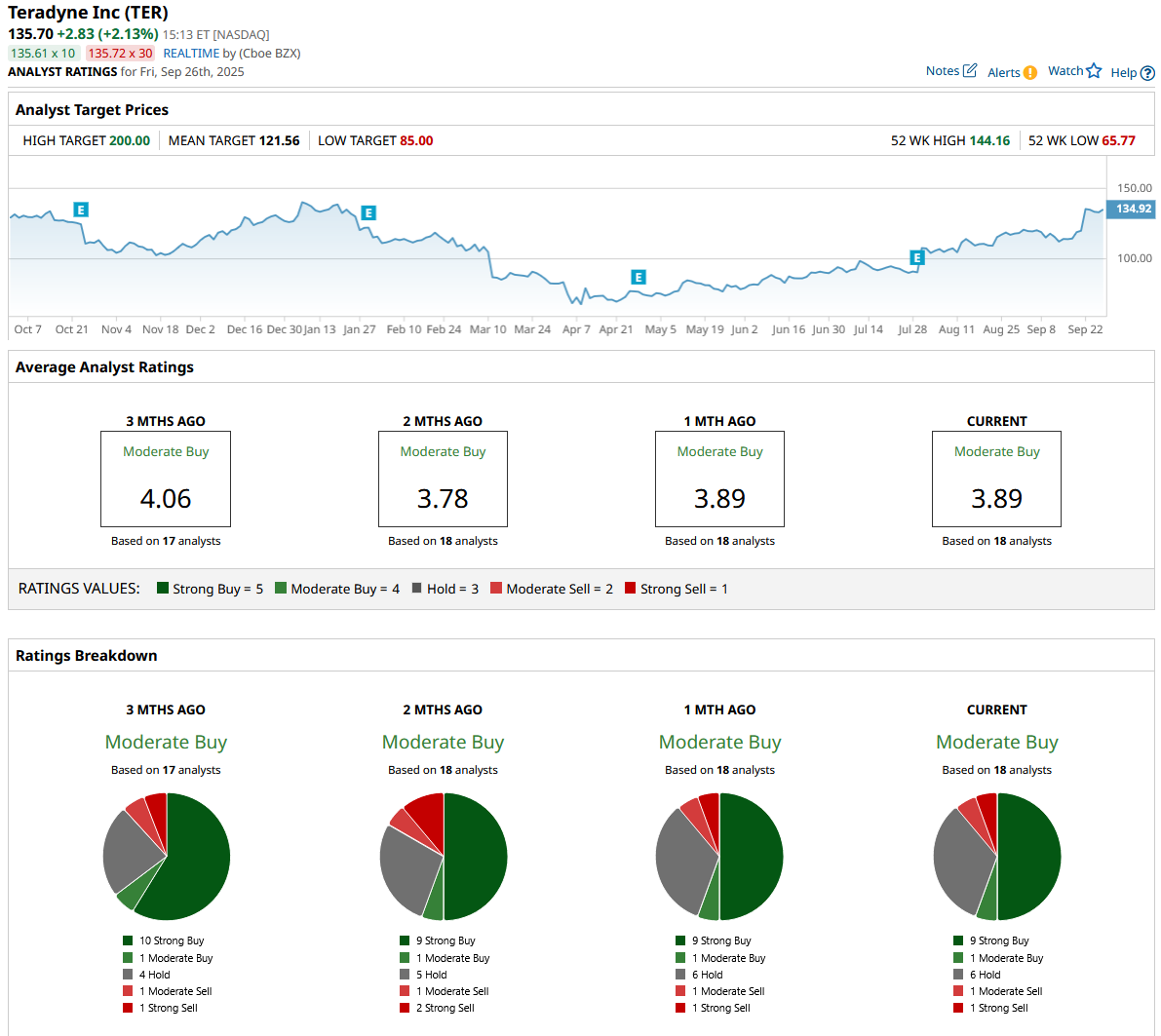

Analysts at Susquehanna just set a new Street-high price target of $200 per share for TER stock. Let's dive into what to make of this call and whether Teradyne has what it takes to surge more than 50% from current levels.

There's a Good Reason Why Investors Are Bullish

Teradyne's business model is both simple and complex at the same time. Investors can easily understand the soaring demand for chips, making the semiconductor manufacturing equipment maker inherently more valuable if demand for its machines surges. However, the extremely complex nature of developing such machines means there are less than a handful of companies around the world that can do what Teradyne does and be profitable. It's a winner-takes-most space, and in some respects, analysts and investors are starting to get the idea that Teradyne isn't getting the love it deserves.

Susquehanna analysts appear to believe that higher growth in 2026 and beyond is not only possible but likely. This is the key driver of their price target hike, with analysts noting that other players in this space should:

"…begin acquiring TER's [system-on-a-chip] testers for this purpose, with additional units to be purchased and consigned to OSA partners in 2026. While we don't anticipate a material incremental revenue contribution from this win until 2026, TER's growing presence across multiple test insertion points—wafer sort and potential adoption at System Level Test (SLT)—is a positive and incremental development that we believe is not entirely reflected in the current share price.”

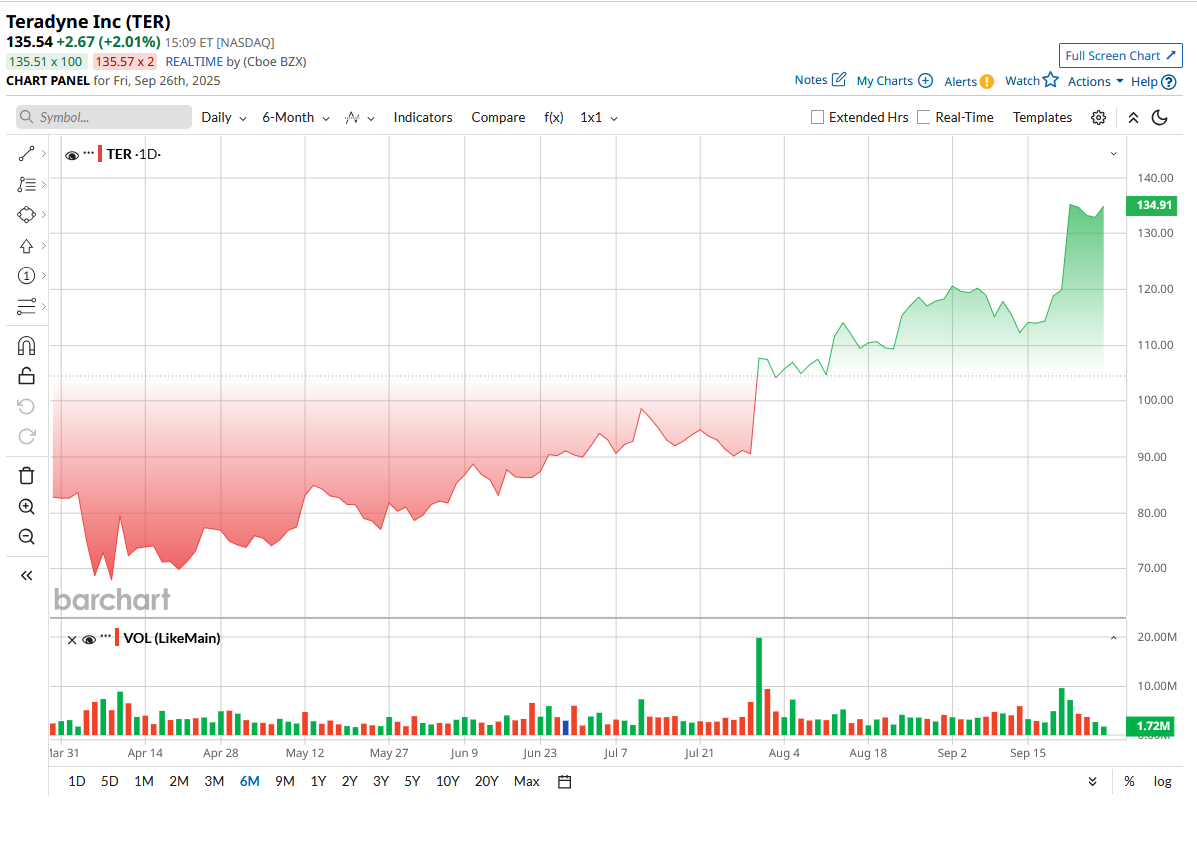

That's led to the kind of stock chart investors see above. That's a solid trend, but can it continue?

What Do the Fundamentals Say?

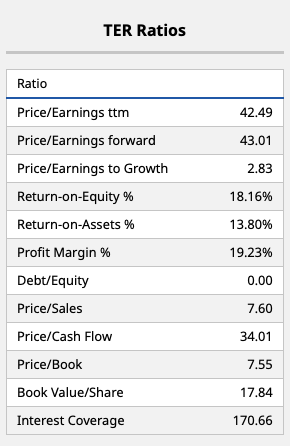

What's of particular interest to me in looking at a company like Teradyne is what investors, analysts, and the market as a whole expect from such a company in terms of growth. Looking at the company's trailing twelve-month (TTM) and forward price-earnings multiples, it's pretty easy to discern that investors don't see either an acceleration or deceleration of growth over the course of the next 12-18 months, given how close these two multiples are.

Now, more than 40 times earnings is a hefty multiple for any stock. But investors don't have to look far within the semiconductor industry (and related stocks) to see much higher multiples. Accordingly, how richly or cheaply valued this stock will turn out to be will ultimately come down to how fast it can grow. And with the $100 billion-plus deals we've seen announced of late, it's clear there's plenty of capital itching to be put to work in this space.

I maintain that Teradyne's solid profit margins (also shown above), as well as its strong return on equity and return on assets metrics, make this a top name in this space that shouldn't get ignored. If Teradyne gets cheaper from here, I think it's a strong buying opportunity. And even if it doesn't, I don't think Susquehanna's $200 price target is off base in terms of the balance of probabilities out there.

What Do Other Analysts Think?

Many investors can get overly bullish on a given stock based on the outlier price target set by one analyst or group of analysts on Wall Street. That's a danger, for sure, as is taking the most bearish analyst at their word on a stock that's been declining for some time.

Looking at the consensus estimate above, Teradyne may actually have more downside risk at current levels than upside. That ought to be the grain of salt some investors need to cool their bullish narrative.

I do think Teradyne could have major upside ahead if the AI spending cycle continues as it has. The thing is, at some point, this spending may have to slow. And if it doesn't because of macro forces, a push toward profitability may lead some companies to do so on their own. Thus, I'm taking the middle path for now on TER stock and saying that Wall Street probably has the price target on Teradyne right, at least in aggregate.