/Semiconductor%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

Astera Labs (ALAB) is earning investor attention following a blowout second quarter that exceeded consensus estimates across revenue, margins, and earnings. The stock has rocketed up almost 42% over the last week, driven by enthusiasm over its potential to be a player in the upcoming second generation of artificial intelligence infrastructure, a market inflection point that its management sees adding a whopping $5 billion to its addressable market by 2030.

Deeper partnerships with leading players such as Nvidia (NVDA), Advanced Micro Devices (AMD), and Alchip Technologies are setting up the company at the forefront of next-generation data center networking.

About Astera Labs Stock

Astera Labs (ALAB) designs high-performance semiconductor connectivity solutions, including PCIe, CXL, and Ethernet-based products for hyperscale data centers. Headquartered in San Jose, California, the company has a market capitalization of approximately $29.8 billion and serves a global customer base that includes leading GPU, CPU, and custom ASIC manufacturers.

Shares have soared from a 52-week low of $36.85 to a high of $193.77, returning a gain of nearly 400% compared to a 20% gain for the S&P 500 Index ($SPX) during the comparable period. Thus far this year, ALAB has beaten most peers in the semiconductor group, led by impressive financial performance and healthy demand for its Intelligent Connectivity Platform.

Valuation is stretched, with ALAB trading at a forward price-earnings ratio of 364.81x and a price-sales ratio of 75.2x, significantly above semiconductor industry norms. These levels reflect high investor expectations but also heighten sensitivity to any execution risks. The company does not pay a dividend, instead reinvesting in R&D and market expansion.

Astera Labs Beats on EPS

In Q2 2025, Astera Labs reported revenue of $191.9 million, up 20% sequentially and 150% year-over-year, exceeding prior guidance. The non-GAAP gross margin expanded to 76%, while its operating margin reached 39.2%, resulting in EPS of $0.44. Operating cash flow climbed to $135.4 million, with $1.07 billion in cash, cash equivalents, and marketable securities at quarter’s end.

Management is guiding for Q3 revenue between $203 million and $210 million, up 6%-9% quarter over quarter, and non-GAAP EPS of $0.38–$0.39. The growth is anticipated across its Aries, Taurus, and Scorpio product lines, and the Scorpio X-Series launch is scheduled for the latter part of 2025

CEO Jitendra Mohan emphasized Astera’s positioning in AI Infrastructure 2.0, highlighting expanded work with Nvidia on NVLink Fusion, AMD on UALink, and Alchip Technologies on integrated ASIC and connectivity solutions. These initiatives aim to capture growing demand for rack-scale AI connectivity in the hyperscale market.

What Do Analysts Expect for Astera Labs Stock?

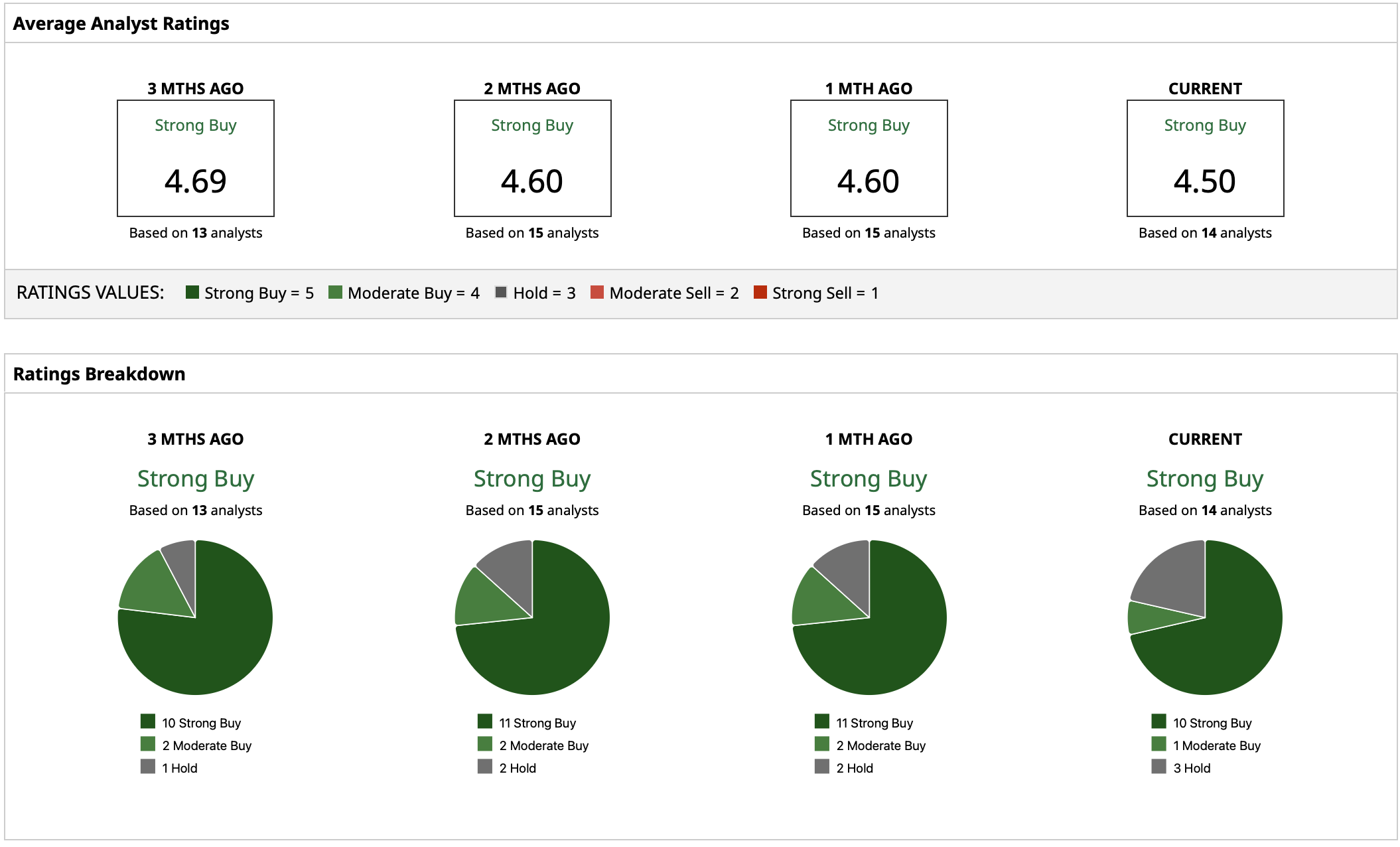

ALAB earns a “Strong Buy” rating consensus rating based on 10 “Strong Buy” ratings, one “Moderate Buy,” and three “Hold.” The mean price target is $160.62 represents potential downside of 17% from current levels. The highest target of $215 implies upside of about 12%.