For investors seeking reliable income, Dividend Aristocrats could be solid long-term investments. These are companies within the S&P 500 Index ($SPX) that have increased their dividend payments every single year for at least a quarter of a century. Their commitment to rewarding shareholders shows their financial strength and disciplined approach to capital allocation.

Besides offering steady dividend income, Dividend Aristocrats have the potential to deliver decent capital appreciation over time. Their track record of durable earnings and resilient business models means they can often withstand market volatility better than many peers. Over time, this reliability translates into share price stability and total returns that outpace the broader market.

Among the compelling names in this group, Altria (MO) stands out. The company offers a high yield of around 6.7%, supported by a long history of consistent payments. Further, the visibility over its future earnings growth suggests that Altria will keep increasing its dividend in the coming years.

Altria Raises Dividend for 60th Time

Altria has recently proven why it remains one of the most reliable income-generating investments. The tobacco giant recently raised its quarterly dividend by 3.9% to $1.06 per share, marking its 60th dividend increase in the past 56 years.

This steady stream of dividend growth reflects Altria’s robust earnings power and disciplined financial management. The company’s ability to consistently return more cash to shareholders is driven by its diversified product portfolio, strategic pricing power, and ongoing operational efficiency initiatives. Together, these strengths form a solid foundation for profitable growth and sustained shareholder value creation.

Altria to Keep Increasing Its Dividend

Looking ahead, Altria appears well-positioned to keep growing both its earnings and its dividend. Its core smokeable products remain the primary driver of profits, even as the company strategically invests in smoke-free alternatives to capture future demand shifts. Within the smokeable segment, Altria’s adjusted operating income is expected to benefit from strong net price realization, helping to offset near-term volume pressures.

The company’s Marlboro brand continues to dominate the premium segment, expanding its market share to 59.5% in the second quarter. Meanwhile, cigar volumes rose 3.7%, with Middleton outperforming within the large mass cigar market. These gains illustrate Altria’s pricing strength and brand loyalty across key categories.

Beyond its traditional products, Altria is actively positioning itself for the industry’s future. The company continues to invest in smoke-free alternatives, including oral nicotine pouches and heated tobacco products, recognizing the shift in consumer preferences toward less harmful products. These investments, while still emerging, represent a key pillar in Altria’s long-term growth strategy.

Altria projects mid-single-digit growth in adjusted diluted earnings per share (EPS) through 2028. This outlook suggests that dividend growth will likely continue at a similar pace.

Altria’s Financial Strength and Strategic Partnership

Altria’s balance sheet remains healthy and well-managed. With a total debt-EBITDA ratio of 2x as of June 30, the company maintains a comfortable leverage position aligned with its long-term target. This financial flexibility gives Altria room to pursue acquisitions, partnerships, and innovation without straining its dividend commitments.

A notable recent move is its Memorandum of Understanding with KT&G Corporation, a major global tobacco and consumer goods player. This collaboration aims to explore opportunities in modern oral nicotine products, non-nicotine wellness items, and efficiency-driven projects. Such partnerships expand Altria’s international reach and strengthen its foothold in next-generation product categories.

In addition, Altria continues to invest heavily in automation and cost optimization initiatives to enhance margins. By improving efficiency and reducing operating expenses, Altria is freeing up more capital to reinvest in growth opportunities, while strengthening its dividend-paying capacity.

Should You Buy Altria Stock?

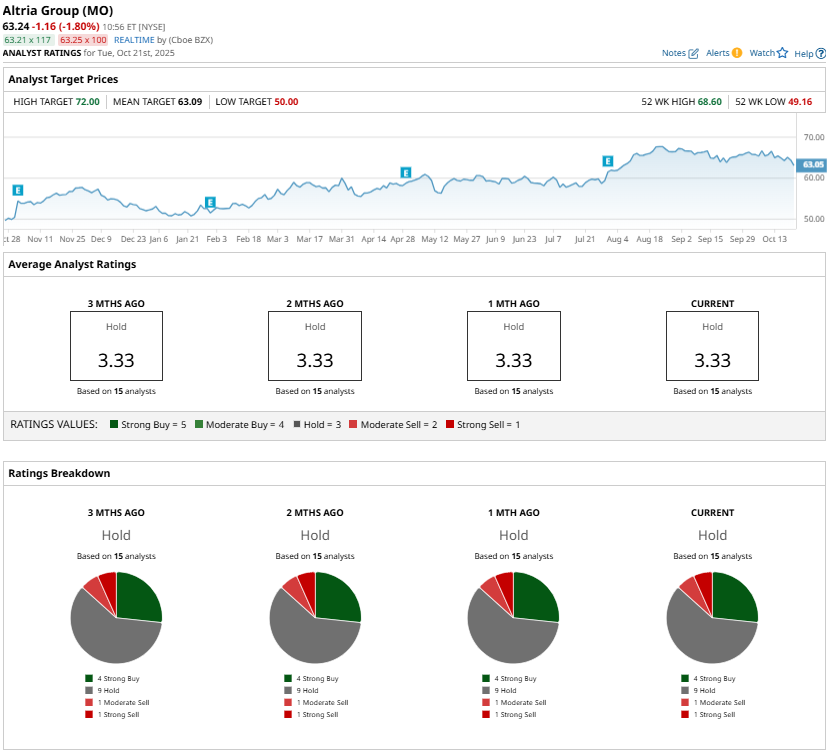

Altria is not without challenges. The declining cigarette volumes, regulatory headwinds, and evolving consumer habits all weigh on the tobacco industry. Further, Wall Street analysts currently maintain a “Hold” rating on the stock.

However, the combination of its robust 6.7% yield, decades-long track record of dividend increases, and steady earnings growth trajectory makes Altria a top stock for income investors.