Beauty stocks often swing with changing consumer tastes and shifting retail trends, leaving many companies struggling to maintain steady growth. While giants like Coty (COTY) and Ulta Beauty (ULTA) face pressure from rising costs and slowing demand, one lesser-expected name has quietly surged ahead.

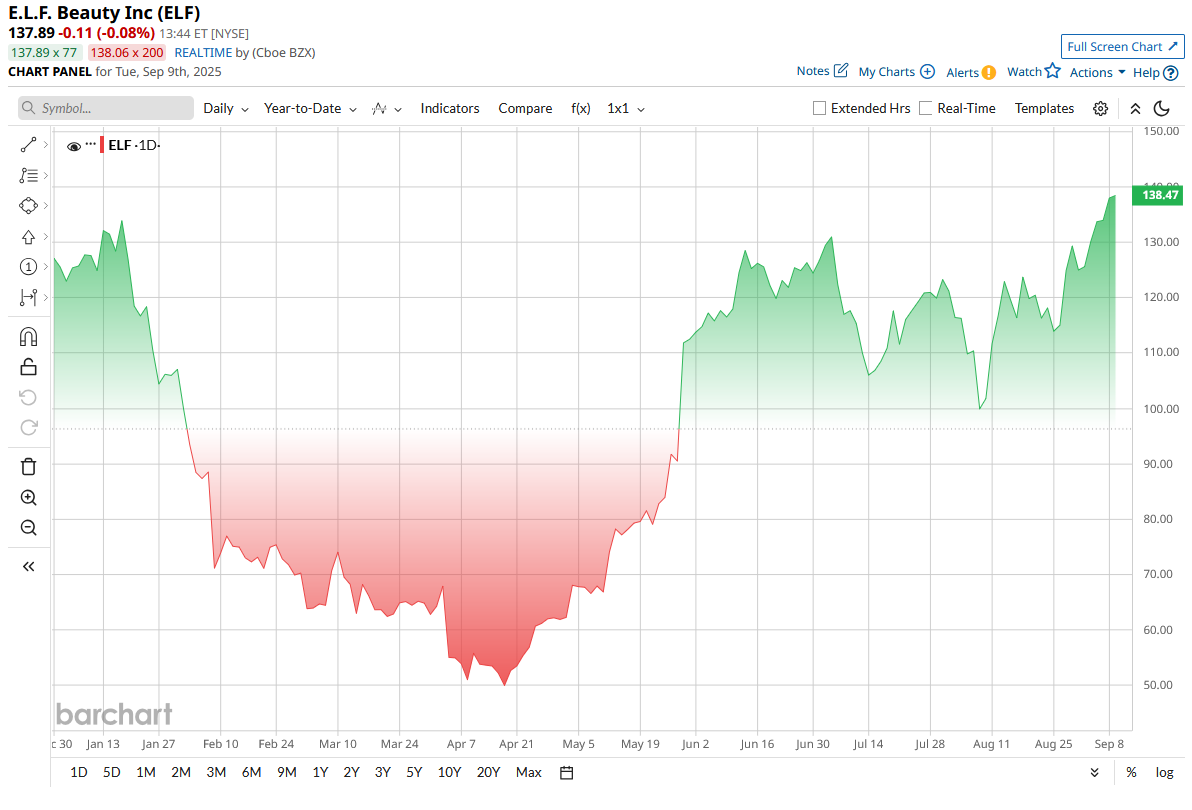

E.l.f. Beauty (ELF), known for its affordable yet trendy cosmetics, has doubled its stock price in the past six months, defying the broader struggles across the industry. The company continues to capture market share through social media marketing, innovative product launches, and a strong presence in both retail and online channels.

For investors searching for growth in a cooling beauty market, ELF’s rapid rise raises a key question. After its 100% run-up, is the stock still worth buying today? Let's find out.

About ELF Stock

Based in California, e.l.f. Beauty is a prominent name in the beauty industry, providing cosmetics and skincare products globally. The company is known for its wide range of products under several brand names, including e.l.f. Cosmetics, e.l.f. SKIN, Well People, Naturium, and Keys Soulcare. These brands are available through both national and international retailers and direct-to-consumer via e-commerce channels. e.l.f. sells affordable makeup and skincare (often under $10) through mass retailers and online. The company currently boasts a market cap of $7.9 billion.

After sinking to a 52-week low of $49.4 in early April 2025, ELF stock has rebounded 176%, wiping out early-year losses and bringing it to a 9.7% year-to-date gain. This strong rebound is linked to stronger sales, the Rhode acquisition, wider Dollar General (DG) distribution, and TikTok marketing, plus modest price hikes that boosted margins, which pushed buyers and lifted the stock.

After the bull run, ELF stock has become expensive on paper, trading at 38x forward earnings, significantly exceeding the sector median of 17x. This suggests ELF might be overpriced compared to its peers.

U.S. Retail and E-commerce Drive Q1 Results

E.l.f.’s revenue still looks healthy, but growth has slowed from last year. In Q1 FY2026, net sales rose 9% year-over-year (YoY) to $353.7 million, helped by stronger U.S. retail and e-commerce sales. E-commerce now accounts for about 20% of total sales and grew roughly 20% in the quarter. By contrast, the same quarter a year earlier delivered a 50% jump, so growth has normalized.

The company continues to expand both at home and abroad. U.S. revenue climbed about 5%, while international sales, now under 20% of the mix, jumped roughly 30% YoY. Management pointed to big international momentum in prior quarters, showed a 91% rise, and says e.l.f. Keeps winning share in color cosmetics and skincare.

On an adjusted basis, the beauty company earned a profit of $0.76 per share, well above the analysts' estimate of $0.63.

On the cash front, e.l.f. sits on solid liquidity and improving cash generation. In Q1 the company generated about $20 million in free cash flow and held roughly $170 million in cash and cash equivalents, giving management room to reinvest.

For guidance, management reaffirmed a goal of greater than 9% net sales growth for the first half of FY2026 but warned that outcome depends on U.S.–China trade talks. The company did not give full-year guidance, citing wide possible outcomes from tariffs and supply-cost shifts.

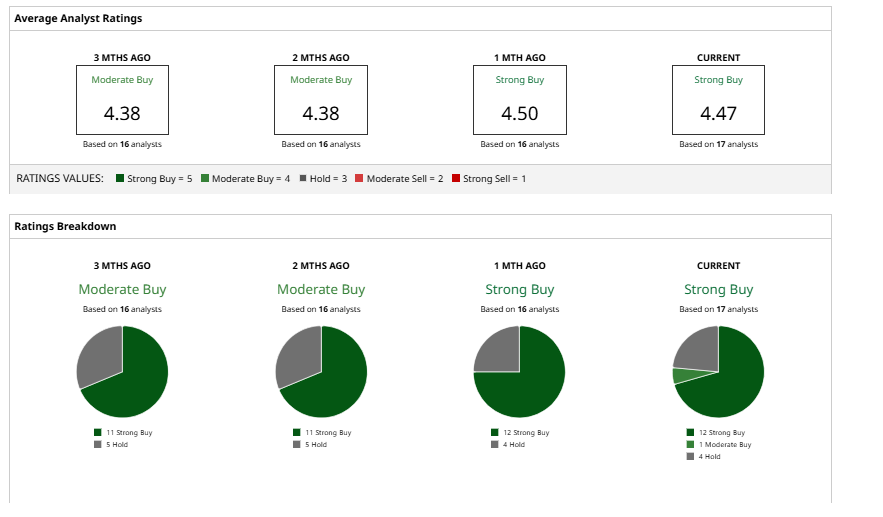

What Do Analysts Say About ELF Stock?

Analysts remain largely bullish on e.l.f. Beauty, calling it a rare standout in an otherwise challenged cosmetics sector. TD Cowen analyst Oliver Chen rates the stock a “Buy,” arguing that e.l.f. is a “structural growth story” supported by innovation, social-media-driven marketing, and international expansion.

Deutsche Bank’s Stephen Powers sees near-term growth momentum accelerating, noting that Q2 revenue could rise 20% or more with the addition of newly acquired Rhode, Hailey Bieber’s skincare brand.

Jefferies analyst Ashley Helgans also carries a “Buy” rating, highlighting strong unit sales and limited demand impact from the company’s recent $1 price hike. She expects continued sales strength, supported by e.l.f.’s aggressive digital marketing and new retail partnerships.

Overall, Wall Street analysts are highly optimistic about having a consensus “Strong Buy” rating. However, the stock has surpassed its mean price target of $135, but its current high target of $150 still suggests around 9% upside potential.