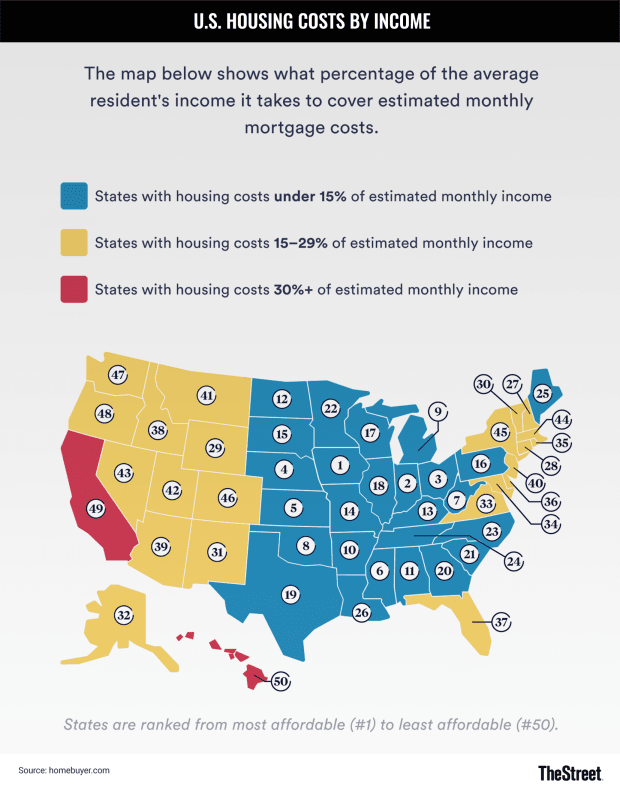

While the primary principle of making money through real estate is always location, shopping for a primary home is a lot easier if one lives in certain states and cities.

Even putting aside differences in salaries between certain popular coastal cities and the rest of the country, many pockets of the country have home prices that are fairly proportional to what an average earner would need to shell out to afford a standard home.

According to a recent study from mortgage lender Homebuyer.com, a median home in Iowa costs $147,800 or an estimated $702 a month in mortgage payments. A person bringing in a median salary would only need to shell out 10.6% for mortgage, well within the long-established "28% rule" that says total mortgage, tax and insurance payments should not surpass 28% of one's income.

Look At The Midwest And South, Not Hawaii

"The largest housing markets in Iowa include Des Moines, Iowa City, and Cedar Rapids," write the study's authors.

Many other Midwestern states also made the top ten of least expensive states to buy a home. Indiana, Ohio, Nebraska and Kansas all take below 12% of a median salary to make mortgage payments on a median-priced home.

The only two states outside the Midwest to make the top ten are Mississippi and West Virginia while other Southern states like Alabama, Kentucky and Missouri all made the top 15.

As the fifteenth cheapest state to buy a home, South Dakota will take 12.62% of one's monthly income to pay for a median-priced home.

TheStreet

Contrast that with Hawaii, which HomeBuyer.com established as the most expensive state to buy a home in the country. With a median home price of $615,300 and estimated monthly mortgage payment of $2,923.36, it will take local residents 35.15% of their salary to pay for a typical home.

And those numbers are still more rosy than what is happening on certain islands — amid an influx of out-of-state residents with big-city salaries who came during the pandemic, many local who have not yet secured a home find themselves being priced out of places they've lived in for generations.

Living Vs. Investing

Notorious for a housing affordability crisis that has been years in the making, California took the second spot with 32% or a median home price of $505,000 and estimated monthly mortgage payment of $2,399.32.

Given skyrocketing prices in the region, Western states like Oregon, Washington and Colorado also made the study's top five for unaffordability.

As lack of demand is the main reason certain states on this list are more affordable, the less expensive places may be more of benefit to those who already live there rather than a motivation to move there for investment — for the latter, it's better to track specific popular pockets.

While it will require an investment much higher than the state's median, the city of Youngstown in Ohio saw its real estate prices appreciate by 77% between 2021 and 2022.

"Home affordability can vary widely from one place to the next, especially with unique taxes, utilities, and other expenses associated with any given city," write the study's authors. "[...] While one region may have more expensive home prices, there are also differences in salaries to offset those price points."

SEE THE FULL LIST OF MOST AND LEAST EXPENSIVE STATES FOR HOMEBUYERS HERE.