Cannabis stocks soared after President Donald Trump shared a video that promoted the health benefits of CBD (cannabidiol) for seniors. The video suggested Medicare coverage for the substance and said it could revolutionize senior healthcare.

The market saw this as Trump condoning CBDs and, perhaps, even cannabis. Federal-level legalization of cannabis has been quite popular among both Republicans and Democrats, and it wouldn't be a bad decision for the president to throw his weight behind getting legalization across the finish line before the midterms.

Anyhow, the shared video caught the attention of Wall Street, and investors poured money into the top-rated cannabis stocks. Here are three that are worth looking into if you believe Trump is backing CBD and, by extension, may open the path for cannabis legalization.

WM Technology (MAPS)

WM Technology (MAPS) owns Weedmaps (a consumer-facing platform) and Weedmaps for Business (a B2B software solution). Weedmaps is a marketplace where consumers can search and buy cannabis products from retailers and brands. Weedmaps for Business sells monthly subscription-based software for cannabis retailers and brands.

Revenue is derived primarily from monthly subscriptions to Weedmaps for Business, which typically have one-month terms that automatically renew. The company also generates income from featured and deal listings, banner advertisements, and promotional tools that serve as add-on products to the basic subscription service.

MAPS stock jumped by around 17% after Trump shared the video but hit resistance at $1.35 and has since been trading sideways. A retest at $1.25 is likely.

The business itself is not that spectacular. Revenue was $215.5 million at its peak in 2022 and has since declined to $184.5 million. Profits are also lower in 2024 ($7.64 million) than they were in 2020 ($38.83 million).

However, the business is special because it has a rising net cash balance and remains profitable, whereas other cannabis stocks have cash-burning businesses. This is one of the only software bets you can make in the cannabis sector.

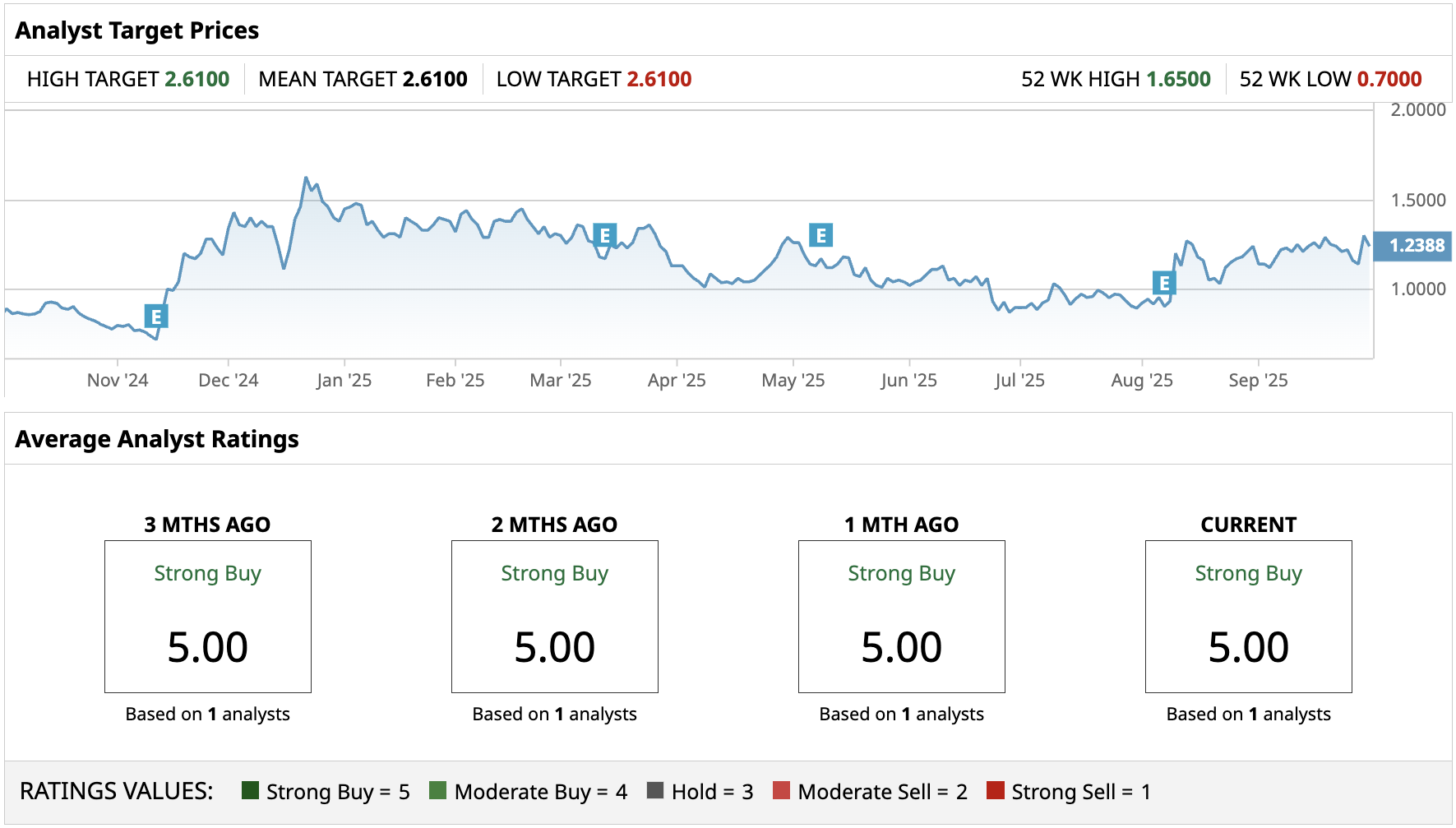

Only one analyst covers MAPS stock, but with a price target more than twice the current price.

Green Thumb Industries (GTBIF)

Green Thumb Industries (GTBIF) is a cannabis and consumer packaged goods company. It is one of the few cannabis companies based in the U.S. that trade publicly and may have a first-mover advantage in the world's biggest cannabis market if legalization goes through.

The company grows cannabis by itself and sells it at dispensaries in states where cannabis is legal. The range of cannabis products being sold by Green Thumb is quite comprehensive, as it sells flower, vapes, edibles, pre-rolls, tinctures, topicals, and concentrates.

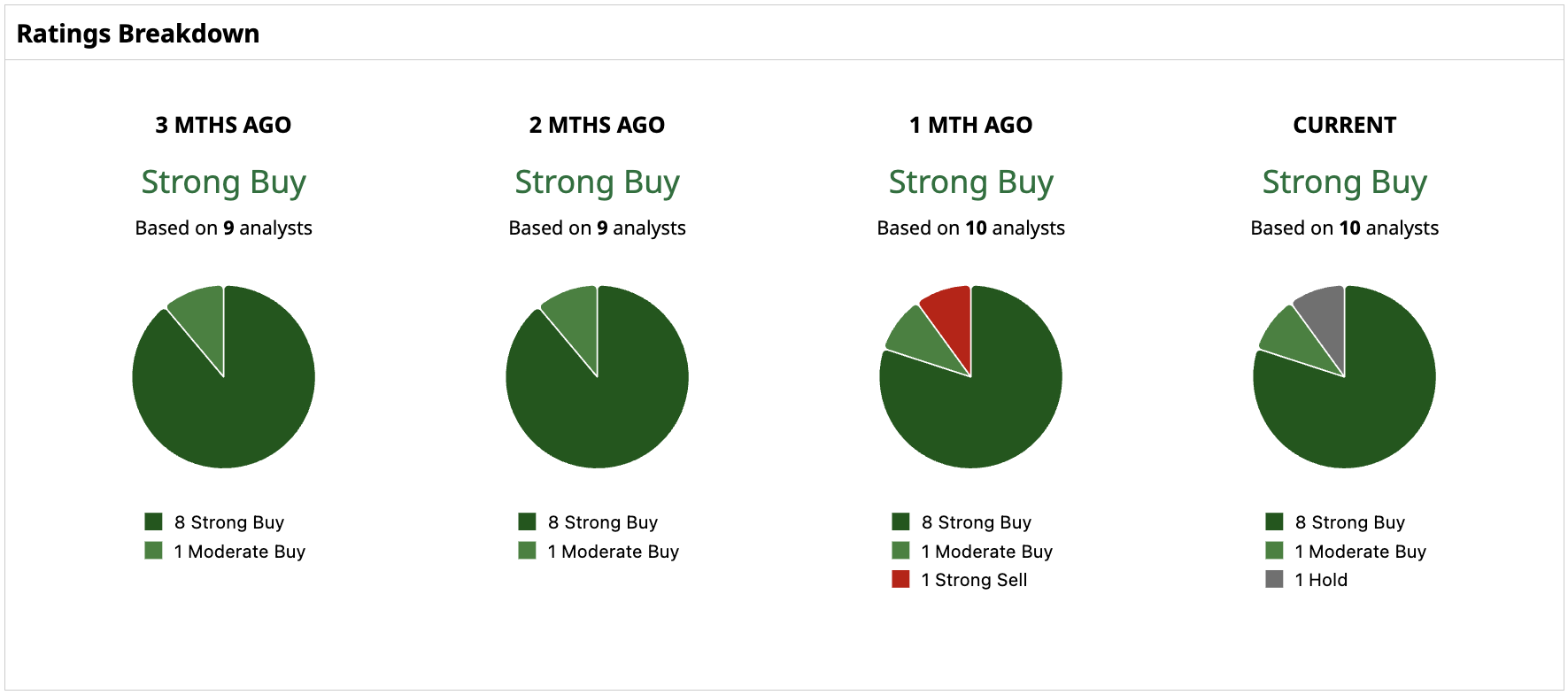

GTBIF stock rose almost 19% from its Friday close to its peak this Monday. Like most other cannabis stocks, traders here are awaiting more clarity, and the stock has been trading sideways. It has a consensus “Strong Buy” rating.

Corbus Pharmaceuticals Holdings (CRBP)

Corbus Pharmaceuticals Holdings (CRBP) is a biotech company that makes therapies for oncology and obesity. This company has a history with endocannabinoid system (ECS) research and development.

Corbus previously concentrated on developing therapeutics targeting the endocannabinoid system for inflammatory and fibrotic diseases. Their former lead compound was Lenabasum (previously called Resunab), which was designed to modulate the endocannabinoid system for treating conditions like cystic fibrosis and systemic sclerosis.

They have since shifted toward oncology, but they still have a cannabis connection through CRB-913, which specifically targets the CB1 cannabinoid receptor. This compound is designed as a peripherally restricted CB1 receptor inverse agonist, meaning it works on cannabinoid receptors but is engineered to avoid central nervous system effects.

As a result, this indirect connection to cannabis did lead to a small uptick. However, this is a part of a larger rebound, as CRBP stock is up 129% in the past six months.

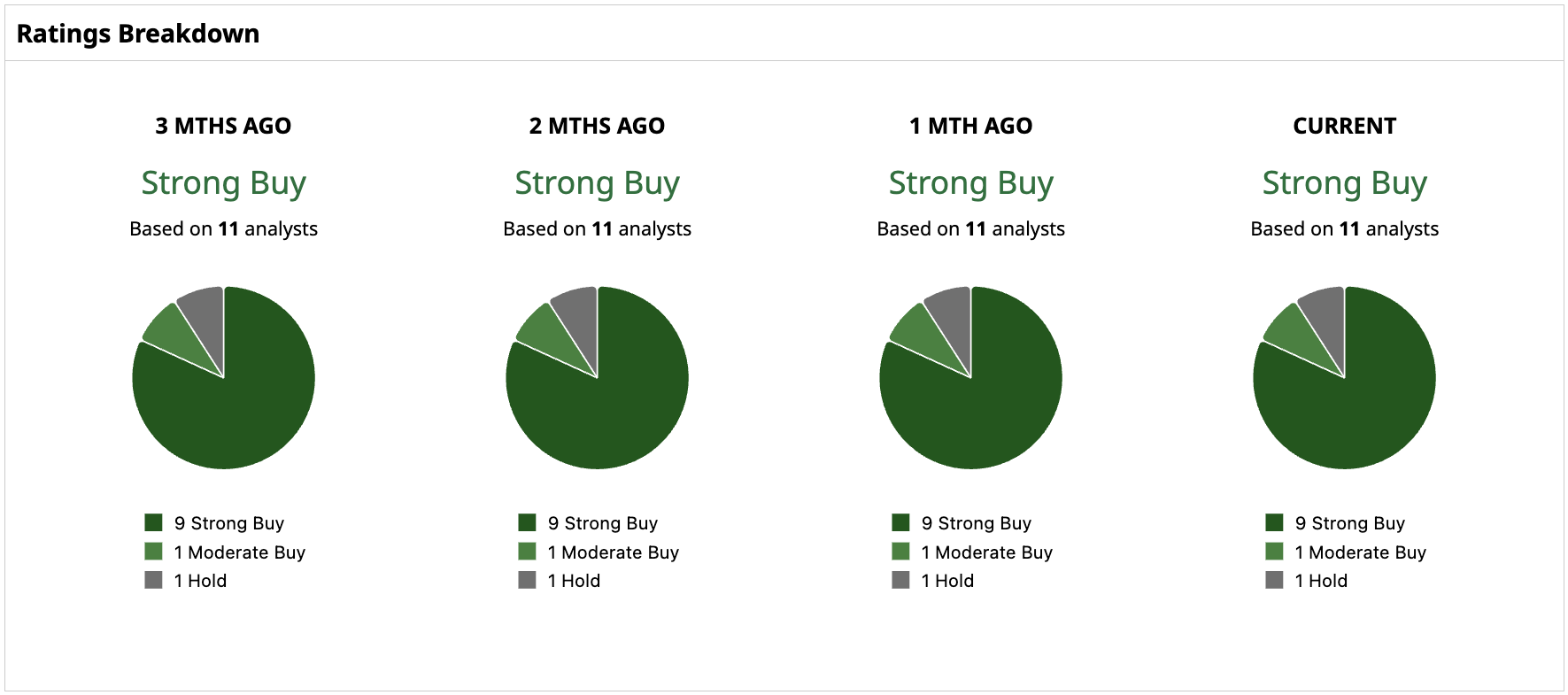

Out of 11 analysts, nine rate it a “Strong Buy.”