/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)

International Business Machines (IBM) stock tumbled more than 7% on Thursday, July 24 following second-quarter earnings results that beat Wall Street expectations, prompting several analysts to view the decline as an overreaction and a compelling buying opportunity despite investor concerns about the consulting business and macro uncertainties.

In Q2 2025, IBM reported revenue of $17 billion, above consensus estimates of $16.6 billion, while adjusted earnings per share stood at $2.80, above estimates of $2.64. However, software sales of $7.39 billion fell short of the $7.43 billion consensus, likely contributing to the stock’s weakness despite the overall revenue beat.

Analysts Remain Bullish on IBM Stock

Melius Research analysts, led by Ben Reitzes, called the stock drop too severe, given IBM’s positioning in what they see as a major mainframe cycle. The analysts highlighted “momentum” for IBM’s new z17 mainframe system and noted benefits from currency tailwinds, as well as prospects for transaction processing to recover.

“We are buyers on weakness since IBM is still entering a big mainframe cycle, software is set to accelerate from here with help from Red Hat and Automation,” the Melius team said, adding they see earnings upside in the coming years.

The analysts view Red Hat as “the business that is most important to IBM’s long-term multiple,” citing the hybrid cloud provider’s 16% growth acceleration in the quarter, up from 12% in the first quarter.

They also expressed optimism about IBM’s prospects in quantum computing and the potential for the z17 mainframe to drive organic growth above the company’s 5% constant-currency target.

Wedbush analysts led by Dan Ives maintained an “Outperform” rating and $325 price target, stating they “would be buyers of any knee-jerk weakness.” The firm believes IBM is “well-positioned to capitalize on the current demand shift for hybrid and artificial-intelligence applications with more enterprises looking to implement AI for productivity gains.”

Even Bank of America, which lowered its price target from $320 to $310, reiterated its “Buy” rating on the stock. The analysts described IBM as a “show me story” on software performance in the second half while remaining “bullish on overall company trajectory,” expecting estimates to move higher with increasing contribution from high-margin software.

During the earnings call, CEO Arvind Krishna expressed optimism about the macroeconomic environment, highlighting strong global technology adoption. He noted that enterprises worldwide are convinced that technology forms the basis for scaling revenue while controlling capital and labor expenses.

IBM demonstrated strong momentum in its hybrid cloud and AI strategy, with its GenAI book of business reaching $7.5 billion in inception-to-date sales. Management raised productivity savings targets and increased free cash flow guidance while maintaining confidence in accelerating revenue growth for the full year.

IBM’s consulting business, while facing near-term headwinds from delayed decision-making and discretionary project cuts, showed encouraging signs with a healthy $32 billion backlog. Krishna noted improved M&A prospects under what he called a “rational regulation environment,” suggesting potential for strategic acquisitions.

The analysts’ bullish stance reflects confidence that IBM’s portfolio strength, mainframe cycle momentum, and accelerating AI adoption among enterprise clients will drive sustainable growth despite current market volatility.

Is IBM Stock Undervalued Right Now?

Analysts tracking IBM stock forecast its free cash flow to improve from $12.75 billion in 2024 to $18.21 billion in 2029. Today, IBM stock trades at a forward FCF multiple of 16.6x, which is higher than its 10-year average of 11.6x.

Given, an estimated annual FCF growth rate of 7.4% and the tech stock’s dividend yield of 2.6%, the tech giant could be priced at 17x forward FCF. This would mean IBM’s market cap could surpass $300 billion in the next three years, indicating upside potential of 25% from current levels. If we adjust for dividend reinvestments, cumulative returns would be closer to 35%.

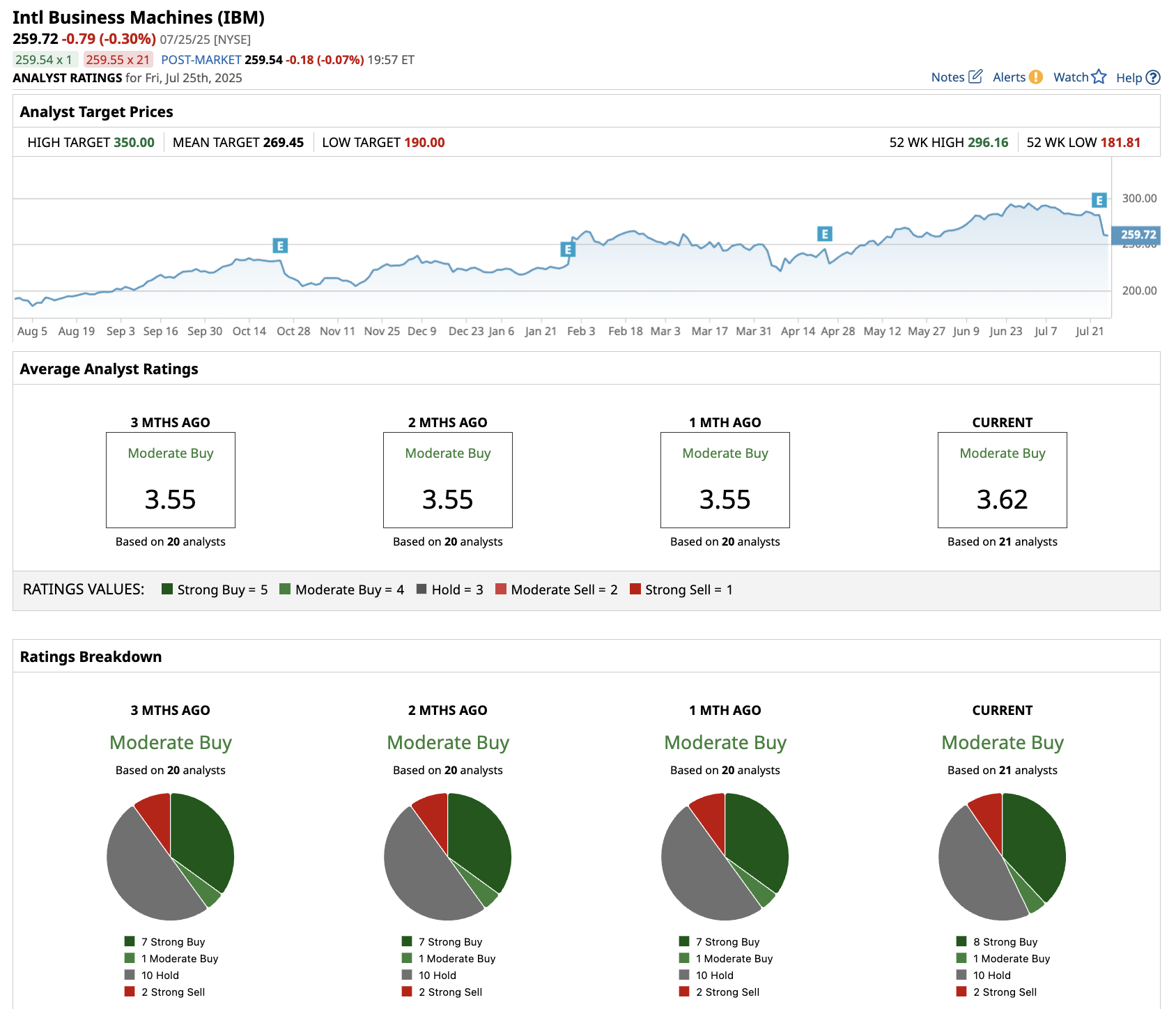

Out of the 21 analysts covering IBM stock, eight recommend “Strong Buy,” one recommends “Moderate Buy,” 10 recommend “Hold,” and two recommend “Strong Sell.” The average target price for IBM is $269, 2% above the current price.