F5 Inc (NASDAQ:FFIV) reported upbeat earnings for the fourth quarter, but issued weak outlook for the current quarter on Monday.

The company posted quarterly earnings of $4.39 per share which beat the analyst consensus estimate of $3.97 per share. The company reported quarterly sales of $810.090 million which beat the analyst consensus estimate of $793.431 million.

F5 said it expects first-quarter adjusted EPS of $3.35-$3.85 vs $4.03 analyst estimate and sees sales of $730.000 million-$780.000 million vs $791.412 million analyst estimate.

“Our fourth quarter revenue of $810 million reflects 8% growth year over year, driven by 16% product revenue growth, including 42% growth in systems revenue,” said François Locoh-Donou, F5’s President and CEO. “Our strong fourth quarter results cap an exceptional year where we grew revenue 10% while driving 18% non-GAAP earnings growth.”

F5 shares fell 10.1% to $261.00 in pre-market trading.

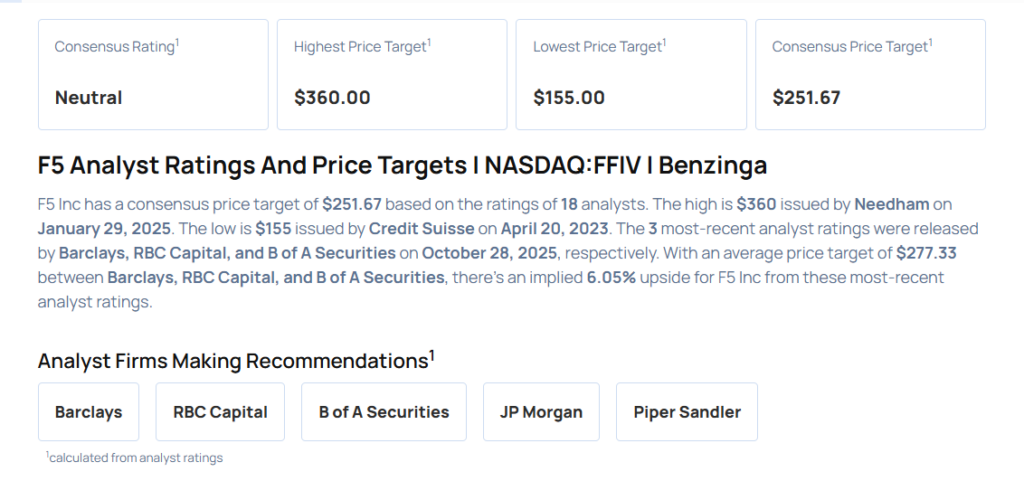

These analysts made changes to their price targets on F5 following earnings announcement.

- Morgan Stanley analyst Meta Marshall maintained F5 with an Equal-Weight rating and lowered the price target from $352 to $336.

- Piper Sandler analyst James Fish maintained the stock with a Neutral and lowered the price target from $355 to $277.

- B of A Securities analyst Tal Liani maintained F5 with an Underperform rating and cut the price target from $260 to $250.

- RBC Capital analyst Matthew Hedberg maintained F5 with a Sector Perform and lowered the price target from $350 to $315.

- Barclays analyst Tim Long maintained F5 with an Equal-Weight rating and lowered the price target from $321 to $267.

Considering buying FFIV stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock