CrowdStrike Holdings Inc (NASDAQ:CRWD) reported better-than-expected financial results for the second quarter after the market close on Wednesday.

CrowdStrike reported second-quarter revenue of $1.17 billion, beating analyst estimates of $1.15 billion, according to Benzinga Pro. The company reported second-quarter adjusted earnings of 93 cents per share, beating estimates of 83 cents per share.

"With reacceleration a quarter ahead of our expectations, CrowdStrike delivered an exceptional Q2. Record Q2 net new ARR of $221 million, over 1,000 Flex customers, and more than 100 re-flexes highlight CrowdStrike as the leader in cybersecurity consolidation," said George Kurtz, founder and CEO of CrowdStrike.

CrowdStrike expects third-quarter revenue to be between $1.208 billion and $1.218 billion versus estimates of $1.228 billion. The cybersecurity company anticipates third-quarter adjusted earnings of 93 cents to 95 cents per share versus estimates of 91 cents per share.

CrowdStrike now expects full-year revenue of $4.749 billion to $4.805 billion versus prior guidance of $4.74 billion to $4.81 billion. Analysts are looking for full-year revenue of $4.784 billion. The company also raised its full-year adjusted earnings guidance from a range of $3.44 to $3.56 per share to a new range of $3.60 to $3.72 per share versus estimates of $3.52 per share.

CrowdStrike announced plans to acquire real-time telemetry pipeline management company Onum. Terms of the deal were not disclosed.

CrowdStrike shares gained 1.8% to $430.00 on Thursday.

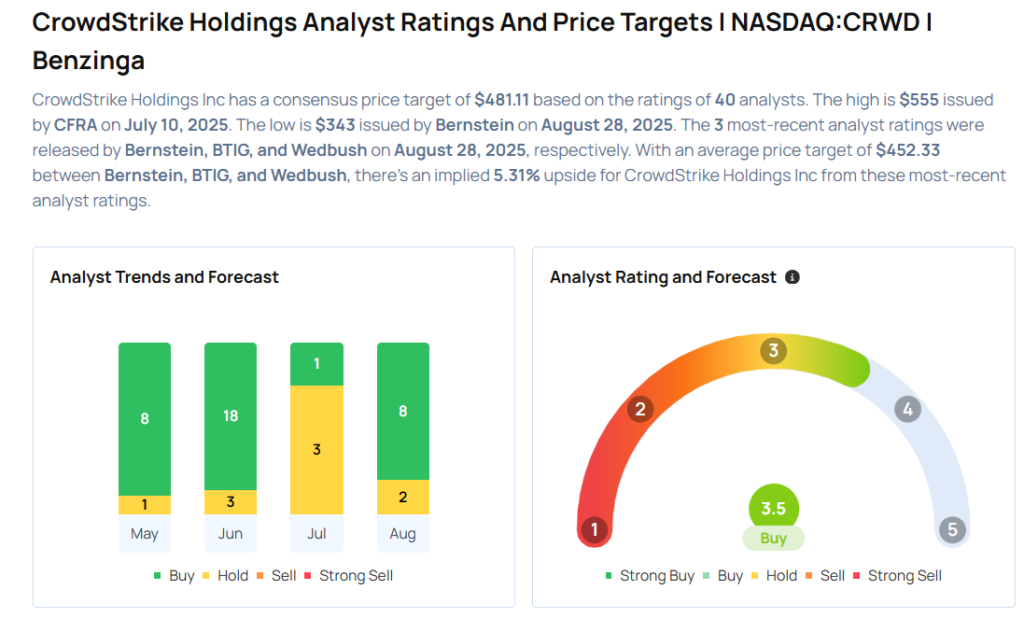

These analysts made changes to their price targets on CrowdStrike following earnings announcement.

- Needham analyst Mike Cikos maintained CrowdStrike with a Buy and lowered the price target from $530 to $475.

- Rosenblatt analyst Catharine Trebnick maintained CrowdStrike with a Buy and lowered the price target from $515 to $490.

- Evercore ISI Group analyst Peter Levine maintained the stock with an In-Line rating and cut the price target from $425 to $405.

- BMO Capital analyst Keith Bachman maintained CrowdStrike with an Outperform rating and lowered the price target from $460 to $450.

- Wedbush analyst Daniel Ives maintained the stock with an Outperform rating and lowered the price target from $575 to $525.

- BTIG analyst Gray Powell maintained CrowdStrike with a Buy and cut the price target from $520 to $489.

Considering buying CRWD stock? Here’s what analysts think:

Photo via Shutterstock

.png?w=600)