Zscaler Inc (NASDAQ:ZS) reported better-than-expected financial results for the fourth quarter of fiscal 2025 after the market close on Tuesday.

Zscaler reported fourth-quarter revenue of $719.23 million, beating the consensus estimate of $706.91 million. The company reported fourth-quarter adjusted earnings of 89 cents per share, beating analyst estimates of 80 cents per share, according to Benzinga Pro.

"We believe Zscaler's Zero Trust and AI security solutions are imperative in today's world and are driving robust demand. We recently delivered AI Guardrails for Public and Private apps, and we are rapidly expanding our AI security portfolio to address the emerging risks of AI models and applications," said Jay Chaudhry, chairman and CEO of Zscaler.

Zscaler expects first-quarter revenue to be in the range of $772 million to $774 million versus estimates of $750.51 million. The company anticipates first-quarter adjusted earnings of 85 cents to 86 cents per share versus estimates of 84 cents per share.

Zscaler expects fiscal 2026 revenue of $3.27 billion to $3.28 billion versus estimates of $2.66 billion. The company anticipates full-year adjusted earnings of $3.64 to $3.68 per share versus estimates of $3.18 per share.

Zscaler shares fell 4.5% to trade at $262.19 on Wednesday.

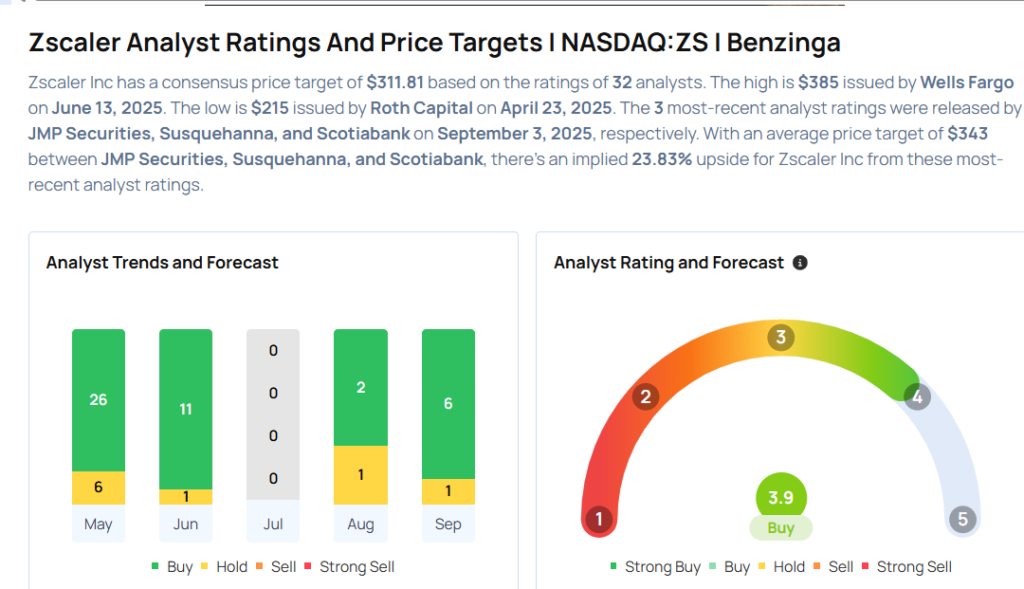

These analysts made changes to their price targets on Zscaler following earnings announcement.

- Rosenblatt analyst Catharine Trebnick maintained Zscaler with a Buy and raised the price target from $315 to $330.

- Baird analyst Shrenik Kothari maintained Zscaler with an Outperform rating and raised the price target from $330 to $345.

- Keybanc analyst Eric Heath maintained the stock with an Overweight rating and boosted the price target from $345 to $350.

- Stifel analyst Adam Borg maintained Zscaler with a Buy and raised the price target from $295 to $330.

- Piper Sandler analyst Rob Owens maintained Zscaler with a Neutral and raised the price target from $260 to $280.

- Susquehanna analyst Shyam Patil maintained the stock with a Positive and raised the price target from $320 to $340.

- Scotiabank analyst Patrick Colville maintained the stock with a Sector Outperform and lowered the price target from $360 to $334.

Considering buying ZS stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock