Union Pacific Corporation (NYSE:UNP) reported better-than-expected earnings for the third quarter on Thursday, driven by operational efficiency gains and core pricing.

The rail transportation company announced net income of $1.8 billion, or $3.01 per diluted share. Including the effect of merger costs of $41 million, adjusted diluted EPS was $3.08, which beat the analyst estimate of $2.99.

The company's operating revenue increased 3% to $6.244 billion, which narrowly missed the analyst estimate of $6.245 billion.

CEO Jim Vena emphasized the focus on the pending Norfolk Southern Corporation (NYSE:NSC) merger to create "America's first transcontinental railroad."

The company reaffirmed its 2025 outlook for EPS growth, consistent with attaining the 3-year CAGR target of high single to low double digits. The capital plan is $3.4 billion.

Union Pacific shares fell 2.3% to close at $220.04 on Thursday.

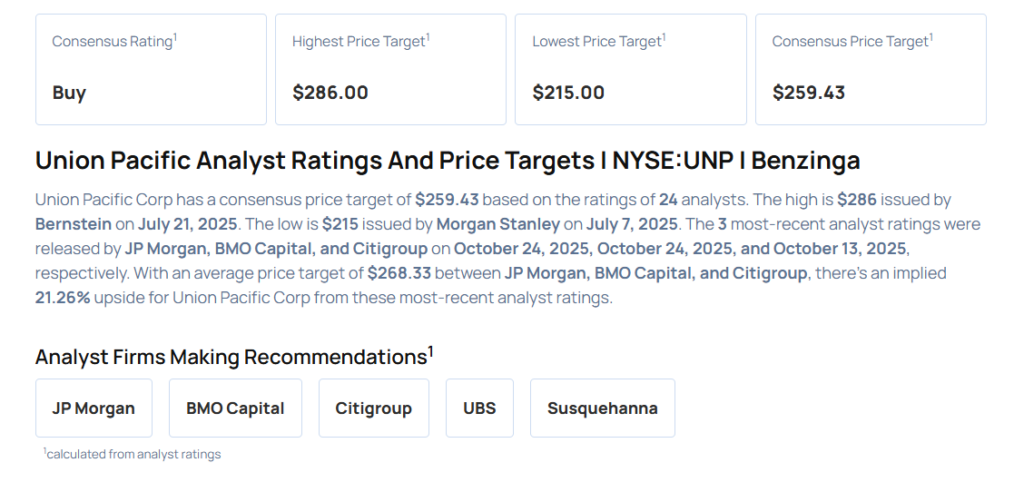

These analysts made changes to their price targets on Union Pacific following earnings announcement.

- BMO Capital analyst Fadi Chamoun maintained Union Pacific with an Outperform rating and lowered the price target from $277 to $275.

- JP Morgan analyst Brian Ossenbeck maintained the stock with a Neutral and raised the price target from $265 to $267.

Considering buying UNP stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock