Target Corporation (NYSE:TGT) posted upbeat second-quarter earnings on Wednesday.

The company reported second-quarter adjusted earnings per share of $2.05, beating the analyst consensus estimate of $2.03. Quarterly sales of $25.21 billion (down 0.9% year over year) outpaced the Street view of $24.93 billion.

Target reaffirmed its fiscal year 2025 adjusted EPS guidance at $7.00–$9.00, compared with the Street estimate of $7.35. Target reiterated its outlook for a low-single-digit decline in fiscal year 2025 sales. In the earnings conference call, Target’s outgoing CEO Brian Cornell acknowledged the impact of tariffs on the company’s financial outlook, stating that this year’s P&L would reflect some short-term pressure due to these costs.

“With the board’s unanimous decision to appoint Michael Fiddelke as Target’s next CEO, I want to express my full confidence in his leadership and focus on driving improved results and sustainable growth. He’s contributed meaningfully during times of change and played a critical role in establishing the differentiated capabilities that will continue to drive Target forward. Michael brings a deep understanding of our business and a genuine commitment to accelerating our progress,” said Brian Cornell, chair and chief executive officer of Target Corporation.

Target shares fell 1.6% to trade at $97.17 on Thursday.

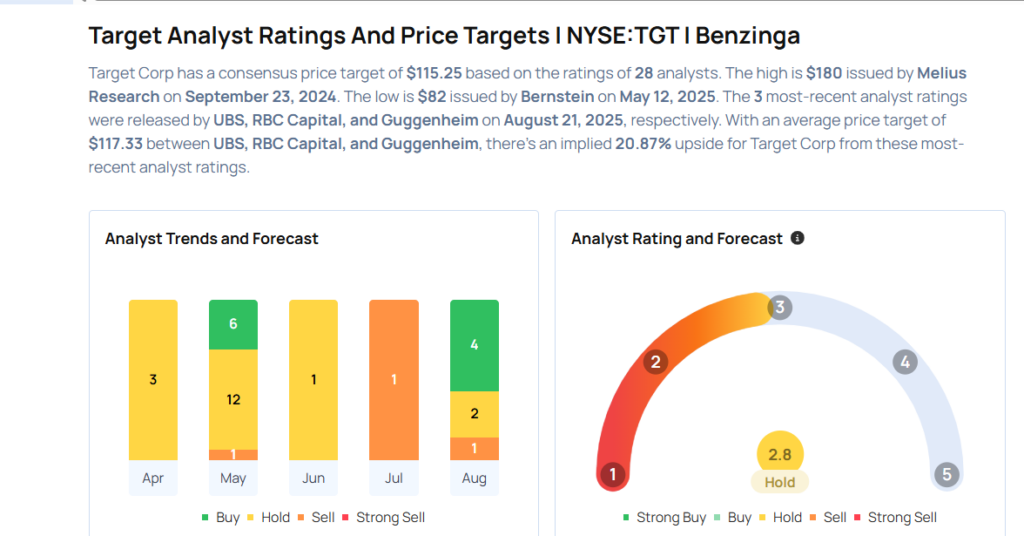

These analysts made changes to their price targets on Target following earnings announcement.

- Evercore ISI Group analyst Greg Melich maintained Target with an In-Line rating and lowered the price target from $108 to $106.

- RBC Capital analyst Steven Shemesh maintained Target with an Outperform rating and raised the price target from $104 to $107.

- UBS analyst Michael Lasser maintained the stock with a Buy and lowered the price target from $135 to $130.

Considering buying TGT stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock