Illinois Tool Works Inc. (NYSE:ITW) reported mixed third-quarter fiscal 2025 results and narrowed its full-year guidance on Friday.

Revenue rose 2.3% year over year (Y/Y) to $4.06 billion, missing the street view of $4.08 billion. The company saw organic revenue growth of 1% Y/Y in the quarter. The company posted earnings of $2.81 per share, versus $3.91 a year ago and above the consensus estimate of $2.71.

Anticipating supply chain disruptions caused by U.S. tariffs, Illinois Tool Works narrowed its full-year profit outlook, Reuters reported.

The company has tightened its full-year 2025 GAAP EPS guidance to the range of $10.40-$10.50 (versus consensus of $10.40) from $10.35-$10.55 prior. Illinois Tool Works projected full-year 2025 sales between $16.057 billion and $16.375 billion (versus consensus of $16.076 billion).

“The ITW team concluded the third quarter with solid operational and financial execution, delivering EPS of $2.81, which grew six percent year-over-year excluding the divestiture gain, alongside record operating margin of 27.4 percent, and a 15 percent increase in free cash flow. This outcome underscores the fundamental strength of the ITW Business Model, the inherent resilience of our diversified portfolio, and the high-quality execution demonstrated by our colleagues worldwide,” said Christopher A. O’Herlihy, President and Chief Executive Officer.

Illinois Tool Works shares rose 1.1% to trade at $248.45 on Monday.

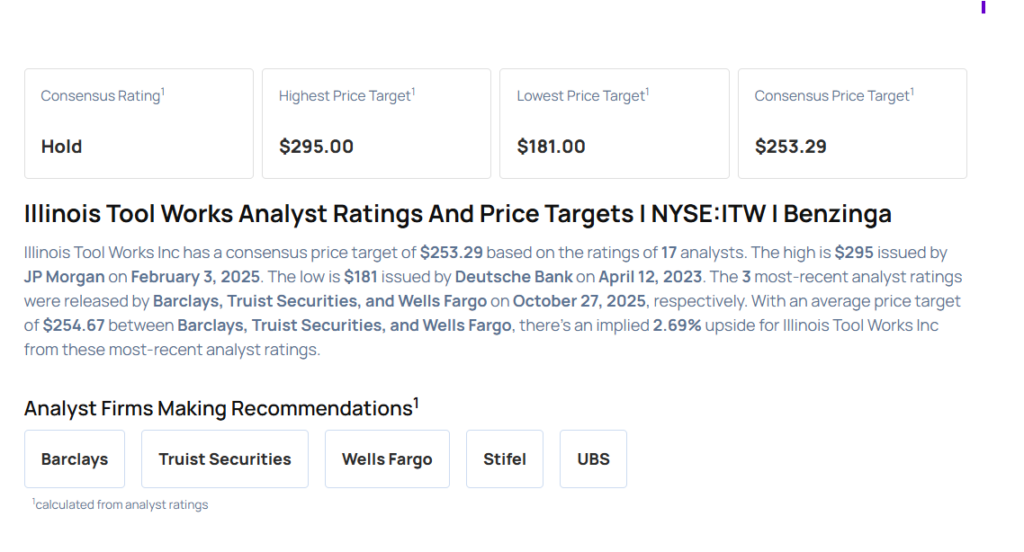

These analysts made changes to their price targets on Illinois Tool Works following earnings announcement.

- Wells Fargo analyst Joseph O’Dea maintained Illinois Tool Works with an Underweight rating and lowered the price target from $250 to $245.

- Truist Securities analyst Jamie Cook maintained the stock with a Hold and lowered the price target from $298 to $275.

- Barclays analyst Julian Mitchell maintained the stock with an Underweight rating and raised the price target from $243 to $244.

Considering buying ITW stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock