Goldman Sachs Group Inc. (NYSE:GS) reported better-than-expected third-quarter results on Tuesday.

Net revenue rose 20% year over year (Y/Y) to $15.18 billion, topping the consensus estimate of $14.10 billion. GAAP earnings came in at $12.25 per share, up from $8.40 a year ago and above the $10.86 consensus.

David Solomon, Chairman and CEO of Goldman Sachs, commented, "This quarter's results reflect the strength of our client franchise and focus on executing our strategic priorities in an improved market environment. Across our business, clients continue to turn to us for their most complex and consequential matters."

Goldman Sachs shares gained 0.2% to $772.64 on Wednesday.

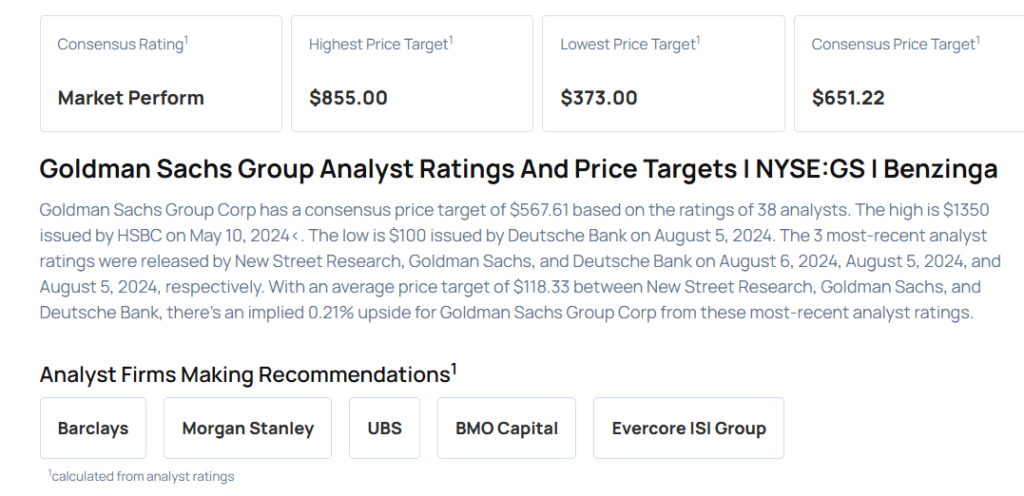

These analysts made changes to their price targets on Goldman Sachs following earnings announcement.

- Morgan Stanley analyst Betsy Graseck maintained Goldman Sachs with an Equal-Weight rating and lowered the price target from $854 to $828.

- Barclays analyst Jason Goldberg maintained the stock with an Overweight rating and raised the price target from $720 to $850.

Considering buying GS stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock