ABM Industries Inc. (NYSE:ABM) reported mixed fiscal third-quarter 2025 results on Friday.

The company posted revenue of $2.22 billion, up 6.2% from $2.09 billion a year earlier. Analysts expected $2.15 billion. Adjusted net income was $51.7 million, or 82 cents per diluted share. It missed the 95-cent estimate and was down from $53.6 million, or 84 cents per diluted share, in the prior year.

"ABM's third quarter performance was highlighted by mid-single-digit organic revenue growth and strong free cash flow," said Scott Salmirs, president and CEO. "Each of our segments once again delivered organic growth, and we secured over $1.5 billion in new bookings through the first three quarters – a 15% increase year-over-year, positioning us for strong revenue and earnings growth in the year ahead."

Looking ahead, ABM narrowed its fiscal 2025 adjusted EPS outlook to $3.65, the low end of its prior $3.65 to $3.80 range and below the $3.75 analyst estimate.

The company also expects an adjusted EBITDA margin of 6.3% to 6.5%. Management said it anticipates that fourth-quarter adjusted EPS and margins will improve meaningfully from the third quarter, supported by restructuring savings and firm performance in Technical Solutions.

ABM shares fell 2% to trade at $47.31 on Monday.

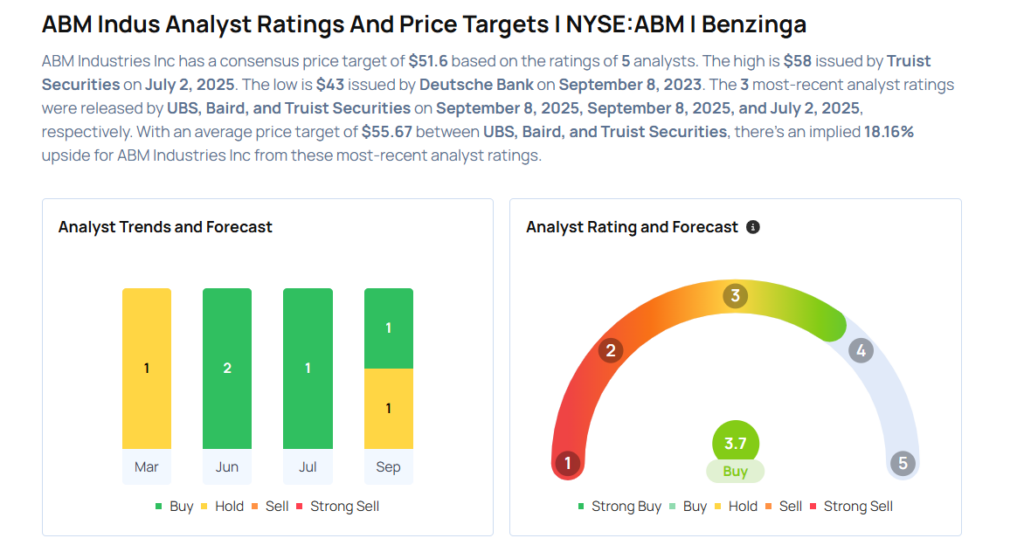

These analysts made changes to their price targets on ABM following earnings announcement.

- Baird analyst Andrew Wittmann downgraded ABM from Outperform to Neutral and lowered the price target from $56 to $54.

- UBS analyst Joshua Chan maintained ABM with a Buy and raised the price target from $54 to $55.

Considering buying ABM stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock