Blackstone Inc. (NYSE:BX) reported better-than-expected second-quarter financial results on Thursday.

The strong performance was fueled by a 25% increase in distributable earnings and robust growth across its key business segments, pushing the firm's total assets under management to a new industry record of over $1.2 trillion.

Blackstone reported second-quarter fiscal year segment revenues of $3.075 billion, up 22% Y/Y, beating the analyst consensus estimate of $2.778 billion. Distributable earnings (DE) rose 25% Y/Y to $1.57 billion.

Chairman and CEO Stephen A. Schwarzman said Blackstone achieved strong second-quarter results, driven by broad growth across private wealth, credit and insurance, and infrastructure. He noted that the firm significantly increased earnings and pushed total assets under management to over $1.2 trillion, marking a new industry record. He emphasized that, above all, Blackstone continued to deliver strong investment performance for its limited partners, with the highest level of fund appreciation in nearly four years.

Blackstone shares gained 3.6% to close at $178.11 on Thursday.

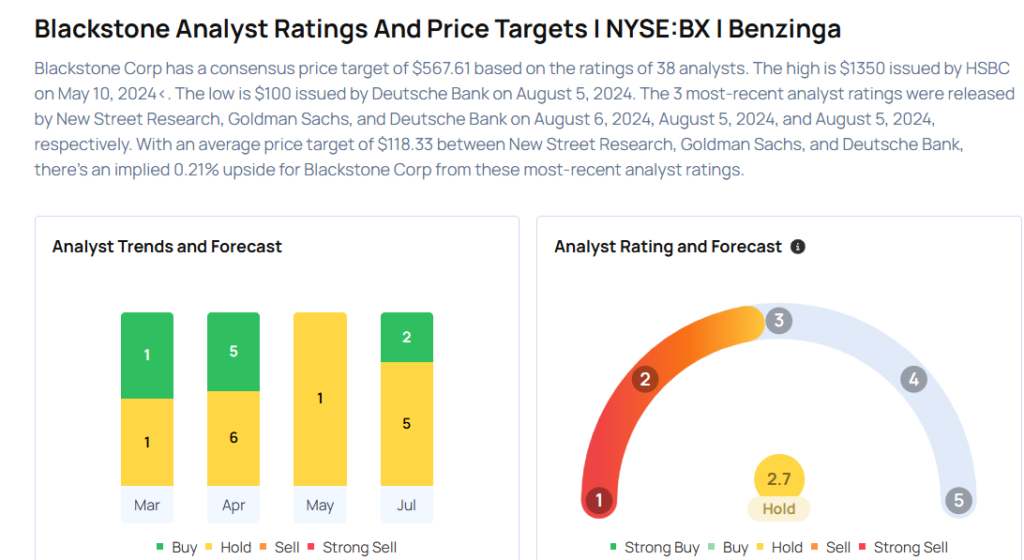

These analysts made changes to their price targets on Blackstone following earnings announcement.

- Deutsche Bank analyst Brian Brungardt maintained Blackstone with a Buy and raised the price target from $170 to $192.

- Keefe, Bruyette & Woods analyst Kyle Voigt maintained the stock with a Market Perform and raised the price target from $168 to $180.

Considering buying BX stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock