Performance Food Group Company (NYSE:PFGC) posted better-than-expected results for the fourth quarter on Wednesday.

The company reported fourth-quarter adjusted earnings per share of $1.55, beating the analyst consensus estimate of $1.45. Quarterly sales of $16.938 billion outpaced the Street view of $16.860 billion (+11.5% year over year).

Performance Food Group expects first-quarter sales between $16.60 billion and $16.90 billion, compared to the $16.916 billion consensus estimate. The company sees adjusted EBITDA to be in a range of approximately $465 million to $485 million.

For the full fiscal year 2026, the company expects net sales to be in a range of approximately $67 billion to $68 billion. It expects adjusted EBITDA to be in a range of approximately $1.9 billion to $2.0 billion.

Performance Food Group shares fell 0.7% to trade at $100.57 on Thursday.

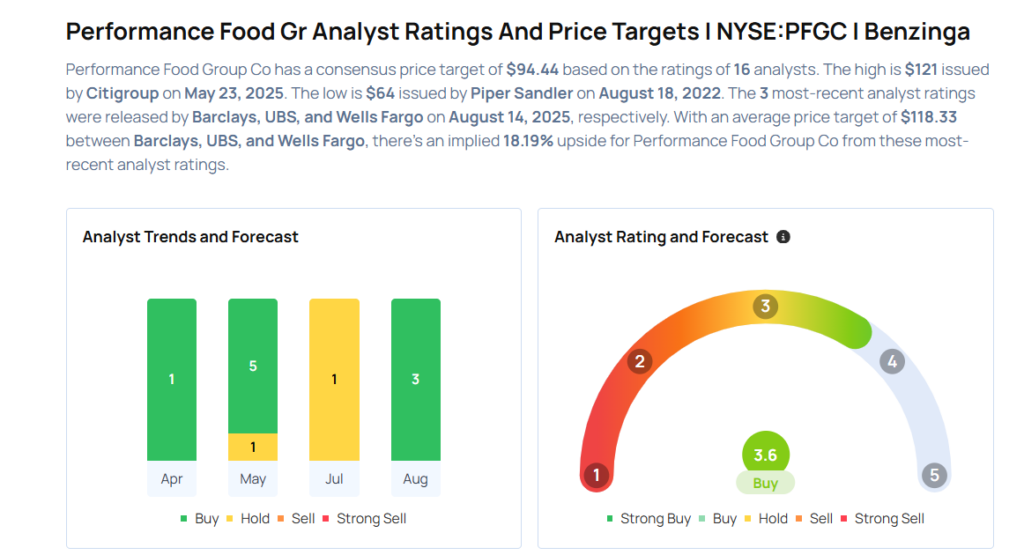

These analysts made changes to their price targets on Performance Food Group following earnings announcement.

- Wells Fargo analyst Edward Kelly maintained Performance Food with an Overweight rating and raised the price target from $100 to $115.

- UBS analyst Mark Carden maintained the stock with a Buy and raised the price target from $110 to $120.

- Barclays analyst Jeffrey Bernstein maintained Performance Food with an Overweight rating and raised the price target from $112 to $120.

Considering buying PFGC stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock