nCino, Inc (NASDAQ:NCNO) posted better-than-expected second-quarter results after Tuesday’s closing bell.

NCino reported quarterly earnings of 22 cents per share, which beat the analyst estimate of 14 cents. Quarterly revenue came in at $148.4 million, which beat the Street estimate of $143.15 million and is up from revenue of $132.4 million from the same period last year.

"We are pleased to report financial results that again exceeded quarterly guidance for total and subscription revenues, as well as non-GAAP operating income," said CEO Sean Desmond.

NCino raised its fiscal 2026 adjusted EPS guidance to between 77 cents and 80 cents, versus the 71 cent estimate, and raised its revenue outlook to between $585 million and $589 million, versus the $581.45 million estimate.

NCino shares gained 14.6% to $32.88 on Wednesday.

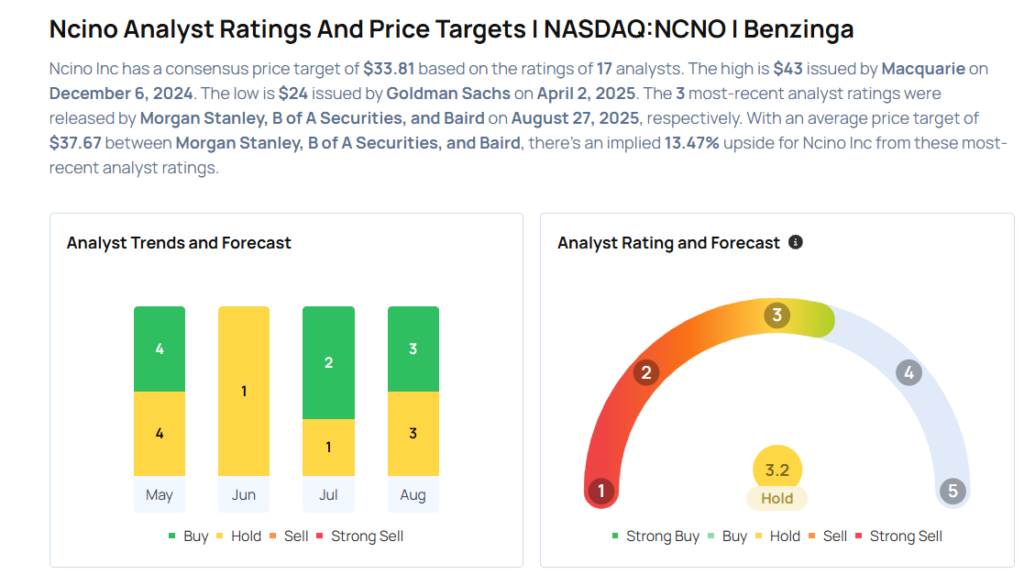

These analysts made changes to their price targets on NCino following earnings announcement.

- Piper Sandler analyst Brent Bracelin maintained Ncino with a Neutral and raised the price target from $28 to $34.

- Needham analyst Mayank Tandon maintained the stock with a Buy and raised the price target from $33 to $38.

- Raymond James analyst Alexander Sklar maintained the stock with an Outperform rating and raised the price target from $35 to $36.

- Truist Securities analyst Terry Tillman maintained Ncino with a Hold and raised the price target from $27 to $32.

- JMP Securities analyst Aaron Kimson maintained the stock with a Market Outperform and raised the price target from $35 to $41.

- Baird analyst Joe Vruwink maintained the stock with an Outperform rating and raised the price target from $38 to $40.

- B of A Securities analyst Brad Sills maintained Ncino with a Neutral and boosted the price target from $34 to $38.

- Morgan Stanley analyst James Faucette maintained the stock with an Equal-Weight rating and raised the price target from $33 to $35.

Considering buying CL stock? Here’s what analysts think:

Photo via Shutterstock