Burlington Stores, Inc. (NYSE:BURL) posted better-than-expected second-quarter fiscal 2025 results on Thursday.

The company posted quarterly revenue of $2.705 billion, up 10% from a year earlier and above the $2.652 billion consensus estimate. Comparable store sales rose 5%. Net income was $94 million, or $1.47 per diluted share, versus $74 million, or $1.15 per share, a year ago. Adjusted earnings were $1.72 per share, up from $1.24 last year and ahead of the $1.32 estimate.

CEO Michael O'Sullivan said, "Comparable store sales increased 5%, which was on top of 5% comparable store sales growth in the second quarter of last year. We also saw very strong margin and earnings performance. Adjusted EBIT Margin increased 120 basis points, while adjusted EPS grew 39% versus the second quarter of last year. This was a high-quality earnings beat driven by ahead of plan sales, higher merchandise margin, lower freight expense and leverage on SG&A expenses."

For fiscal 2025, Burlington raised its adjusted EPS outlook to $9.19 to $9.59 from $8.70 to $9.30, compared with the $9.41 estimate. Full-year sales guidance was lifted to $11.38 billion to $11.49 billion, from $11.27 billion to $11.49 billion, but remains below the $11.58 billion consensus.

For the third quarter, Burlington guided adjusted EPS of $1.50 to $1.60, short of the $1.71 estimate, and sales of $2.66 billion to $2.71 billion, below the $2.76 billion forecast.

Burlington shares gained 5.3% to close at $295.28 on Thursday.

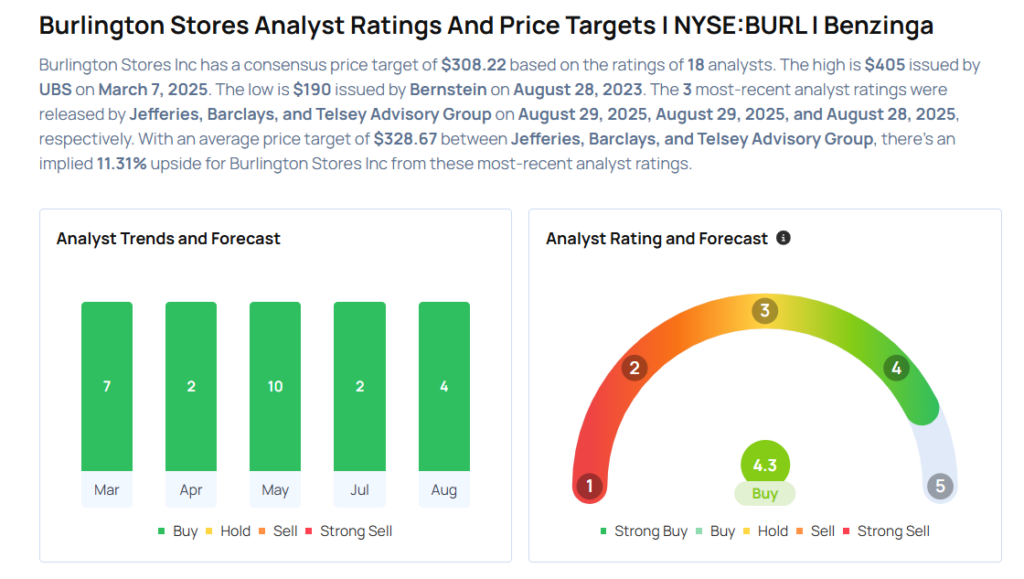

These analysts made changes to their price targets on Burlington following earnings announcement.

- Barclays analyst Adrienne Yih maintained Burlington Stores with an Overweight rating and raised the price target from $299 to $336.

- Jefferies analyst Corey Tarlowe maintained Burlington Stores with a Buy and raised the price target from $300 to $350.

Considering buying BURL stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock