Monday.com Ltd. (NASDAQ:MNDY) reported a rise in sales for the second quarter on Monday.

The software company posted revenue of $299 million, up 27% year over year, driven by strong demand from enterprise customers and growth in its customer base. The company also added a record number of net new customers generating over $100,000 in annual recurring revenue (ARR), while its monday CRM product reached $100 million in ARR just three years after launch.

Looking ahead, Monday.com expects third-quarter revenue of $311 million to $313 million, representing 24% to 25% growth. For the full year, the company projects revenue of $1.224 billion to $1.229 billion.

“Q2 marked another strong quarter for monday.com, with continued revenue growth and rapidly growing demand for our broad product suite, particularly from enterprise customers,” said monday.com co-founders and co-CEOs Roy Mann and Eran Zinman. “We continue to see evidence that our commitment to AI innovation is delivering real value for customers, and we’re proud to be leading a new era of work execution. By taking the platform’s flexibility to the next level, our new AI capabilities address core challenges across all our product areas and allow users to focus on their most critical strategic priorities.”

Monday.com shares fell 1.1% to close at $172.15 on Tuesday.

These analysts made changes to their price targets on Monday.com following earnings announcement.

- Morgan Stanley analyst Josh Baer upgraded Monday.Com from Equal-Weight to Overweight and lowered the price target from $330 to $260.

- Jefferies analyst Brent Thill maintained the stock with a Buy and lowered the price target from $360 to $330.

- B of A Securities analyst Michael Funk maintained Monday.Com with a Buy and lowered the price target from $340 to $240.

- Citigroup analyst Steven Enders maintained the stock with a Buy and cut the price target from $381 to $326.

- Baird analyst Rob Oliver maintained Monday.Com with an Outperform rating and lowered the price target from $310 to $240.

- Barclays analyst Raimo Lenschow maintained the stock with an Overweight rating and lowered the price target from $345 to $258.

- UBS analyst Taylor McGinnis maintained the stock with a Neutral and slashed the price target from $310 to $215.

- TD Cowen analyst J. Derrick Wood maintained the stock with a Buy and cut the price target from $360 to $290.

- Piper Sandler analyst Brent Bracelin maintained Monday.Com with an Overweight rating and lowered the price target from $325 to $300.

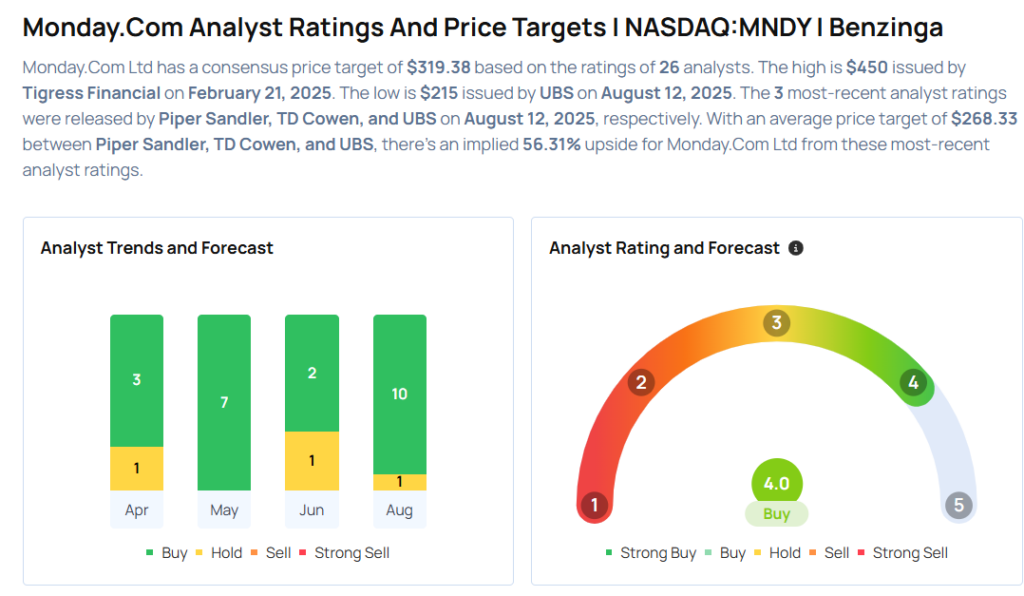

Considering buying MNDY stock? Here’s what analysts think:

Read This Next:

Photo via Shuttertstock