Darden Restaurants, Inc. (NYSE:DRI) reported worse-than-expected first-quarter financial results.

Darden Restaurants reported quarterly earnings of $1.97 per share which missed the analyst consensus estimate of $2.00 per share. The company reported quarterly sales of $3.004 billion which missed the analyst consensus estimate of $3.040 billion.

"We had a strong start to the fiscal year with same-restaurant sales and earnings growth that exceeded our expectations," said Darden President & CEO Rick Cardenas.

Darden Restaurants reaffirmed fiscal 2026 adjusted EPS guidance at $10.50–$10.70, compared with the $10.68 consensus estimate. It also raised its fiscal 2026 sales outlook to $12.983 billion–$13.104 billion from $12.922 billion–$13.043 billion, versus the $13.078 billion Street estimate.

Darden shares fell 7.7% to close at $192.74 on Thursday.

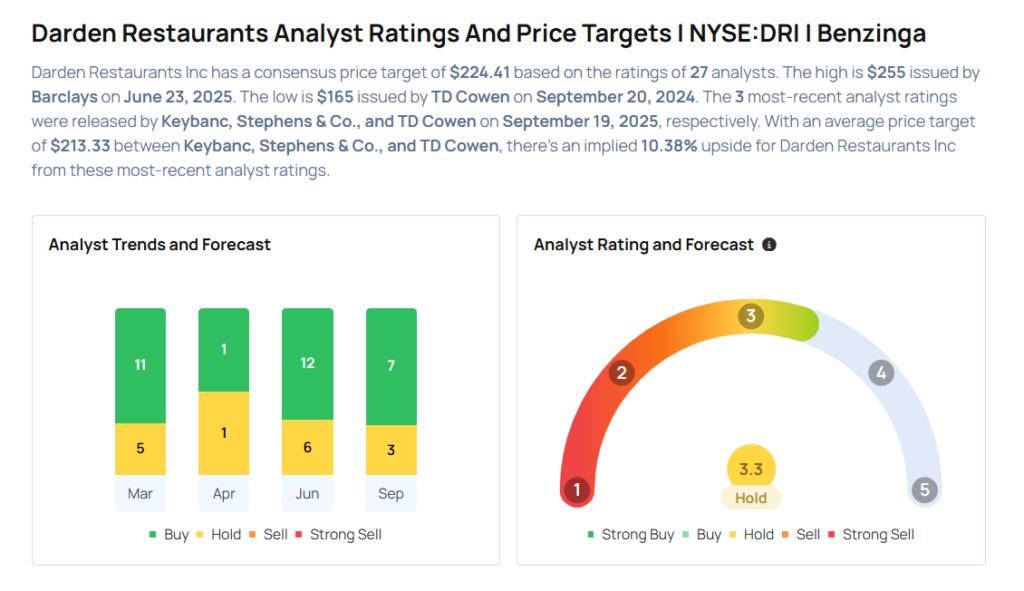

These analysts made changes to their price targets on Darden following earnings announcement.

- BTIG analyst Peter Saleh maintained Darden with a Buy and lowered the price target from $235 to $225.

- TD Cowen analyst Andrew M. Charles maintained the stock with a Hold and cut the price target from $235 to $200.

- Keybanc analyst Eric Gonzalez maintained Darden with an Overweight rating and lowered the price target from $240 to $225.

Considering buying DRI stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock