Bill Holdings, Inc (NYSE:BILL) posted better-than-expected fourth-quarter results after Wednesday’s closing bell.

Bill Holdings reported quarterly earnings of 53 cents per share, which beat the analyst estimate of 41 cents. Quarterly revenue came in at $383.34 million, which beat the Street estimate of $376.17 million and is up from revenue of $343.66 million from the same period last year.

"Fiscal year 2025 was pivotal for BILL as we drove growth and profitability, launched essential new software and payment products for customers and suppliers, and expanded our market opportunity. Our progress in Q4 reinforces our scale advantage, with approximately half a million SMBs and 9,000 accounting firms on our platform, and a network of eight million members," said René Lacerte, Bill CEO.

Bill is looking for first-quarter adjusted earnings of between 49 cents and 52 cents per share, versus the 54 cent estimate, and revenue of between $385 million and $395 million, versus the $394.02 million estimate.

Bill Holdings shares gained 10.3% to $45.94 on Thursday.

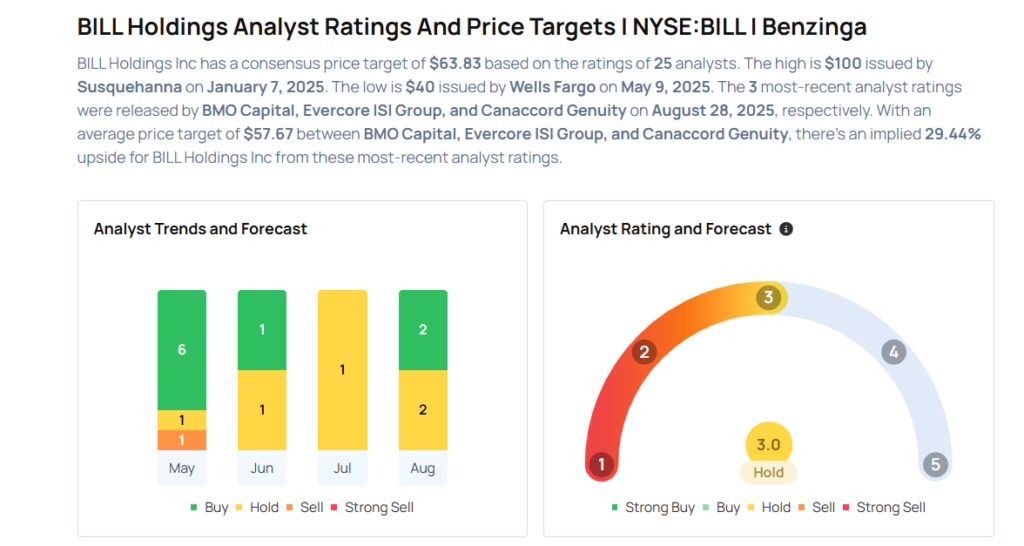

These analysts made changes to their price targets on Bill Holdings following earnings announcement.

- Piper Sandler analyst Clarke Jeffries downgraded BILL Holdings from Overweight to Neutral and lowered the price target from $70 to $50.

- Evercore ISI Group analyst Peter Levine maintained the stock with an In-Line rating and lowered the price target from $50 to $48.

- BMO Capital analyst Daniel Jester maintained the stock with a Market Perform and cut the price target from $52 to $50.

- Keefe, Bruyette & Woods analyst Sanjay Sakhrani maintained the stock with a Market Perform and lowered the price target from $54 to $46.

Considering buying BILL stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock