Semtech Corporation (NASDAQ:SMTC) reported better-than-expected second-quarter financial results after the market closed on Monday.

Semtech reported second-quarter revenue of $257 million, beating analyst estimates of $256.09 million, according to Benzinga Pro. The semiconductor, IoT systems and cloud connectivity service provider reported second-quarter adjusted earnings of 41 cents per share, beating estimates of 40 cents per share.

"Our second quarter results reflect strong year-over-year financial performance, driven by deep customer engagement, operational discipline, and a culture of excellence," said Hong Hou, president and CEO of Semtech.

Semtech expects third-quarter revenue to be in the range of $261 million to $271 million versus estimates of $264.74 million. The company expects third-quarter adjusted earnings to be between 41 cents and 47 cents per share versus estimates of 44 cents per share.

Semtech shares jumped 11.5% to $56.89 on Tuesday.

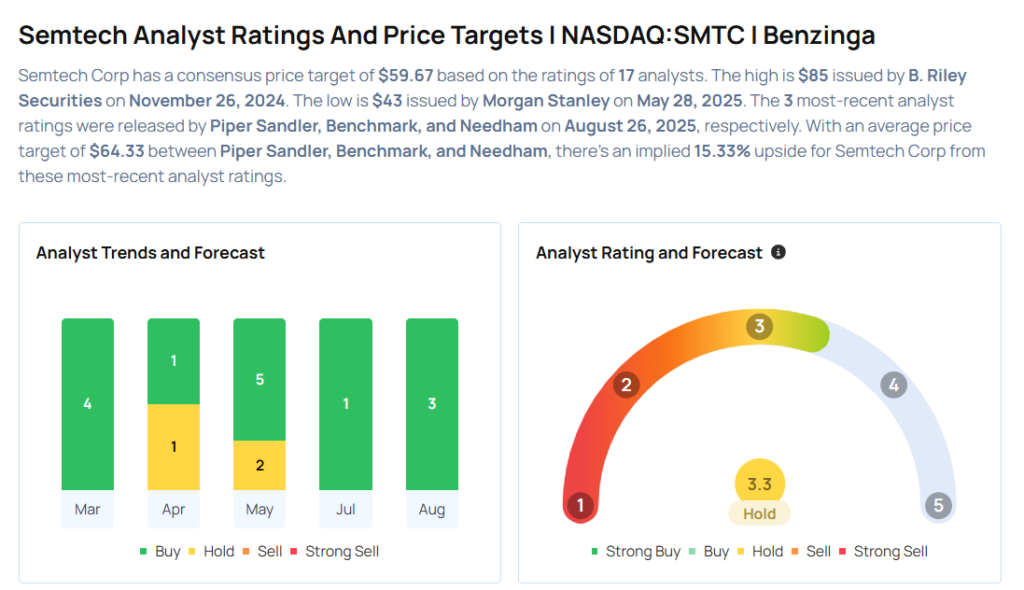

These analysts made changes to their price targets on Semtech following earnings announcement.

- Needham analyst N. Quinn Bolton maintained Semtech with a Buy and raised the price target from $54 to $60.

- Piper Sandler analyst Harsh Kumar maintained the stock with an Overweight rating and boosted the price target from $55 to $65.

- Benchmark analyst Cody Acree reiterated Semtech with a Buy and maintained a $68 price target.

Considering buying SMTC stock? Here’s what analysts think:

Photo via Shutterstock