Planet Labs PBC (NYSE:PL) reported better-than-expected second-quarter fiscal 2026 results, driven by record revenue growth and raised guidance.

Revenue rose 20% from a year earlier to $73.39 million, above analyst estimates of $65.74 million. The company reported a GAAP net loss of $22.6 million, or 7 cents per share, compared with a loss of $38.7 million, or 13 cents per share, a year ago.

On a non-GAAP basis, net loss per share was 3 cents, beating expectations for a 4-cent loss. Adjusted EBITDA was $6.4 million, compared with a loss of $4.4 million a year earlier.

CEO Will Marshall said, "Our second quarter results demonstrate incredibly strong momentum across our business, with record revenue and substantial growth in our backlog. The increased demand for our unique Earth intelligence, highlighted by pivotal contracts including one in collaboration with the German government, one with NATO, and others with the U.S. Department of Defense, underscores the critical role Planet plays in addressing global challenges and supporting peace and security."

For the third quarter, Planet guided revenue between $71 million and $74 million, above the $68.86 million analyst consensus. Non-GAAP gross margin is expected at 55% to 56%, with adjusted EBITDA between a $4 million loss and breakeven.

For fiscal 2026, the company raised its revenue outlook to $281 million to $289 million, up from prior guidance of $265 million to $280 million, but below the $328.38 million analyst estimate. Non-GAAP gross margin is expected to be 55% to 57%, and adjusted EBITDA between a $7 million loss and breakeven.

After the closing bell on Monday, Planet Labs announced a private offering of $300 million convertible senior notes due 2023.

Planet shares fell 3.6% to trade at $9.31 on Tuesday.

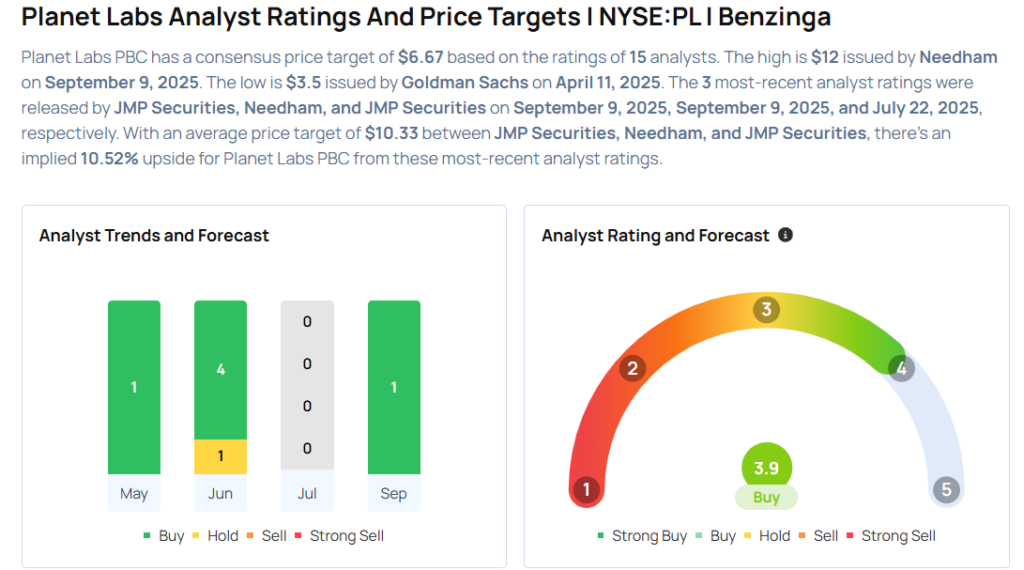

These analysts made changes to their price targets on Planet following earnings announcement.

- Needham analyst Ryan Koontz maintained Planet Labs with a Buy and raised the price target from $8 to $12.

- JMP Securities analyst Trevor Walsh maintained the stock with a Market Outperform and raised the price target from $8 to $11.

Considering buying PL stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

.jpg?w=600)