Oracle Corporation (NYSE:ORCL) reported weaker-than-expected first-quarter results on Tuesday.

Oracle reported quarterly earnings of $1.47 per share, which missed the analyst consensus estimate of $1.48. Quarterly revenue came in at $14.92 billion, which missed the Street estimate of $15.03 billion and is up from revenue of $13.3 billion from the same period last year. CEO Catz teased significant revenue growth in the quarters ahead.

"MultiCloud database revenue from Amazon, Google and Microsoft grew at the incredible rate of 1,529% in the first quarter," said Oracle Chairman and Chief Technology Officer Larry Ellison. "We expect MultiCloud revenue to grow substantially every quarter for several years as we deliver another 37 datacenters to our three Hyperscaler partners, for a total of 71."

CEO Catz teased significant revenue growth in the quarters ahead.

Oracle shares jumped 29.6% to $312.96 in the pre-market trading session.

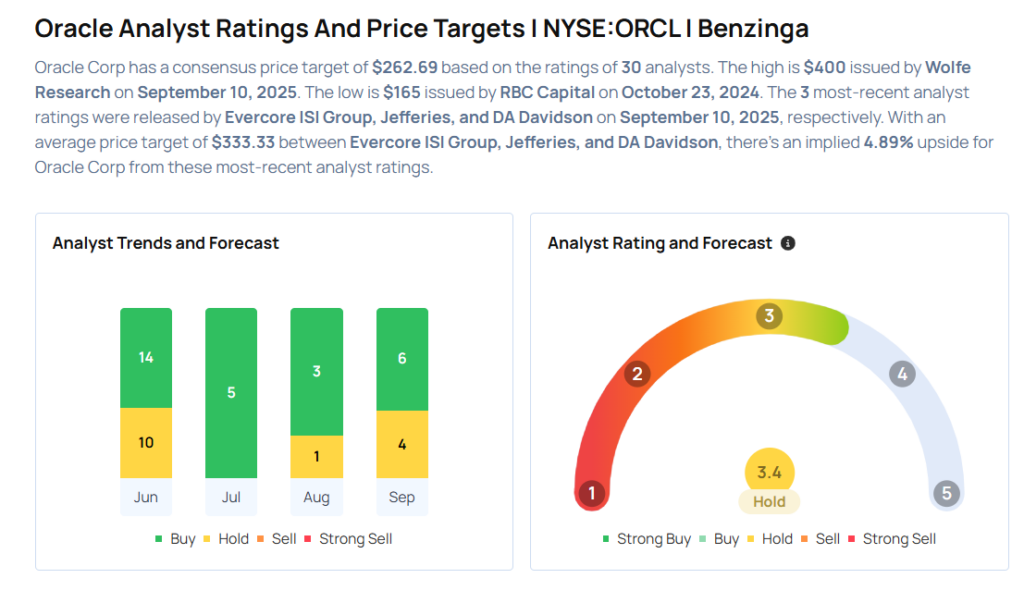

These analysts made changes to their price targets on Oracle following earnings announcement.

- Piper Sandler analyst Brent Bracelin maintained Oracle with an Overweight rating and raised the price target from $270 to $330.

- Wolfe Research analyst Alex Zukin maintained the stock with an Outperform rating and raised the price target from $300 to $400.

- DA Davidson analyst Gil Luria maintained Oracle with a Neutral and raised the price target from $220 to $300.

- Jefferies analyst Brent Thill maintained the stock with a Buy and raised the price target from $270 to $360.

- Evercore ISI Group analyst Kirk Materne maintained Oracle with an Outperform rating and raised the price target from $270 to $340.

Considering buying ORCL stock? Here’s what analysts think:

Photo via Shutterstock