Johnson & Johnson (NYSE:JNJ) on Tuesday reported better-than-expected third-quarter earnings on Tuesday.

The company posted adjusted earnings of $2.80 per share, up 15.7% year over year, beating the consensus of $2.75. The pharmaceutical and medtech giant reported sales of $23.99 billion, up 6.8% year over year and beating the consensus of $23.74 billion. Operational growth was 5.4%, and adjusted operational growth was 4.4%.

Johnson & Johnson affirmed its fiscal year 2025 adjusted earnings guidance of $10.80-$10.90, compared to the consensus of $10.87. Johnson & Johnson raised sales guidance from $93.2 billion-$93.6 billion to $93.5 billion-$93.9 billion compared to the consensus of $93.44 billion.

Johnson & Johnson on Tuesday said it plans to separate its Orthopedics business to enhance the strategic and operational focus.

Johnson & Johnson shares fell 0.2% to $190.48 on Wednesday.

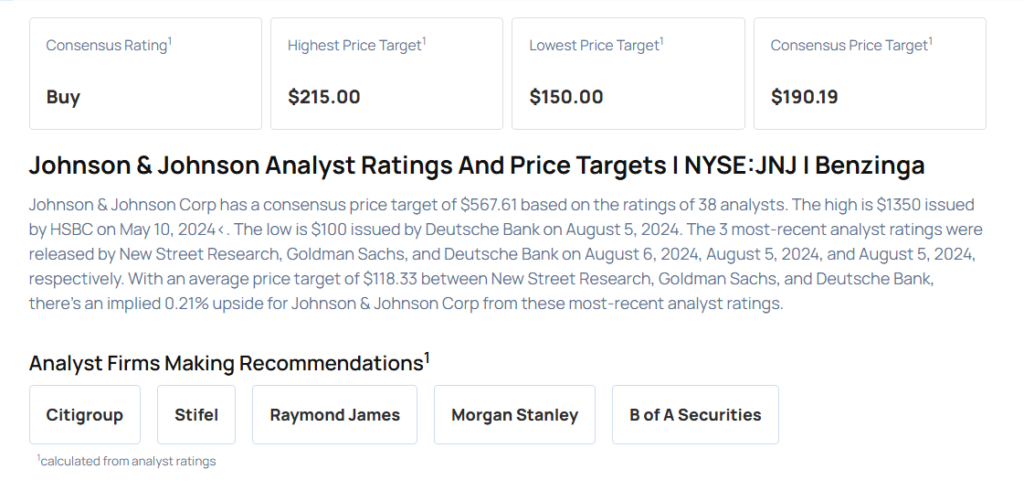

These analysts made changes to their price targets on Johnson & Johnson following earnings announcement.

- B of A Securities analyst Tim Anderson maintained Johnson & Johnson with a Neutral and raised the price target from $198 to $204.

- Morgan Stanley analyst Terence Flynn maintained the stock with an Equal-Weight rating and raised the price target from $178 to $190.

- Raymond James analyst Jayson Bedford maintained Johnson & Johnson with an Outperform rating and raised the price target from $174 to $209.

- Stifel analyst Rick Wise maintained the stock with a Hold and raised the price target from $165 to $190.

- Citigroup analyst Joanne Wuensch maintained Johnson & Johnson with a Buy and raised the price target from $213 to $215.

Considering buying CL stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock