Illumina, Inc. (NASDAQ:ILMN) reported better-than-expected earnings for the second quarter on Thursday.

The company posted quarterly earnings of $1.19 per share which beat the analyst consensus estimate of $1.01 per share. The company reported quarterly sales of $1.059 billion which beat the analyst consensus estimate of $1.049 billion.

“The Illumina team again delivered results that exceeded our guidance, driven by the continued ramp in X consumables, as well as accelerating growth in clinical, our largest customer segment,” said Jacob Thaysen, Chief Executive Officer. “In research, we are actively helping our customers navigate a constrained funding environment. Even in these challenging conditions, the team’s focus on operational excellence helped drive margin expansion, enabling us to increase our expectations for the year.”

Illumina raised its FY2025 adjusted EPS guidance from $4.20-$4.30 to $4.45-$4.55.

Illumina shares fell 6.8% to trade at $95.76 on Friday.

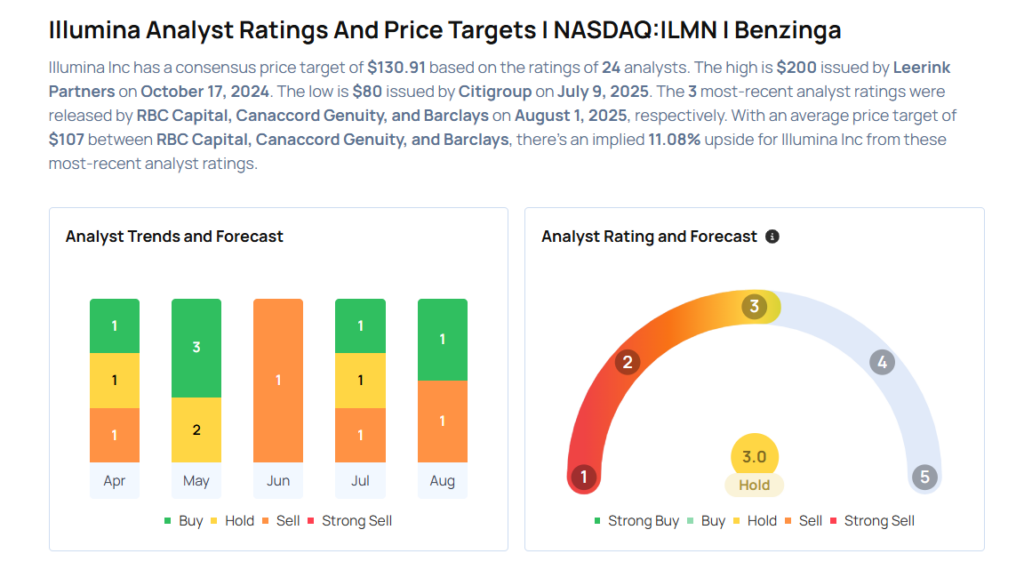

These analysts made changes to their price targets on Illumina following earnings announcement.

- Barclays analyst Luke Sergott maintained Illumina with an Underweight rating and raised the price target from $85 to $90.

- Canaccord Genuity analyst Kyle Mikson maintained the stock with a Hold and raised the price target from $99 to $105.

Considering buying ILMN stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock