Huntington Bancshares Incorporated (NASDAQ:HBAN) reported better-than-expected earnings for the third quarter on Friday.

The company posted quarterly earnings of 41 cents per share which beat the analyst consensus estimate of 37 cents per share.

“Huntington’s third-quarter results reflect the strength of our differentiated operating model, driven by targeted growth investments and disciplined execution of core strategies,” said Steve Steinour, chairman, president, and CEO. “We continue to deliver balanced, above-peer growth by acquiring new customers, deepening relationships, and expanding both net interest income and diversified fee revenues. Our proven approach—combining national expertise with local delivery—has enabled us to accelerate organic growth across our core footprint and new markets and verticals. Over the past year, we have grown loans and deposits by more than $11 billion and $8 billion, respectively, with approximately 60% of loan growth from our core businesses and 40% from new initiatives.”

Huntington Bancshares shares gained 2.1% to trade at $15.82 on Monday.

These analysts made changes to their price targets on Huntington Bancshares following earnings announcement.

- Keefe, Bruyette & Woods analyst David Konrad maintained Huntington Bancshares with a Market Perform and raised the price target from $19 to $20.

- TD Cowen analyst Steven Alexoloulos maintained the stock with a Buy and raised the price target from $21 to $22.

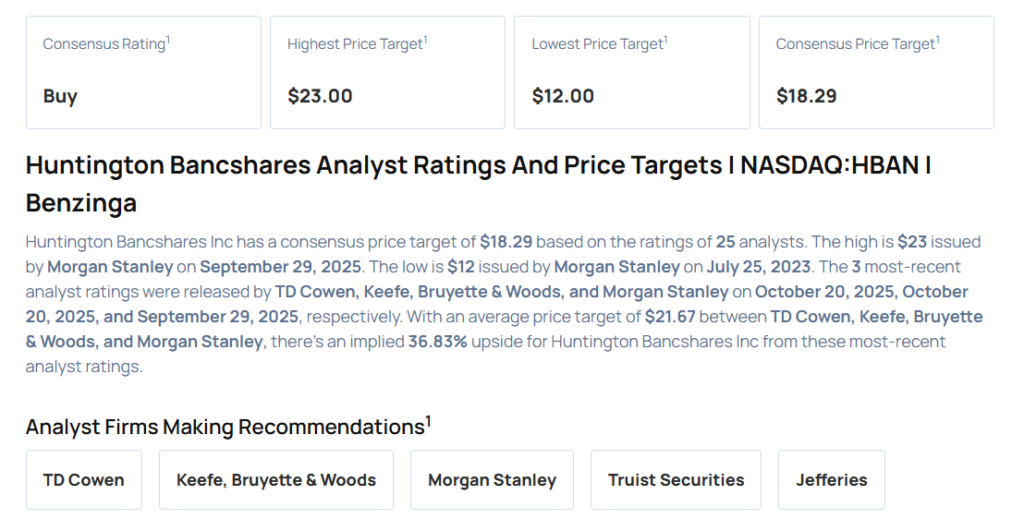

Considering buying HBAN stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock