Guidewire Software, Inc. (NYSE:GWRE) reported fourth-quarter results above analyst estimates on Thursday.

Guidewire Software reported quarterly earnings of $84 cents per share which beat the analyst consensus estimate of 64 cents per share. The company reported quarterly sales of $356.570 million which beat the analyst consensus estimate of $337.858 million.

Guidewire Software said it sees FY2026 sales of $1.385B-$1.405B, versus estimates of $1.184 billion.

“We were thrilled to close the year with an outstanding fourth quarter executing 19 cloud deals and surpassing $1 billion in ARR,” said Mike Rosenbaum, chief executive officer, Guidewire. “The fourth quarter was highlighted by a significant 10-year agreement with a major Tier-1 insurer that exemplifies the platform maturity and referenceability driving increased deal sizes and deeper customer commitments.”

Guidewire Software shares jumped 18.5% to trade at $257.52 on Friday.

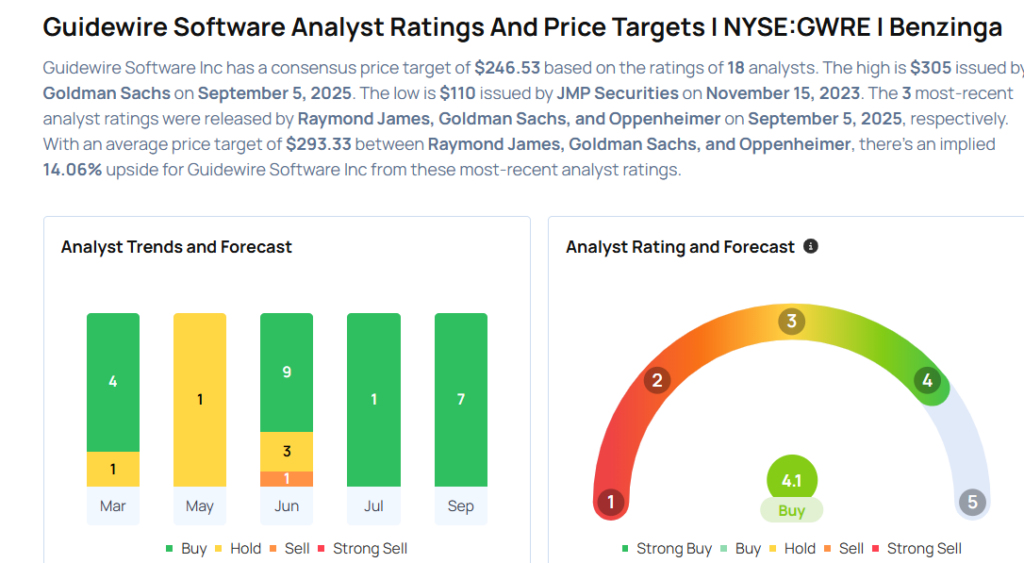

These analysts made changes to their price targets on Guidewire Software following earnings announcement.

- RBC Capital analyst Rishi Jaluria maintained Guidewire Software with an Outperform rating and raised the price target from $290 to $300.

- Oppenheimer analyst Ken Wong maintained Guidewire Software with an Outperform rating and raised the price target from $275 to $300.

- Stifel analyst Parker Lane maintained Guidewire Software with a Buy and raised the price target from $270 to $300.

- Wells Fargo analyst Michael Turrin maintained the stock with an Overweight rating and raised the price target from $265 to $275.

- Goldman Sachs analyst Adam Hotchkiss maintained Guidewire Software with a Buy and raised the price target from $270 to $305.

- Raymond James analyst Alexander Sklar reiterated the stock with an Outperform rating and boosted the price target from $255 to $275.

Considering buying GWRE stock? Here’s what analysts think:

Photo via Shutterstock