General Dynamics (NYSE:GD) posted better-than-expected results for the third quarter of 2025 on Friday.

The aerospace and defense giant reported total revenue of $12.907 billion, a 10.6% increase from the year-ago quarter and surpassing the consensus analyst estimate of $12.566 billion.

Diluted GAAP earnings per share (EPS) was $3.88, which handily beat the analyst estimate of $3.69, and marked a 15.8% increase year-over-year. Operating earnings were $1.3 billion, with the operating margin expanding to 10.3%, a 20-basis-point increase year-over-year.

“Each of our four segments grew earnings and backlog in the quarter, reflecting solid execution coupled with growing demand,” said Phebe Novakovic, chairman and chief executive officer. “The Aerospace segment in particular performed impressively, growing revenue 30.3% and expanding margins by 100 basis points from the same period a year ago, with order activity for business jets remaining very strong.”

General Dynamics shares fell 0.8% to trade at $348.02 on Monday.

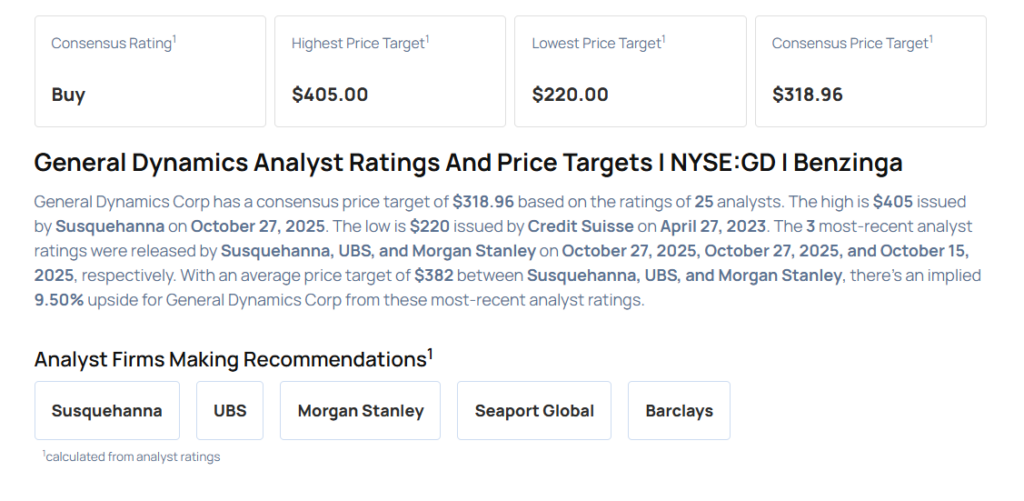

These analysts made changes to their price targets on General Dynamics following earnings announcement.

- UBS analyst Gavin Parsons maintained General Dynamics with a Neutral and raised the price target from $369 to $381.

- Susquehanna analyst Charles Minervino maintained the stock with a Positive and raised the price target from $365 to $405.

Considering buying GD stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock