The tide has turned for the markets in recent months. Inflationary pressures, higher interest rates and the war in Ukraine have prompted money managers such as Frank Lee of Miracle Mile Advisors to adjust course. He's investing in some of the best ETFs that reflect the current environment.

Lee, managing director and head of the investment strategy group at Miracle Mile, says the firm's philosophy is to use a top-down macroeconomic view. He uses it to find the best investment themes and opportunities that express those views. And ETFs are among the tools he prefers.

With $3 billion under management, the Los Angeles-based registered investment advisor has doubled its assets in two years. The firm also made two acquisitions last year, adding $500 million in assets to Miracle Mile's portfolio. The company now has four offices across the country.

"We're trying to find teams of advisors that have similar investment philosophies to ours and they're looking to offload some of the investment operational duties to the firm," said Lee. This allows them to "focus more on client servicing and business development." The goal is to make two to three acquisitions per year.

Finding Opportunity In Best ETFs

Lee pointed out that volatility and risk have increased in 2022. A hawkish Federal Reserve, lower fiscal spending and the Ukraine conflict have challenged the markets. But he's not factoring in the likelihood of a recession yet.

"We're in a slowdown period," he said. "A slowdown doesn't necessarily lead to a contraction or recession. A slowdown can shift and pivot back into an accelerating growth period. And that's what we're forecasting."

That analysis informs his ETF picks. "We've seen that equity and risk markets actually do quite well as you enter that slowdown period and pivot back into expansion," he said. Before, given the rising tide, all risk markets did very well, he says. "Now, given the higher volatility and the slowdown period, it's a stock-pickers market."

Finding Tech Dividends From Best ETFs

Lee's first pick for the best ETF in the current environment is First Trust Nasdaq Technology Dividend. The $1.9 billion fund focuses on larger, high-quality tech firms that are trading at reasonable valuations. And they pay dividends.

"These are not high-growth, unprofitable companies," he said. "These are companies that are generating cash flows, have positive earnings and pay dividends. These are truly the high-quality companies in the technology space."

Among the fund's 93 holdings are Intel, Microsoft, Oracle, Texas Instruments, IBM and Qualcomm. Microsoft is on IBD's Leaderboard. The fund's SEC yield is 2.2% and it charges an annual fee of 0.5%.

While the ETF sold off this year along with the tech names, it posted only a moderate decline of 4.8% YTD vs. some of the high-growth tech names.

"It's really playing on multiple themes this year: quality, dividend, earnings," said Lee. "I think it's the only fund that might be in this area."

Mining Fixed-Income Gems

Another of his picks is Invesco Senior Loan. Fixed income does not provide the same safe-haven experience as in the past. But the floating-rate nature of this fund should help it adjust to higher interest rates, he says. The $5.1 billion fund invests in senior secured loans, which are considered "safer" than the rest of the high-yield bonds. They hold senior position in a company's capital structure.

"We still have a positive view on the economy, and these companies will continue to grow," he said. The markets expect as many as seven rate hikes by the Fed in 2022. The fund's yield of 3.4% should help cushion against rate increases, he says. BKLN charges an annual fee of 0.65% and is down 1.1% YTD.

Best ETFs: Finding Protection From Inflation

Lee's third ETF pick focuses on shielding investors from higher inflation. It also takes advantage of higher commodity prices. Energy Select Sector SPDR invests in energy such as oil, gas and consumable fuels. It also holds energy equipment and services.

The $37.7 billion fund is quite concentrated, holding just 21 stocks. More than 75% of assets make up the top 10 holdings. These include Exxon Mobil and Chevron, at 22% weight each, as well as EOG Resources, ConocoPhillips, Schlumberger, Marathon Petroleum and Valero Energy.

"Commodity prices have risen exponentially. Energy stocks are starting to finally catch up to that, but I think the runway is much longer," said Lee. "Energy firms make money by selling the commodity, but they need to produce it. So, energy prices can stay elevated and (those firms) don't necessarily need the energy prices to go higher (to do well)."

XLE yields 2.8%, charges just 0.1% annually and is up 40% YTD. It is the largest energy ETF in the space.

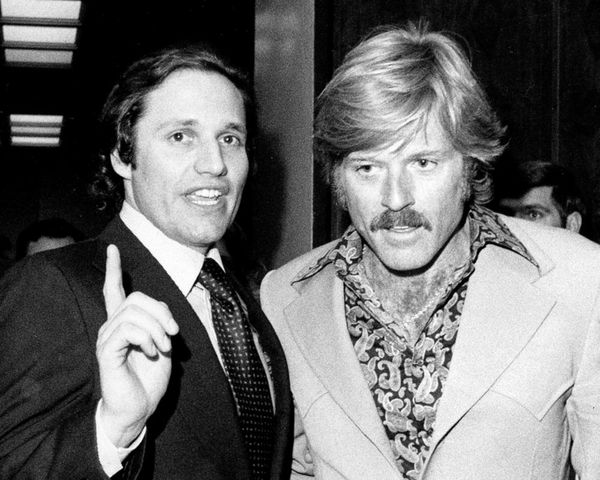

Frank Lee At A Glance

- Miracle Mile Advisors

- Managing director and head of the investment strategy group

- Lee sees the economy slowing down and the risk of recession growing as the Fed hikes interest rates. But high-quality stocks and bonds will still pay off amid higher volatility for broad markets.