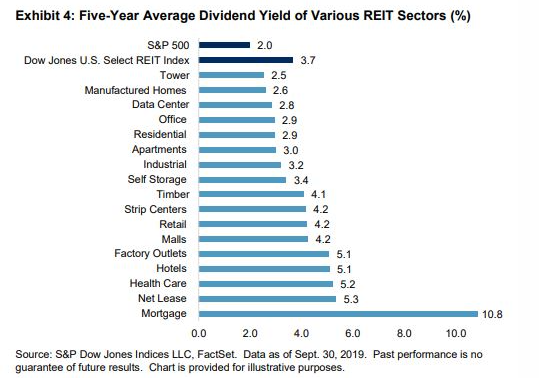

Over a 10-year period, equity real estate investment trusts (REITs) tend to have a higher annualized return than mortgage REITs, which have an average return of 8.2%. Meanwhile, mortgage real estate investment trusts tend to have a higher five-year average dividend yield of 10.8%, which is much higher than equity REITs.

The main difference between an equity REIT and a mortgage REIT is that equity REITs own the real estate and earn income through rents, while mortgage REITs lend money to real estate owners and collect the interest on those loans.

The Invesco KBW Premium Yield Equity REIT ETF (NASDAQ:KBWY) which is constructed using a dividend yield-weighted methodology that seeks to reflect the performance of approximately 24 to 40 small- and mid-cap equity REITs in the United States, is down nearly 20% year-to-date. While its mortgage REIT ETF counterpart, iShares Trust iShares Mortgage Real Estate ETF (BATS:REM) is down over 31% year-to-date, and has 50 holdings diversified evenly across small, mid, and large-cap equities, also allocating a little less than half of its assets to the financial services sector.

See Also: These 2 Mortgage REITs Have Yields Above 10% And Have Gone Unnoticed Trading At A Steep Discount

See how this mortgage REIT stacks up against an equity REIT.

Dynex Capital Inc. (NYSE:DX) is offering a dividend yield of 12.99% or $1.56 per share annually, conducting monthly payments, with an infrequent track record of increasing its dividend payments. Dynex Capital is a mortgage real estate investment trust and primarily invests in residential and commercial mortgage-backed securities.

In the third quarter, Dynex Capital saw its book value decrease by $2.56 per share to $14.23 per share as of Sept. 30, 2022. Although realized gains on interest rate hedges included in GAAP results were $149.6 million for the third quarter and $486 million year-to-date.

“While we experienced a decline in book value during the quarter related to this volatility and spread widening, our liquidity remains solid. We are prepared and well-positioned to benefit when the markets find equilibrium,” stated Byron L. Boston, CEO of Dynex Capital.

Apple Hospitality REIT Inc. (NYSE:APLE) is offering a dividend yield of 5.62% or 96 cents per share annually, through monthly payments, with a track record of increasing its dividends once in the past year. Apple Hospitality is a real estate investment trust that invests in income-producing real estate, primarily in the lodging sector in the United States. Apple Hospitality owns one of the largest and most diverse portfolios of upscale, rooms-focused hotels with a portfolio consisting of 220 hotels with approximately 29,000 guest rooms located in 87 markets throughout 37 states.

Justin Knight, CEO of Apple Hospitality in the second quarter press release mentioned, “We remain confident in the resiliency of travel, the merits of our underlying strategy and our ability to continue to drive strong total returns for our shareholders over time.” The firm increased its monthly cash dividend to $0.08 per share for November 2022.

Apple Hospitality’s hotels include 96 hotels under the banner name Marriott International Inc. (NASDAQ:MAR), 119 branded hotels under Hilton Worldwide Holdings Inc. (NYSE:HLT), four Hyatt branded hotels and one independent hotel.

Now Check Out: Benzinga's Complete Guiden To Real Estate Investing