Kinder Morgan (KMI) and Phillips 66 (PSX) announced on Oct. 20 that they started a binding open season for the Western Gateway Pipeline. This marks the first partnership of its kind between these two big players in energy pipelines for moving refined products. The project is a major build-out that will link refined fuel supplies from Texas straight to important markets in Arizona and California. It will also connect to Las Vegas, Nevada, using Kinder Morgan's existing CALNEV Pipeline.

This Western Gateway Pipeline plan arrives right when both companies are already strong sources of steady income for investors. Kinder Morgan has a market value of about $61.1 billion and pays a dividend yield of 4.22%. Its most recent payment was $0.292 on July 31. Phillips 66 carries a market value of around $51.9 billion and offers a dividend yield of 3.65%. Analysts keep backing both stocks, and the whole energy sector is seeing gains from solid investments in pipelines and related assets.

Could the Western Gateway Pipeline project represent a turning point for dividend-focused investors seeking exposure to essential energy transportation assets? Let’s take a closer look.

Kinder Morgan (KMI)

Kinder Morgan plays a major role in the energy infrastructure field. It manages one of North America's biggest setups of pipelines and terminals that carry natural gas, refined products, crude oil, and carbon dioxide.

The company has earned trust over time for its steady dividends. It raised payments for seven years straight through 2024, then made a small 2% bump to $1.17 per share in 2025. That creates a solid 4.22% yield, right under the energy sector average of 4.24%.

KMI stock's price lately shows this even keel. It gained 7.4% over the past 52 weeks, even as it dropped 3% year-to-date (YTD) through October 2025, now trading near $27.

The numbers suggest a high price tag, with a forward P/E of 21.78x, far above the sector's 12.50x. This hints at a strong belief in coming growth, yet it carries risks of being too pricey if earnings slow down.

In its July 16 report for the second quarter, Kinder Morgan posted net income of $715 million, a 24% rise from Q2 2024. Adjusted net income reached $619 million, up 13%, and adjusted EBITDA climbed 6% to $1.972 billion. EPS rose 23% to $0.28, which shows solid day-to-day results.

For the rest of 2025, the view beats earlier plans, aiming for net income of at least $2.8 billion, an 8% increase. Adjusted EPS targets $1.27, up 10%, and EBITDA hits $8.3 billion, a 4% gain. This gets a lift from the $640 million Outrigger Energy II purchase in Q1 2025. That added a 270 MMcf/d processing plant and a 104-mile pipeline in North Dakota, right away boosting cash flows and growing the midstream operations.

At the core, these steps build on Kinder Morgan's drive, as its project list jumped to $8.8 billion by Q1 2025, almost three times the $3 billion from the end of 2023. This comes from $900 million in fresh natural gas projects ready to start through 2030. The standout is the key Western Gateway tie-up with Phillips 66, which sets up the first pipeline for refined products to California. It opens fresh markets and steady long-term income. Just in Q1, the company tacked on $900 million worth of new projects, which strengthens cash available for payouts and keeps dividends dependable.

Analysts match this positive take, as the 21 polled give a consensus "Moderate Buy" rating. The average price goal sits at $31.74, which means 16% room to grow from current price levels.

Phillips 66 (PSX)

Phillips 66 runs a broad energy business that includes refining, midstream transport, chemicals, and marketing across the Americas, Europe, and Asia. This spread-out setup has supported a strong track record on dividends, with 14 years in a row of raises that led to a quarterly payment of $1.20 per share on August 19. That gives a 3.65% yield, close to the energy sector average of 4.24%, and it points to good returns for people after income, even if the forward payout ratio of 135.67% calls for some care.

The stock price holds up well in an uneven market, up 4% over the past 52 weeks but up 18% YTD through October 2025, sitting around $134.

The numbers show careful hope, with a forward P/E of 23.86x, a bit higher than the sector's 22.77x, which means people expect steady growth without paying too much extra.

On July 25, Phillips 66 put out its second-quarter numbers, with net earnings of $877 million, or $2.15 per share, a big jump back from the first quarter's $487 million. Adjusted earnings came in at $973 million, or $2.38 per share, once they factored out special costs like $239 million in refinery wear and tear. The refining side worked at 98% capacity with 86% clean product output, and net operating cash flow hit $845 million, or $1.9 billion without working capital changes, which let them send $906 million back to shareholders in dividends and stock buys. The plan going forward keeps the push alive, with midstream builds and cost savings leading to higher adjusted earnings through 2026, aiming for refined product output over 85% and using cash flow to bring more money back to owners.

The main drivers keep this path going. The company finished the EPIC NGL buy, now called Coastal Bend, and saw strong midstream cash flow at $845 million net operating and $1.9 billion without working capital. It sent $906 million to shareholders in dividends and buybacks. Ahead, Phillips 66's plan rests on making the most of the Coastal Bend deal, the almost-done pipeline build to raise capacity from 175 to 225 million barrels per day, and the Dos Picos II gas plant in the Midland Basin that adds 220 MMcf/d of space. All this backs ongoing earnings strength and the ability to keep up dividends.

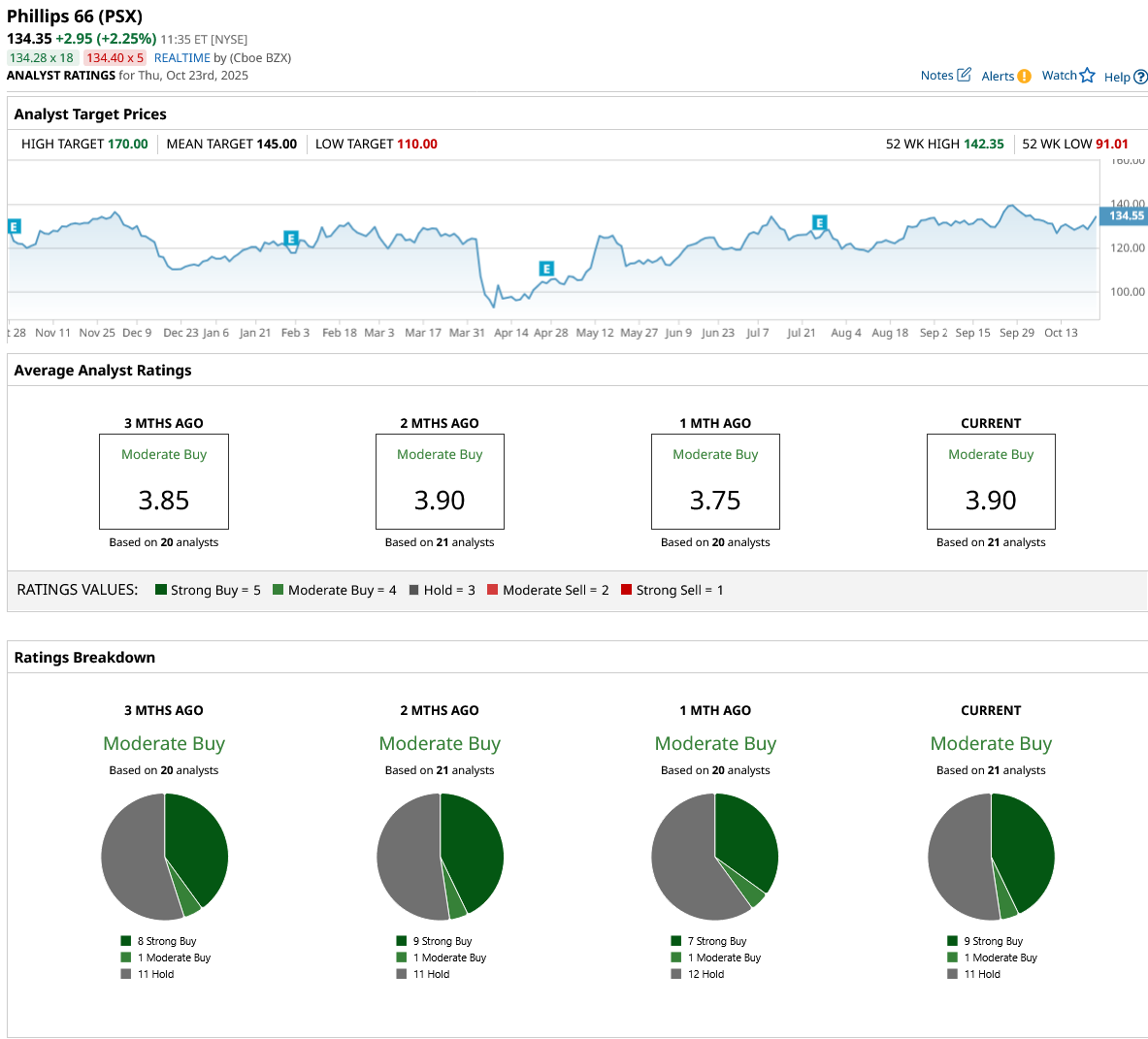

Wall Street feels the same way, with all 21 analysts giving it a consensus "Moderate Buy" rating and an average target of $145, which points to 8% growth from current prices.

Conclusion

Both Kinder Morgan and Phillips 66 are advancing history through transformative infrastructure and disciplined capital deployment, delivering sizable yields for income-focused investors. While KMI’s backlog growth and the Western Gateway venture promise long-term cash flows, PSX’s strategic mix of refining and midstream expansion supports durable dividends and earnings upside. In the near term, shares may drift with energy sentiment, but the long-term path looks solid for dividend-focused investors.