/Unitedhealth%20Group%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg)

UnitedHealth (UNH) shares are keeping resilient this morning despite reports the healthcare giant is under investigation for much more than Medicare fraud only.

According to Bloomberg, the criminal division of the U.S. Justice Department is investigating UNH’s pharmacy benefit manager Optum Rx and physician reimbursement practices as well.

UnitedHealth stock has recovered sharply after legendary investor Warren Buffett revealed a stake in the insurance behemoth. At the time of writing, it’s up nearly 30% versus the start of August.

What the Expanded Probe May Mean for UnitedHealth Stock

The expanded probe into UNH’s prescription management services and physician reimbursement practices adds legal and reputational risk to an already pressured stock.

While UnitedHealth shares are showing short-term resilience, investor sentiment remains fragile amid regulatory scrutiny, margin compression, and Medicare Advantage headwinds.

And this investigation, which we now know is multi-pronged, could result in fines, operational changes, or tighter oversight, essentially making things worse for the NYSE-listed firm.

Together, these challenges may weigh on the company’s future earnings, and make it incrementally more difficult for UNH stock to reclaim the massive ground it has lost in 2025.

Why UNH Shares Remain Attractive for Long-Term Investors

While the near-term may remain volatile, UNH shares appear attractive for the long-term investors.

Why? Because at current levels, it offers unmatched value, something that’s been driving famed investors into UnitedHealth stock in recent weeks.

Other than Warren Buffett, the founder of Appaloosa Management, David Tepper, and “Big Short” investor, Michael Burry, have loaded up on the healthcare stock, citing its unprecedented discount.

Additionally, UnitedHealth currently pays a healthy dividend yield of 2.94%, which further aligns with their investment strategies.

Investors could also take heart in the fact that UNH is fully cooperating with the DOJ and maintains that it has “full confidence in its business practices.”

How Wall Street Recommends Playing UnitedHealth Group

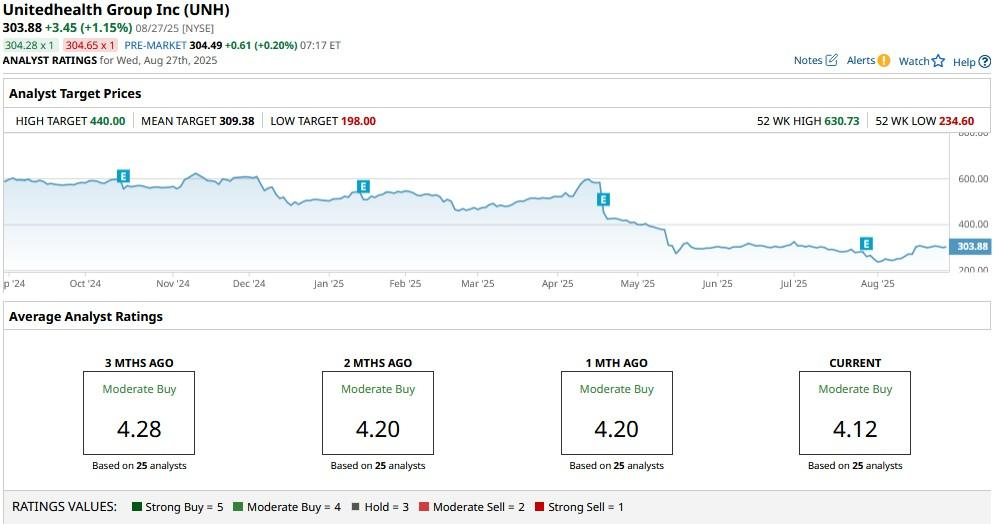

Despite its attractive valuation and a vote of confidence from high-profile names, Wall Street analysts recommend treading with caution on UnitedHealth stock.

While the consensus rating on UNH shares remains at “Moderate Buy,” the mean target of roughly $309 does not indicate meaningful upside from current levels.