NuScale (SMR) shares soared 15% on Wednesday after the U.S. Army launched the “Janus Program” – a new initiative aimed at accelerating the development and commercialization of micro nuclear reactors.

The U.S. Army has partnered with the Defense Innovation Unit to fast-track advanced reactor tech, an effort aligned with President Donald Trump’s directive to have operational reactors at military bases by 2028.

Including today’s rally, NuScale stock is up more than 375% versus its year-to-date low in April.

How the U.S. Army Program Helps NuScale Stock

The Janus Program signals policy momentum that creates a lucrative, derisked opportunity for the likes of Corvallis-headquartered NuScale Power.

As a leader in small modular reactors (SMR), and the only one with a design approved by the U.S. Nuclear Regulatory Commission, NuScale is strongly positioned to secure valuable, high-profile government contracts.

This could boost the company’s revenue, scale its production, and validate its technology for wider commercial markets.

In short, the U.S. Army’s announcement boosts investor confidence in SMR stock and could drive both retail and institutional capital into the NYSE-listed firm over the next few months.

Why the Valuation Isn’t Too Concerning for SMR Stock

NuScale shares sure aren’t inexpensive to own at a price-sales (P/S) multiple of 346x at the time of writing.

But there are several reasons beyond the Army’s support that warrant owning them for the long term. For example, it’s the only American firm that already has regulatory approval for its SMR design.

Plus, renewed trade tensions between the U.S. and China are increasing interest in domestic energy solutions, which also stands to benefit SMR shares.

More broadly, nuclear power outperforms renewables like solar and wind in terms of reliability as well, further strengthening the overall bull case for NuScale.

NuScale Remains a ‘Buy’-Rated Stock Among Wall Street

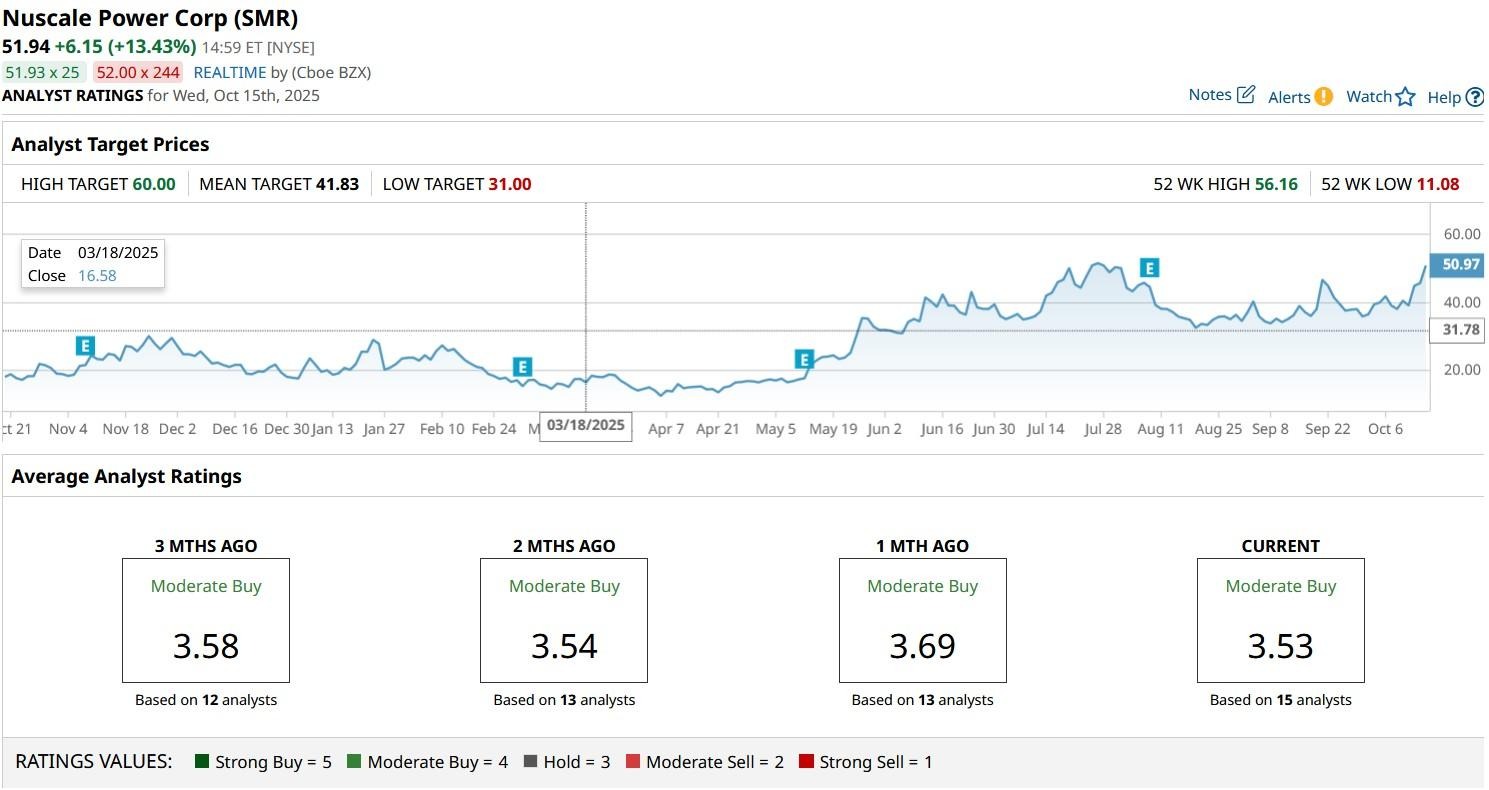

Investors can also take heart in the fact that Wall Street remains constructive on NuScale shares in 2025.

According to Barchart, the consensus rating on SMR stock currently sits at “Moderate Buy” with price targets going as high as $60, indicating potential upside of another 12% from here.