Digital-asset treasury (DAT) stocks have become a high-volatility corner of the market, attracting both speculative traders and well-known names testing the crypto waters. These companies park corporate capital in tokens and sometimes expand into related ventures like mining or custody, promising outsized returns and meaningful risk.

One such name drawing headlines is Thumzup (TZUP), a Los Angeles-based firm that recently raised fresh capital to buy crypto tokens and build mining operations. Notably, Donald Trump Jr. appears among TZUP’s largest shareholders, a detail that has amplified retail interest and scrutiny.

For investors considering exposure to DATs, whether TZUP offers a convenient play or not, let's find out.

About TZUP Stock

Thumzup Media is a small company with a market cap of roughly $60 million. It started as a social media advertising platform and pivoted to crypto in late 2024. The board approved using its cash to buy Bitcoin and other coins, calling it a digital asset treasury company.

By mid-2025, Thumzup had raised capital for mining and digital assets. Now, Donald Trump Jr. owns about 350,000 shares of TZUP, making him one of the largest individual investors.

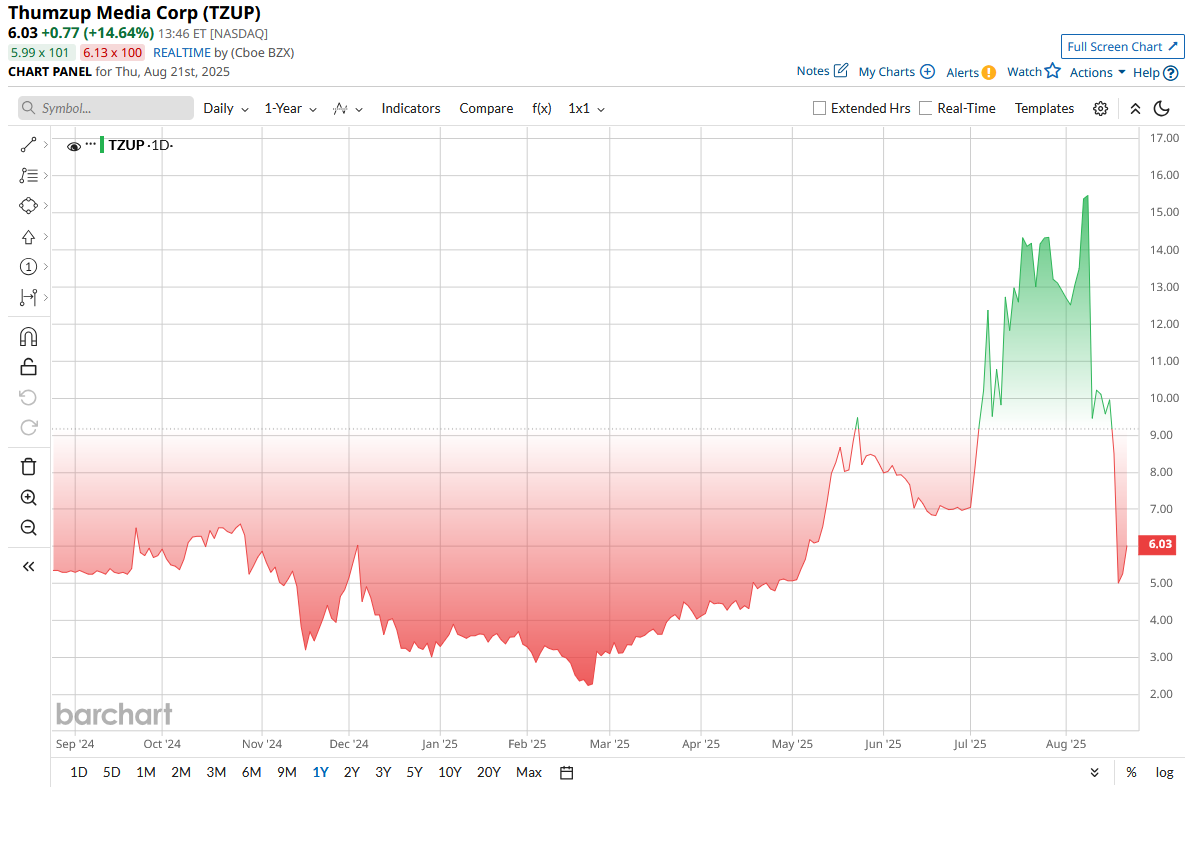

TZUP stock has been quite volatile this year. It started in 2025 at nearly $2 per share and rode the crypto wave higher through the first half of the year. By early August, shares peaked around $16.49, marking a surge of more than 700% from Feb. 25's rock bottom $2.02 low. Despite volatility, TZUP still remains well above its early-year lows.

Thumzup’s Bold Shift

Thumzup has pivoted from ad-tech to a crypto-focused treasury business, raising $50 million in July 2025 to fund mining and coin purchases. The company agreed to acquire Dogehash Technologies for $153.8 million in stock, gaining 2,500 Dogecoin/Litecoin rigs and planning a rebranding to Dogehash Technologies Holdings. Its multi-asset strategy targets Bitcoin (BTCUSD), Ethereum (ETHUSD), Solana (SOLUSD), XRP (XRPUSD), Dogecoin (DOGEUSD), Litecoin (LTCUSD), and stablecoins.

Regulatory filings revealed Donald Trump Jr. owns about 350,000 shares, worth $3.3 million, making him a major shareholder. The Trump family’s growing crypto involvement highlights why Trump Jr. may see TZUP as a strategic bet on digital assets.

Financial Overview

Thumzup’s financial results remain very weak. It generates minimal revenue while running significant losses.

In the first half of 2025, the company reported only about $166,000 in sales, down sharply from the prior year, while incurring an operating loss of more than $3.39 million due to heavy marketing and administrative expenses.

In the second quarter alone, Thumzup lost about $1.19 million on just $15,000 of revenue. The company is spending aggressively on ad tech and new crypto projects far faster than it earns sales.

To keep operations afloat, Thumzup has relied on equity offerings. It completed a $50 million raise in July 2025 after earlier private placements.

The result has been dilution, with more shares outstanding and a volatile stock price. By July, the company’s market capitalization ranged between $90 million and $150 million depending on share price, roughly in line with the announced Dogehash deal value.

Should You Buy TZUP Too?

Thumzup Media is a high-risk investment. Its fundamentals nearly zero with revenue, multi-million-dollar losses are weak. The only value is in its crypto-related assets and future mining potential. Donald Trump Jr.’s involvement and buzz around Dogecoin/Dogehash can draw speculators, but they also make the stock volatile.