- Despite the stock market's recent sell-off, sticking to your investment plan is still the best strategy.

- There's evidence that the market may bounce soon in what is known as a relief rally.

- It's important to remember that even though this year has been tough, the stock market always rebounds eventually.

The market has been tough this year.

Really tough.

Year-to-date, the S&P 500 is in correction territory, down over 12%, and the NASDAQ? Forget about it. It's in a bear market, down over 20%. You don't even want to know how much some of last year's high-flyers are down. Let's just say it's a lot.

If your portfolio is a sea of red, your head may be spinning.

It will be Okay.

It may not be tomorrow, next month, or this year, but the stock market is a fantastic wealth generation machine, and over time, the dramatic sell-off we’re experiencing will simply be another data point on a chart.

Nothing more. Nothing less.

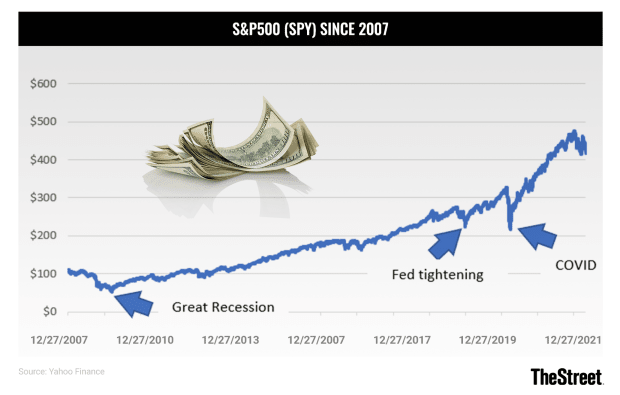

Don’t believe me? Look at the arrows in the following chart showing the historical prices of the S&P 500 ETF (SPY) since 2007. The Great Recession, quantitative tightening in 2018, and COVID in 2020 made for horrible markets, yet the market – eventually – marched higher.

Still need convincing? The S&P 500's year-to-date return is the worst in 30 years. Yet, the S&P 500 is up over 870% since 1992. Sure, there were some gnarly moments in the early 90s, but you really have to squint to see them now.

Stay the course

Often, “I can’t take it anymore” moments shake investors out during brutal tapes. However, the regret experienced because of emotionally driven panic selling is palpable when stocks eventually recover.

The internal argument goes, “I couldn’t take it, so I sold it all. Now, the market’s rallying, but I don’t believe it. It won’t last. There’s too much wrong for stocks to move higher.”

I’ve heard this argument many times in my career. Eventually, the seller becomes the buyer again but only after missing the biggest move up.

Remember, the average return during the first year of a bull market is 38%. That’s significantly better than the 12% average return in the second year and the market’s 10% average annual return since 1926.

It’s not just missing the first year of the bull market, though. It can be costly if selling makes you miss even a few of the market’s best-performing days.

According to J.P. Morgan Asset Management, a $10,000 buy-and-hold investment on January 1, 2002, grew to $61,685 on Dec. 31, 2021. However, missing the ten best days over that span reduced the nest egg to $28,260. If you weren’t in the market during its best days, you gave up 334% in cumulative return.

Indeed, enduring the Great Recession, 2018’s fourth-quarter swoon, and 2020’s COVID-driven craziness wasn’t fun. When stocks fall, you can’t do anything right. But when they go up? You feel like Midas.

I don’t know when the market will bottom. Nobody has a crystal ball. But I do know that market pain is high, and investor sentiment is horrible. The total put/call ratio is bullish at above 1. The American Association of Individual Investors (AAII) sentiment survey’s bullishness reading is below 20%, which is among the lowest readings since the early 1990s. The number of stocks trading 5% or more below the 200 DMA is relatively high. And the volatility index (VIX) is back above 30 for the first time since the March lows.

In "There Could Be Light at the End of the Tunnel" Real Money Pro's Carley Garner writes:

"The VIX spends most of its time under 20 but can see temporary spikes. Historically, the VIX has struggled to break above 35 to 40 but did during the Covid crash and the financial crisis. Nevertheless, any stock market selling accompanied by a VIX peak near 35 has generally resulted in a stock market recovery...While traders should remain cautious, we see a potential head-and-shoulders pattern in the VIX. A head-and-shoulders pattern is exactly how it sounds; it is a three-wave rally in which the two shoulders post lower highs than the middle rally (head). Traders believe a break below the neckline will open the door to swift selling. If this pattern plays out, the VIX could be headed back into the mid-teens. This would be a positive for the stock market."

There’s fuel for a fire.

Could the Fed’s next decision on interest rates be the spark? After all, the May 4 meeting may not offer ‘shocking’ revelations. The market's already pricing in a dump truck full of tightening, including rate hikes and a run-off of bonds on its balance sheet. So could it say something surprising? Sure. But if not, then perhaps, we get a buy the news rally.

Back to Garner:

"Some of the stories that led to corrective action in stocks might have run their course...It should also be noted that the Fed hasn't always been able to follow through on its rate-hike campaign ambitions (remember 2019/2019?). Perhaps the market has priced in more rate hikes than the Fed will be able to, or need to, deliver."

Or maybe the spark will come from someplace else. As Stephen Guilfoyle wrote in Real Money's Market Recon earlier this week, we got the “advance (first of three) estimate of Q1 US economic growth” on Thursday. GDP is decelerating. Perhaps, that’s encouraging because it means inflation will fall, and the Fed won’t need to hike as much as its forecasting?

Again, pure speculation.

But there’s some evidence suggesting that if the market sells off a bit more, we’ll get oversold (at least short-term), and if the market is oversold, it might not take much to light a fuse for a rally.

In “Waiting for Capitulation? All I Can Offer You Is This,” Top Stocks’ Helene Meisler uses oscillators to help determine if the odds favor bulls or bears.

Bears still have control, but Meisler’s indicators could get friendlier in the coming days. Meisler writes:

”I can now report to you that by the end of this week/early next week the indicator stops going down. It doesn't exactly spurt upward, but it does stop going down. That is a change. It is also a sign of short-term "oversoldness."

If so, then a shift toward net long by Real Money Pro’s Doug Kass this week could prove prescient (if you missed Monday’s Smarts column, here it is again).

Kass reaffirmed his increasing bullishness in his diary today, writing:

“I have long written that one should invest and trade unemotionally…Today, as the Bee Gees crooned, emotion has taken over the markets…A market dominated recently by overly passionate and emotional activity is an opportunity for the tactical trader and investor…Typically, such an opportunity is not borne out of selling (to those that "don't give a damn") - but the emotional selling could provide a birthright for reasonably attractive entry points.”

The Smart Play

This year it’s been a trading tape, so it’s paid off to sell rallies at resistance and buy the market at support. However, individual stock picking has been a different story. You either embraced the business cycle trade I discussed when Smarts first launched and hung in there, or you got walloped.

I still think it’s a trader’s tape, and focusing on late-cycle stocks is better than buying high-beta, early-cycle ideas hoping for snapbacks. Eventually, early-cycle stocks will form actionable entry points. But we're not there yet.

A simple strategy? Overlay the 200-day moving average on your price chart. Is the 200-DMA climbing or falling? Is the stock’s current price above it or below it? If you’re a short-term or intermediate-term trader, the odds favor buying strong stocks on pullbacks, not pawing through past high-flyers hoping for glory.

Overall, it’s impossible to pick exact bottoms consistently. But you don’t have to. All you need to do is be in the vicinity of them. Tracking sentiment can help you, and right now, indicators suggest we could be within shooting distance of an actionable rally. So spread out your buys over time, but consider taking a little here and a little more if we get beat up a bit more.