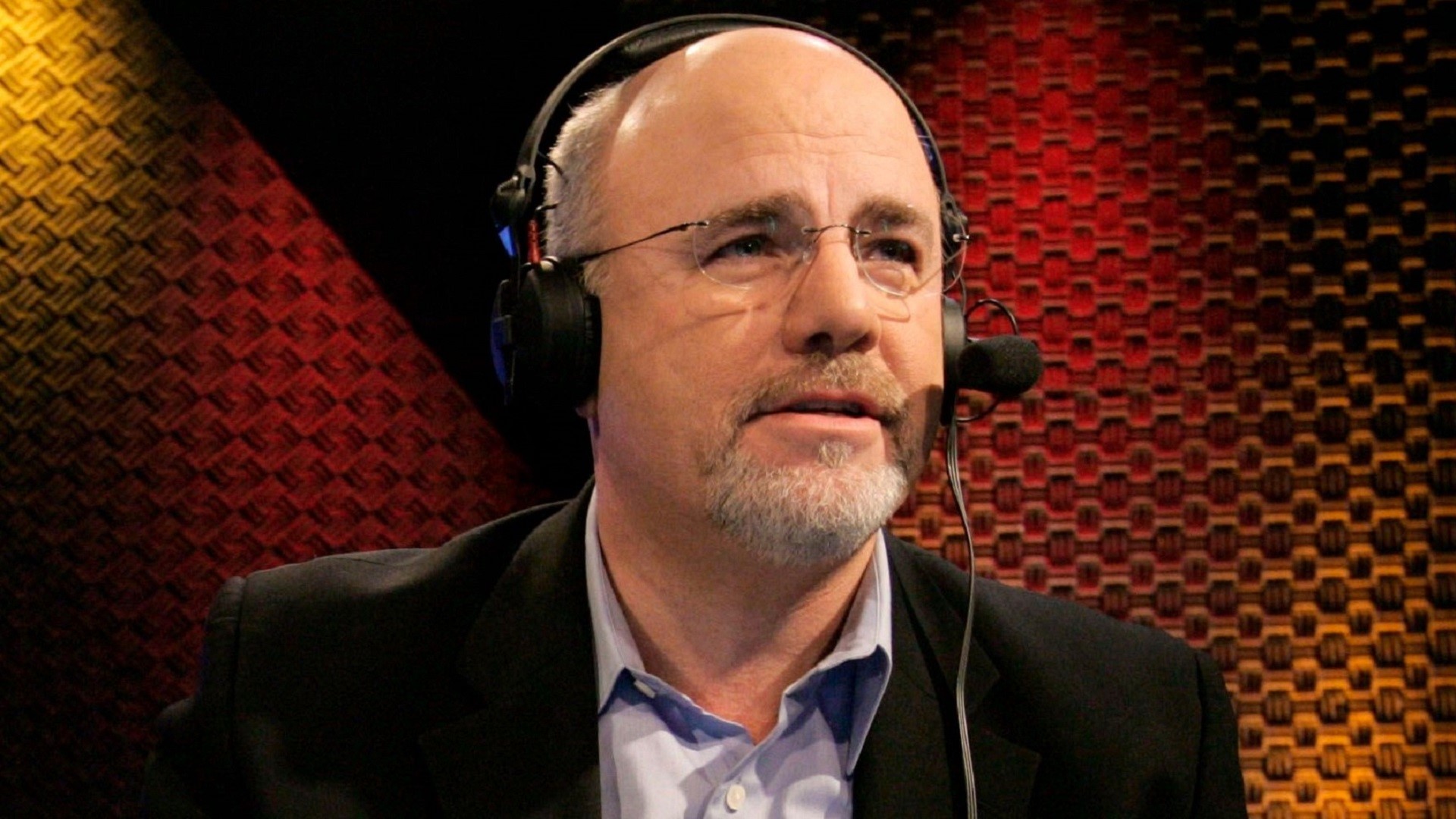

What’s going to happen with Social Security? It’s the question haunting almost everyone these days — though it feels most pressing for people who hope to retire in the next few years. Like any good mystery, it calls for a skilled detective. But instead of Benson and Stabler, this quandary requires a financial expert like Dave Ramsey.

Learn More: ‘You’ll Run Out of Money in 20 Years’ — Why Retirees Are Rethinking Their Savings Strategy

Read Next: 9 Downsizing Tips for the Middle Class To Save on Monthly Expenses

He’s got strong opinions about what people can expect from the future of Social Security — and spoiler alert — they’re not very rosy.

On the Ramsey Solutions website, readers can find a dire warning: Barring certain actions from the federal government, the Social Security Trust Fund reserves could be depleted, resulting in reduced benefits for workers. But Ramsey doesn’t want you to be scared. He wants you to be prepared.

Alongside that ominous prediction, he also offered advice on what it will take to retire successfully.

Don’t Rely on Social Security as Primary Income in Retirement

In the same Ramsey Solutions article, the team explained why the average worker can’t count on Social Security to support them in retirement: The number of baby boomers entering retirement continues to rise, while fewer workers are paying into the system.

“Depending on what Congress does (or doesn’t do), future retirees might need to prepare for the possibility of reduced benefits, and workers might see a hike in Social Security taxes,” they wrote.

The bottom line? You shouldn’t assume Social Security will make up a major part of your retirement income. Or, as the Ramsey team put it: “Any money you get from Social Security should be considered icing on the cake. But making Social Security the main ingredient of your retirement plan? That’s a recipe for disaster.”

Be Aware: 3 Little-Known Social Security Rules That Could Save You Thousands

Be the CEO of Your Own Retirement

If you can’t rely on Social Security income in retirement the way your parents or grandparents did, what should you do? According to Ramsey, you need to become “the CEO of your retirement.”

In other words, you must take charge of your retirement planning as early as possible. That doesn’t mean stuffing money under the mattress. Ramsey encourages creating a plan with specific, measurable goals and working with a professional to help you achieve them. You also need to hold yourself accountable and assume that you’re responsible for creating a secure retirement.

Invest 15% of Your Income for Retirement

Since your retirement security may fall entirely on your shoulders, Ramsey has recommended investing 15% of your gross income into growth stock mutual funds using tax-advantaged accounts, such as your employer’s 401(k) and a Roth IRA.

Why 15%? According to Ramsey, that amount allows you to build a strong retirement portfolio while still meeting other financial goals — like paying off your home. Once those goals are met, you can always increase your retirement contributions.

“Ideally, you should be able to live off the growth of your retirement savings rather than dipping into your nest egg,” he said.

Be Proactive About Saving for Healthcare Costs

Healthcare is one of the most significant expenses in retirement — which is why Ramsey urges people to prepare for it early. Since you may not be able to rely on Social Security to pad your nest egg, unexpected healthcare costs could drain your savings faster than expected.

Open a health savings account (HSA) as soon as you’re eligible. Ramsey emphasized the urgency, noting that once you’re enrolled in Medicare, you can no longer contribute to an HSA — though you can still use existing funds to pay for medical expenses.

Ramsey also encouraged enrolling in Medicare even if you’re still working. If you’re 65, you’re eligible.

“Once you retire, you have eight months to enroll in Medicare without a penalty,” he said. “If you sign up for Medicare while you’re still working (which you have the option to do), Medicare will become either your primary or secondary insurance, depending on how big your employer is.”

Additionally, once you turn 60, Ramsey recommended purchasing long-term care insurance. He believes most retirees will need long-term care at some point, and if you’re not financially prepared, the cost could quickly deplete your nest egg and place a significant burden on your family.

Take a Long-Term View

Ramsey understands that the prospect of reduced Social Security benefits is unsettling — especially for those getting a late start on retirement planning. But one of his most important messages is that acting out of fear or anxiety won’t help.

“It’s true that there’s no magic formula that will instantly give you a multi-million-dollar nest egg, but with careful planning, disciplined budgeting and a positive outlook, you can build a decent retirement fund that will keep you content,” he said.

More From GOBankingRates

- Here's What It Costs To Charge a Tesla Monthly vs. Using Gas for a Nissan Altima

- Why You Should Start Investing Now (Even If You Only Have $10)

- 5 Cities You Need To Consider If You're Retiring in 2025

- 3 Reasons Retired Boomers Shouldn't Give Their Kids a Living Inheritance (And 2 Reasons They Should)

This article originally appeared on GOBankingRates.com: The Social Security Warning Dave Ramsey Is Adamant About in 2025