While great white sharks are fascinating creatures, they’re also incredibly difficult for scientists to study for obvious reasons. However, with the aid of technology, marine ecologists are able to tag great whites to study their behaviors and migration patterns. In other words, data isolation represents one of the most powerful tools in science.

In much the same way, we can isolate different “species” of market behaviors, under the reasonable hypothesis that different sentiment regimes produce different reactions — and thus engender different probabilities.

It may sound kooky at first. However, we know that via GARCH (Generalized Autoregressive Conditional Heteroskedasticity) studies, volatility does not diffuse linearly and independently but rather clusters on a dependent basis. To put it simply, volatility today depends largely on volatility yesterday. Also, impactful events that materialized in the immediate term matter far more than market-moving events that occurred deep in the past.

By logical deduction, certain sentiment regimes have different probabilistic behaviors than the aggregate behavior of all regimes. This is no different than saying great whites have different migratory patterns than reef sharks.

Where the taxonomical approach really comes to life is in forward probabilities. If we can determine each sentiment regime’s behavioral tendencies, we can also observe through empirical calculations their exceedance ratios (profit rate relative to anchor), terminal median price and the density of price outcome (or where prices tend to cluster).

From there, we can use options pricing data from Barchart Premier to pinpoint the trades that make the most sense. Without further ado, below are three bull call spreads to consider this week.

Bristol-Myers Squibb (BMY)

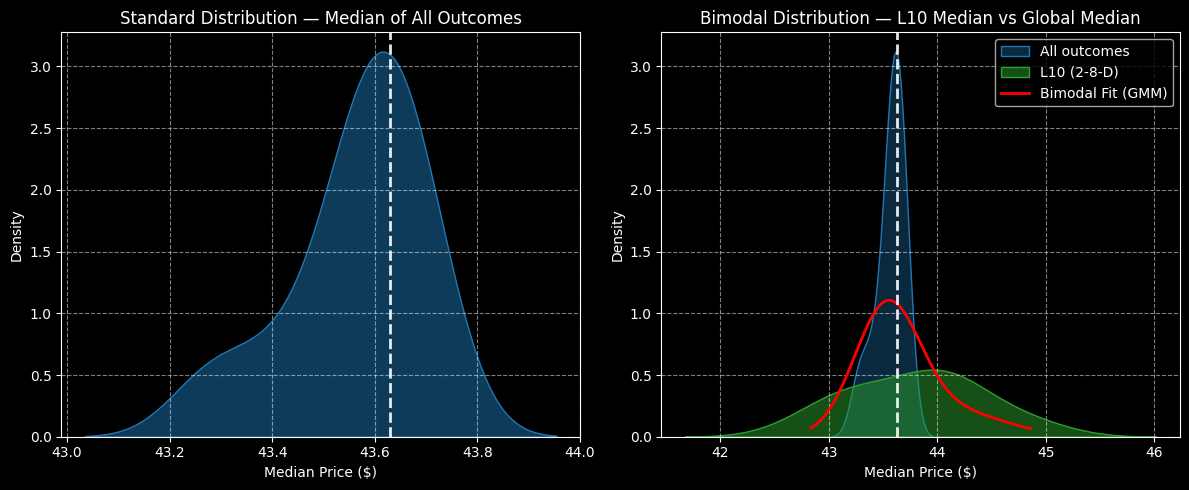

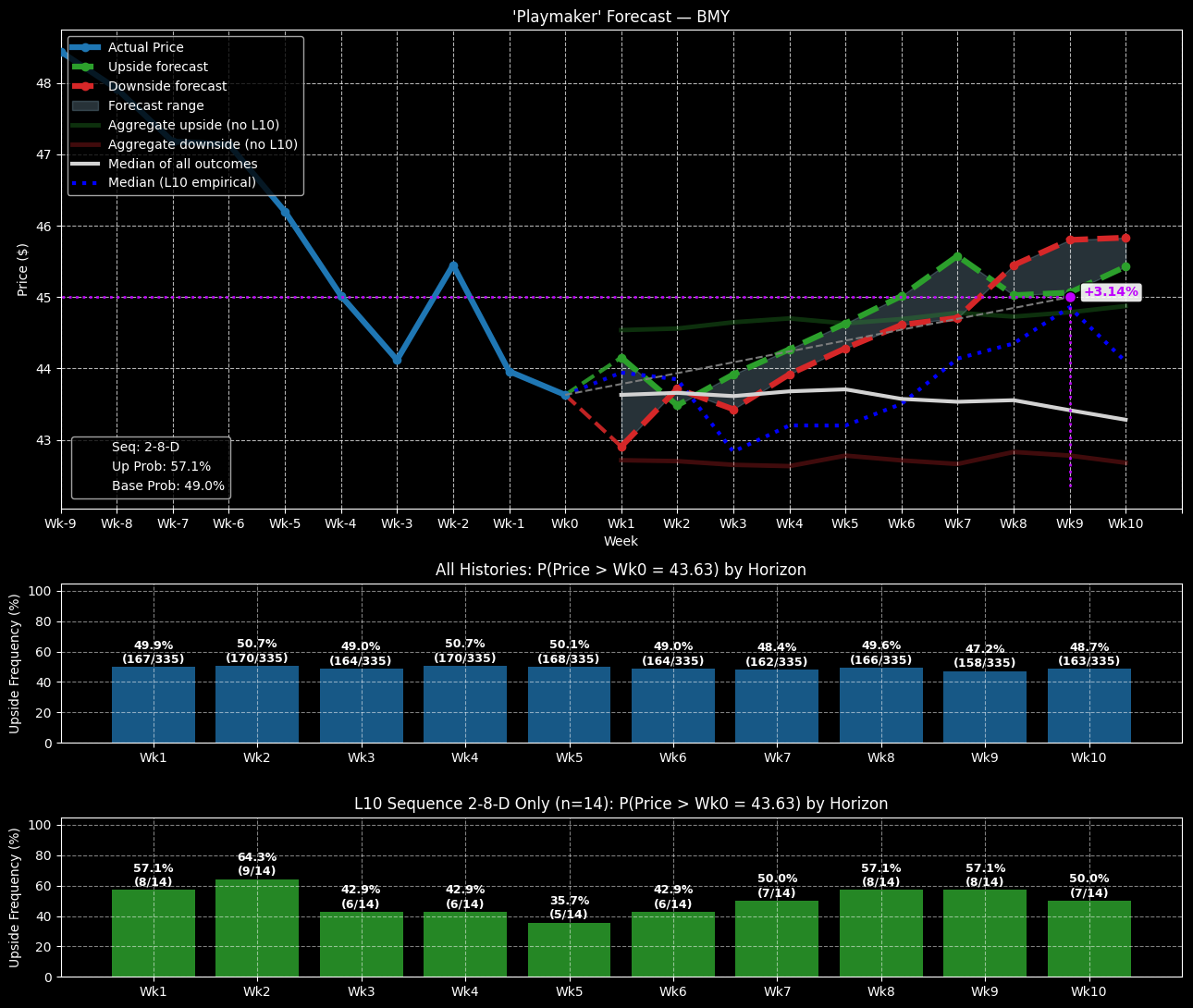

In the last 10 weeks, shares of Bristol-Myers Squibb (BMY) quantitatively printed a 2-8-D sequence: two up weeks, eight down weeks, with an overall downward trajectory across the period. This sequence is super rare, representing only 4.18% of all identifiable patterns since January 2019. When it does materialize, BMY stock tends to trade choppily before rising higher in the back end of the next 10-week period.

Under ordinary circumstances, BMY stock features a neutral to slightly bearish bias. Under aggregate conditions, the security has a tendency of clustering around $43.50, assuming an anchor price of $43.63 (Friday’s close). What makes the 2-8-D sequence intriguing is that, under this sentiment regime, BMY would be expected to cluster around $44. On a terminal basis on the ninth week, the median price may rise closer to $45.

To be fair, these stats don’t necessarily sound all that enticing. However, forecasted market dynamics would put the 44/45 bull call spread expiring Dec. 19 into play. Those who are seeking greater excitement may consider the 44/46 bull spread, also expiring on the same day.

Deere (DE)

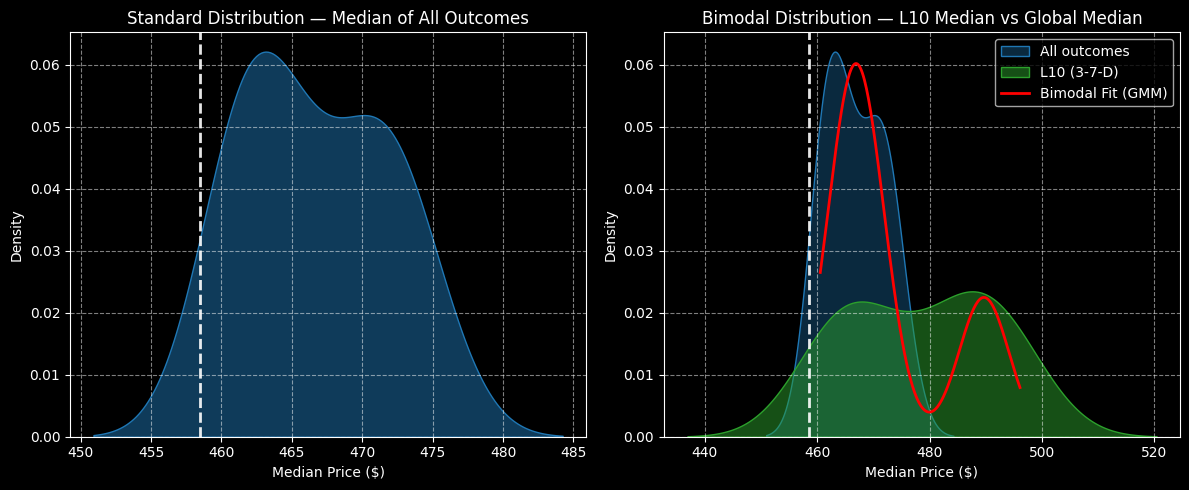

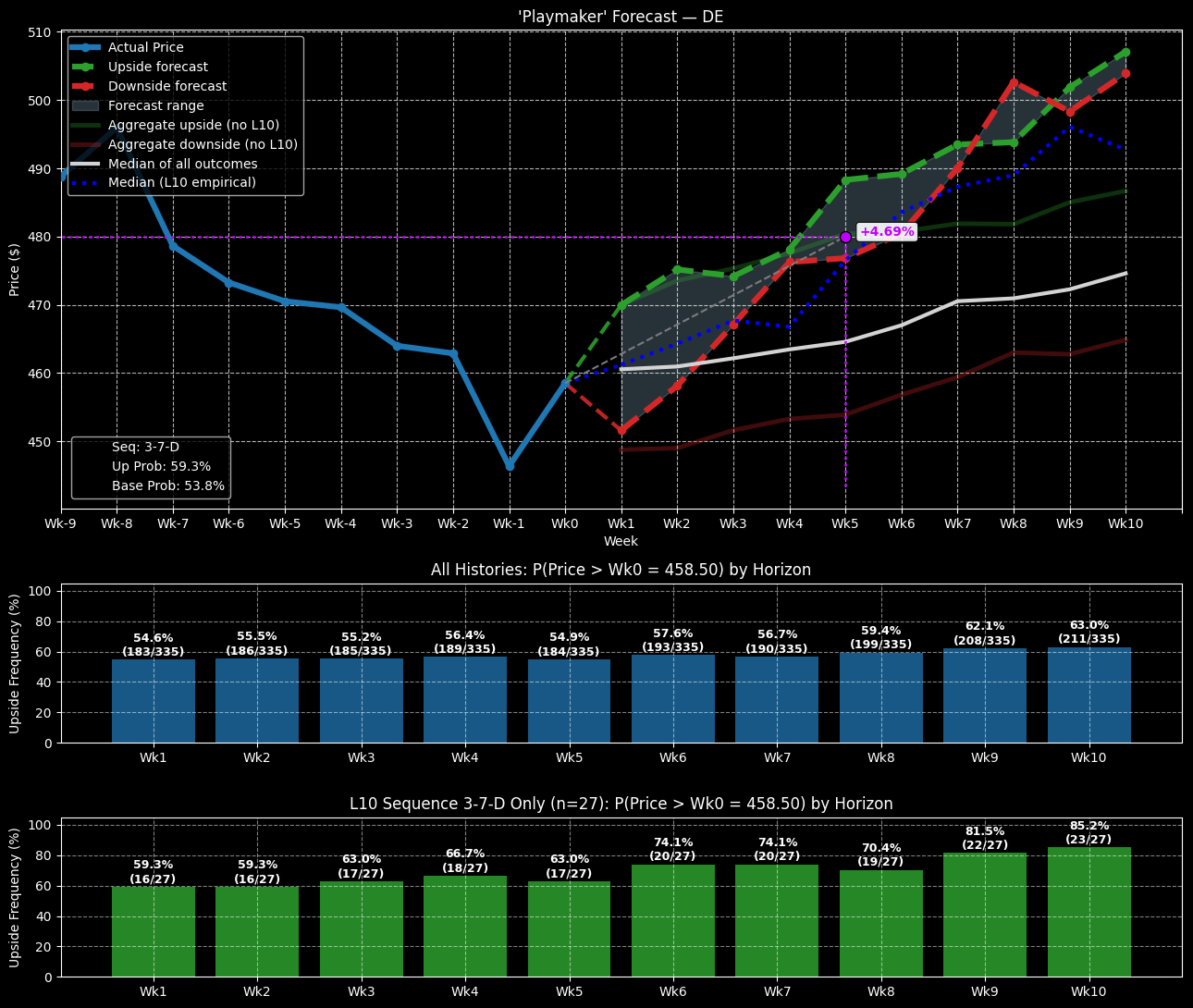

A reliable enterprise, Deere (DE) has lagged the broader market, gaining a little over 8% on a year-to-date basis. Quantitatively, DE stock printed a 3-7-D sequence: three up weeks, seven down weeks, with a downward trajectory. This is another rare pattern, having materialized only 8.06% of the time since January 2019. Still, by tracking its unique behavior, we can plot a potentially profitable trading idea.

As a baseline, Deere stock has an upward bias. Over the next 10 weeks, its exceedance ratio is calculated to reach 63%. Further, the bulk of prices would be expected to land between $465 and $470, with a clustering effect around $463. However, under 3-7-D conditions, the exceedance ratio would land above 85%. Further, prices may cluster around $482.

For those looking for a relatively quick hit, the 470/480 bull spread expiring Nov. 21 could be intriguing. Traders who prefer a more extended runway may look at the 470/490 bull spread expiring Dec. 19. However, with a net debit of $925, this would be a much more expensive spread.

Zeta Global (ZETA)

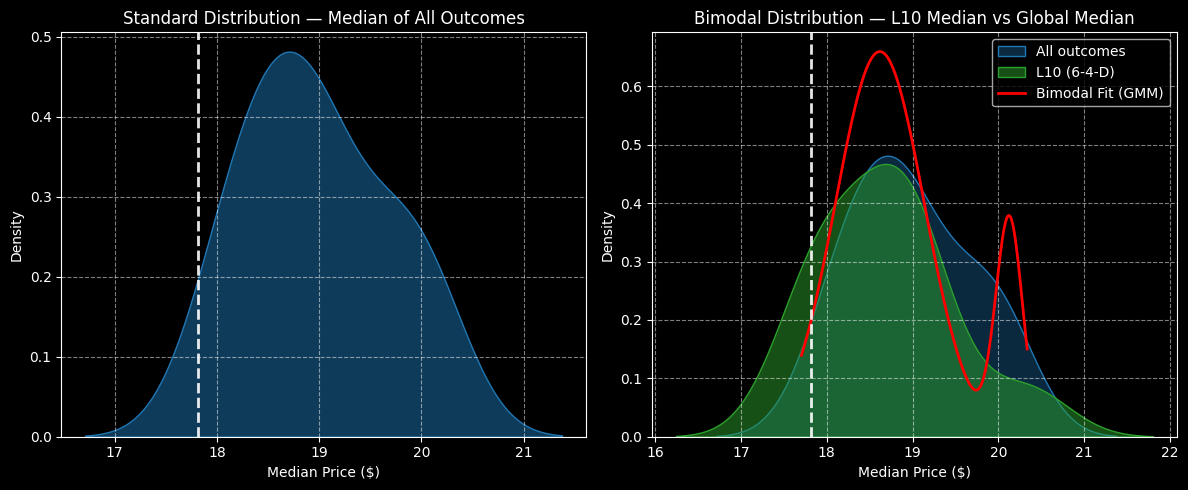

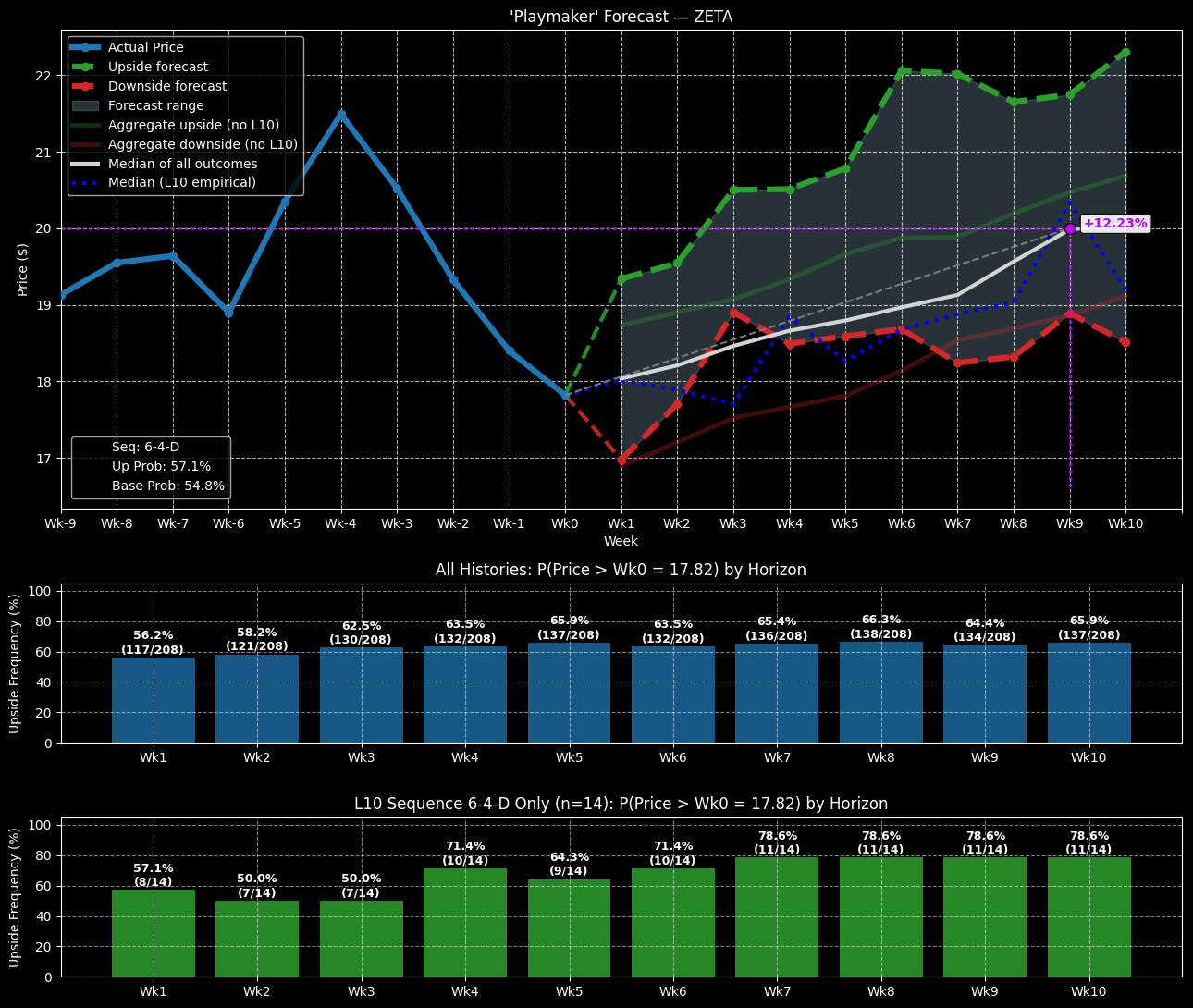

A cloud-based marketing tech firm, Zeta Global (ZETA) was negatively impacted by recent sector volatility. In the trailing one-month period, ZETA stock lost roughly 16%. In terms of the quantitative framework, ZETA printed an unusual 6-4-D sequence: six up weeks, four down weeks, with an overall downward trajectory. This pattern represents only 6.73% of all the security’s identifiable sequences.

Still, its rarity helps to make the sequence’s tracking easier. Currently, ZETA stock on an aggregate basis features a strongly bullish bias, with a 10-week expected exceedance ratio of 65.9%. Mostly, the median price would be expected to land between $18 and $20, with a clustering effect occurring around $18.80. Under 6-4-D conditions, a similar clustering around $18.80 would be expected to occur but with greater frequency. Also, the exceedance ratio may climb to 78.6%.

Based on projected market data, the 17.50/20 bull spread expiring Dec. 19 may make the most sense. That’s because ZETA’s median price under 6-4-D conditions would be expected to break above $20 on the ninth week. Super-aggressive traders may consider the 20/22.50 bull spread, also expiring Dec. 19.