Question #6 of GOBankingRates’ Top 100 Money Experts Series

What is a Roth 401(k), and how does it differ from a traditional 401(k)?

One of the many challenging aspects of retirement planning is picking the smartest vehicles in which to save and grow your funds. Most people are familiar with traditional 401(k) accounts, typically offered through an employer.

For You: 25 Cities Where You Can Retire in Great Weather for $2,000 a Month

Learn More: 3 Advanced Investing Moves Experts Use to Minimize Taxes and Help Boost Returns

However, many people are skipping over the Roth 401(k) — if they even realize it’s an option. So what’s the difference, and why might you choose one over the other?

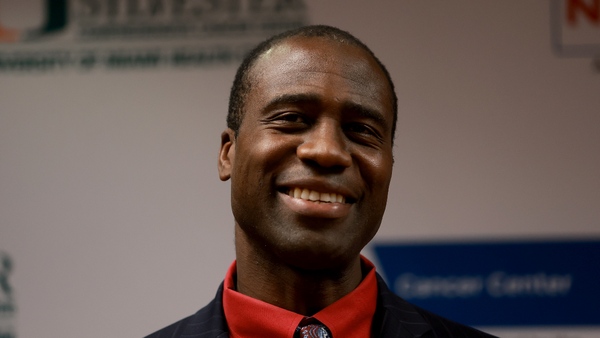

To explore the distinctions, GOBankingRates spoke with Jamie Hopkins, CEO of Bryn Mawr Trust Advisors and chief wealth officer for WSFS Bank. He is also a financial services industry advocate, a Wall Street Journal best-selling author, and founder of the FinServ Foundation, a nonprofit dedicated to helping college students reach their full potential through coaching, mentorship and community.

Breaking Down the Differences: Traditional 401(k) vs. Roth 401(k)

Hopkins said it’s a little “misleading” to think of Roth and traditional 401(k) plans as entirely separate savings vehicles. They’re fundamentally the same type of account — employer-sponsored retirement plans — but they differ in how your contributions and withdrawals are taxed.

A traditional 401(k) is an employer-sponsored retirement savings plan that allows for salary-deferral contributions from employees and matching contributions from employers. That means you put money into this type of account before you pay taxes on it, which reduces your taxable income in the year you contribute. You then pay taxes on the money when you withdraw it in retirement.

A Roth 401(k), in contrast, is funded with after-tax dollars. Hopkins explained, “This means taxes are paid before the money is contributed to your retirement account.”

The major benefit of a Roth 401(k) is that the money grows tax-free, instead of tax-deferred. Withdrawals in retirement are also tax-free, as long as two conditions are met:

- The account must be open for at least five years

- The withdrawal must occur after a qualifying event, typically reaching age 59½

“While there are other slight differences, the core distinction between a Roth account and a tax-deferred traditional account is when you pay taxes,” Hopkins said.

Read Next: Suze Orman: 4 Tips To Protect Your Finances in Retirement

Mitigating Taxes on Social Security and Medicare

One of the best reasons to open a Roth 401(k) is to get your taxes out of the way before retirement, Hopkins said. Doing so can reduce your taxable income in retirement, and may also help you avoid or minimize taxes on Social Security and reduce your Medicare premiums.

“If most of your income outside of Social Security comes from a Roth account, you may be able to avoid taxation on Social Security benefits and stay within the lowest Medicare premium tiers,” he explained.

Traditional 401(k) withdrawals, on the other hand, defer your taxes on the front end and place the burden of taxation on you in retirement — increasing your overall taxable income at a time when you’d prefer to keep it low. This could mean paying higher Medicare premiums, partial taxation of Social Security benefits and reduced eligibility for need-based programs like Medicaid.

Key Advantages of a Roth 401(k)

If you’re still not quite sure which one to go with, here are some of the standout benefits of a Roth 401(k), according to Hopkins:

Tax Diversification: Having money spread across taxable, tax-deferred, and tax-free (Roth) accounts gives you more flexibility. Hopkins emphasized that tax diversification helps you manage changing tax rates throughout retirement. “If tax laws or your personal situation shift, you’ll have more control over how and when you pay taxes,” he said.

No RMDs for Roth IRAs: While Roth 401(k)s are subject to required minimum distributions (RMDs) beginning at age 73, you can avoid those by rolling your balance into a Roth IRA before that age. “This gives you more control over when you withdraw funds and allows your money to continue growing tax-free,” Hopkins said.

Greater After-Tax Savings Power: On an after-tax basis, Roth contributions may give you more net retirement income. For example, if you contribute $5,000 pre-tax into a traditional 401(k) and your tax rate is 20%, you’d end up with $4,000 after taxes at withdrawal. If you contribute $5,000 after-tax into a Roth 401(k), the full $5,000 can be withdrawn tax-free.

However, it would have taken $6,250 in pre-tax income to net that $5,000 in a Roth — so it’s important to understand the real trade-offs.

Deciding if a Roth 401(k) Is Right For You

When weighing whether a Roth 401(k) is the right fit for your retirement strategy, Hopkins recommends asking the following:

- Do you want to hedge against future tax increases? If so, contributing to both Roth and traditional accounts can provide protection and flexibility.

- Do you want more control over when to take distributions in retirement and potentially avoid RMDs? If yes, consider the Roth.

- Do you expect your personal tax rate to rise over time — due to income growth, policy changes, or reduced deductions? Paying taxes now via Roth contributions might be the better choice.

“On the flip side, if you expect to be in a lower tax bracket in retirement, deferring taxes with a traditional 401(k) may be more advantageous,” Hopkins noted.

If you’re still not decided, don’t stress about choosing between the two accounts. “At the end of the day, the most important thing is to save and invest consistently,” Hopkins said. “There’s no perfect answer.” He often advises splitting contributions between both types of accounts to enjoy the benefits and flexibility of each.

This article is part of GOBankingRates’ Top 100 Money Experts series, where we spotlight expert answers to the biggest financial questions Americans are asking. Got a question of your own? You could win $500 just for asking — learn more at GOBankingRates.com.

More From GoBankingRates

- I'm an Economist: Here's When Tariff Price Hikes Will Start Hitting Your Wallet

- 3 Little-Known Social Security Rules That Could Save You Thousands

- 5 Cities You Need To Consider If You're Retiring in 2025

- 3 Advanced Investing Moves Experts Use to Minimize Taxes and Help Boost Returns

This article originally appeared on GOBankingRates.com: The Retirement Account That Could Cut Your Taxes — Forever, According to a CFP