/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)

The promise of quantum computing has been on the horizon for decades. Today, however, the race has accelerated.

Quantum computers use quantum bits (qubits) to achieve exponential processing power, compared to other computers, which process information in bits (either zero or one). With advances in hardware, networking, artificial intelligence (AI), and commercialization, the global quantum computing market is getting closer to being a $12.6 billion market by 2032. This has piqued investors’ interest in this emerging technology.

Which companies will lead the race ahead? Let’s find out.

Quantum Computing Stock #1: IonQ

With a market cap of $11.9 billion, IonQ (IONQ) is a pure-play quantum computing company that designs, builds, and operates quantum computers. The company’s goal is to make quantum computing practical and commercially viable, while also laying the groundwork for future quantum networks.

While IONQ stock is down 11% year to date, it has returned 410% over the past year.

In the second quarter, the company reported revenue of $20.7 million, which was 15% higher than expected. The highlight of the quarter was the $1 billion equity investment closed in July, representing the largest single investment in quantum computing and networking history. This financing increased IonQ’s pro forma cash balance to $1.6 billion, giving it the financial flexibility to carry out its aggressive expansion plans. However, it raised concerns about share dilution and the timeline for profitable growth.

At the same time, IonQ is investing heavily in growth. In the second quarter, R&D spending increased by 231% year on year to $103.4 million, reflecting significant investment in scaling quantum networking and computing capabilities. This resulted in a net loss of $177.5 million, although management stressed that this was due to strategic scaling rather than operational weaknesses.

Besides the U.S., IonQ is rapidly expanding its global presence through strategic partnerships with Japan and South Korea. Aside from government collaborations, IonQ highlighted a 20x speedup in quantum-accelerated drug development with AstraZeneca (AZN), Amazon’s (AMZN) AWS, and Nvidia (NVDA), combining hardware access with hybrid workflows.

Furthermore, IonQ’s acquisitions of Lightsynq, Oxford Ionics, and Capella Space Corporation provide the foundation for the industry’s most ambitious quantum roadmap. The company aims for 800 logical qubits by 2027, with an ambitious goal of 80,000 logical qubits by early 2030. For 2025, IonQ increased its full-year revenue guidance to between $82 million and $100 million, in line with consensus estimates. Analysts further project revenue increase of 87% to $170.9 million in 2026.

Looking ahead, IonQ’s long-term goals go far beyond selling standalone quantum computers. Management described the company’s vision as a seamlessly connected quantum ecosystem in which quantum processors, sensors, and communication endpoints interact securely across terrestrial and space networks.

CEO Niccolo de Masi emphasized that IonQ has a competitive advantage derived from decades of R&D and vertical integration, allowing it to lead as the industry transitions from theory to commercialization. He stated, “We were first to operate on all three of the Google, Amazon, and Microsoft public clouds five years ago. Looking forward, we believe our unit economic advantages will underpin IONQ’s long-term market share leadership.”

With a fortified balance sheet, an expanding global presence, and a growing ecosystem of commercial and government partners, IonQ is positioning itself to be a clear leader in this field.

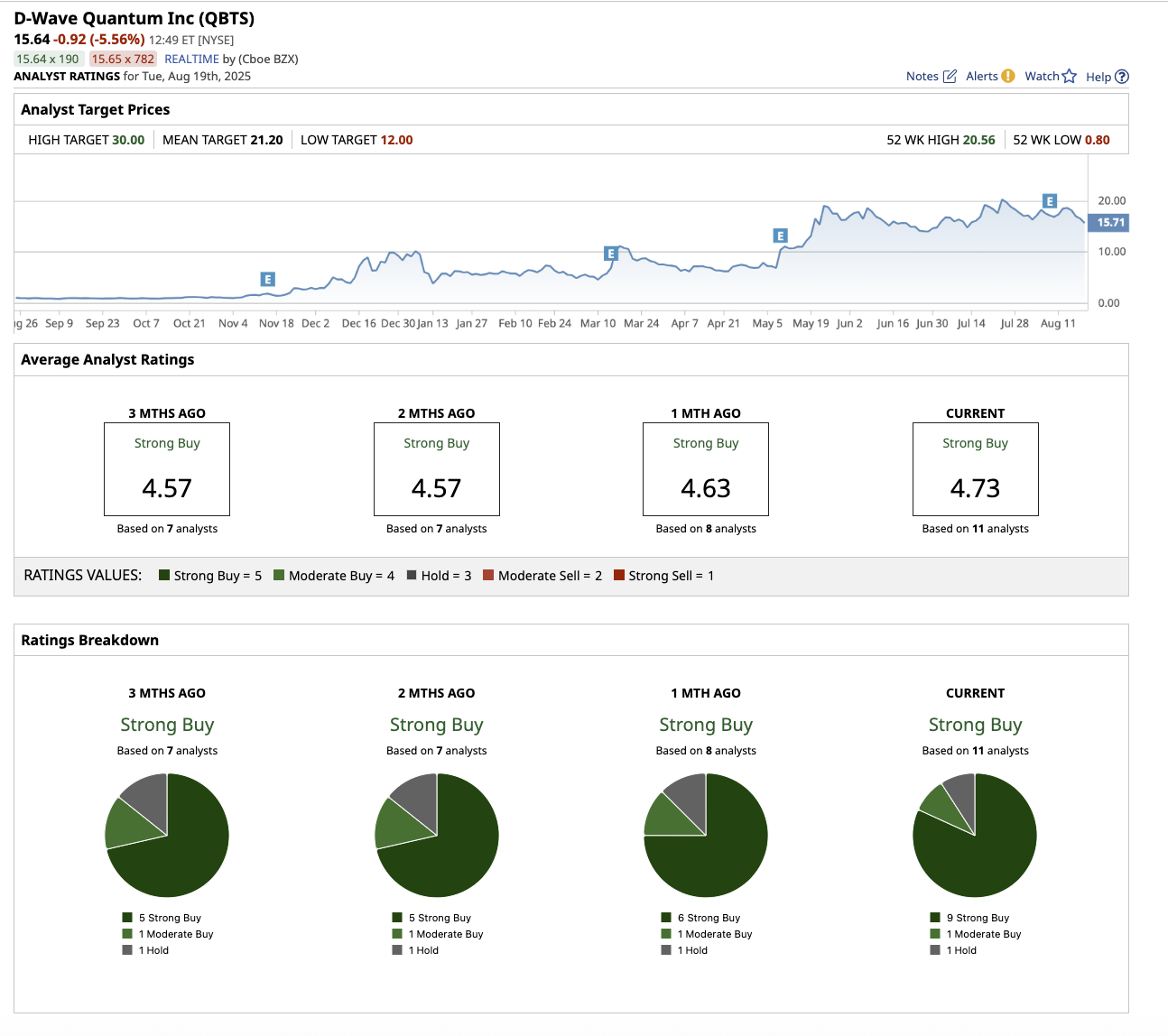

Overall, on Wall Street, IONQ is a “Moderate Buy.” Among the eight analysts covering IONQ stock, four rate it a “Strong Buy,” one gives it a “Moderate Buy” rating, while three suggest a “Hold.” Its average price target of $49.57 suggests the stock can rally 36% from current levels. The high price estimate of $70 implies upside potential of 94% over the next 12 months.

Quantum Computing Stock #2: D-Wave Quantum

Valued at $5.7 billion, D-Wave Quantum (QBTS) is a quantum computing company that takes a very different approach than most other players in the industry. Instead of developing gate-based quantum computers like IonQ, IBM, or Google, D-Wave focuses on quantum annealing, a technique used to solve optimization problems.

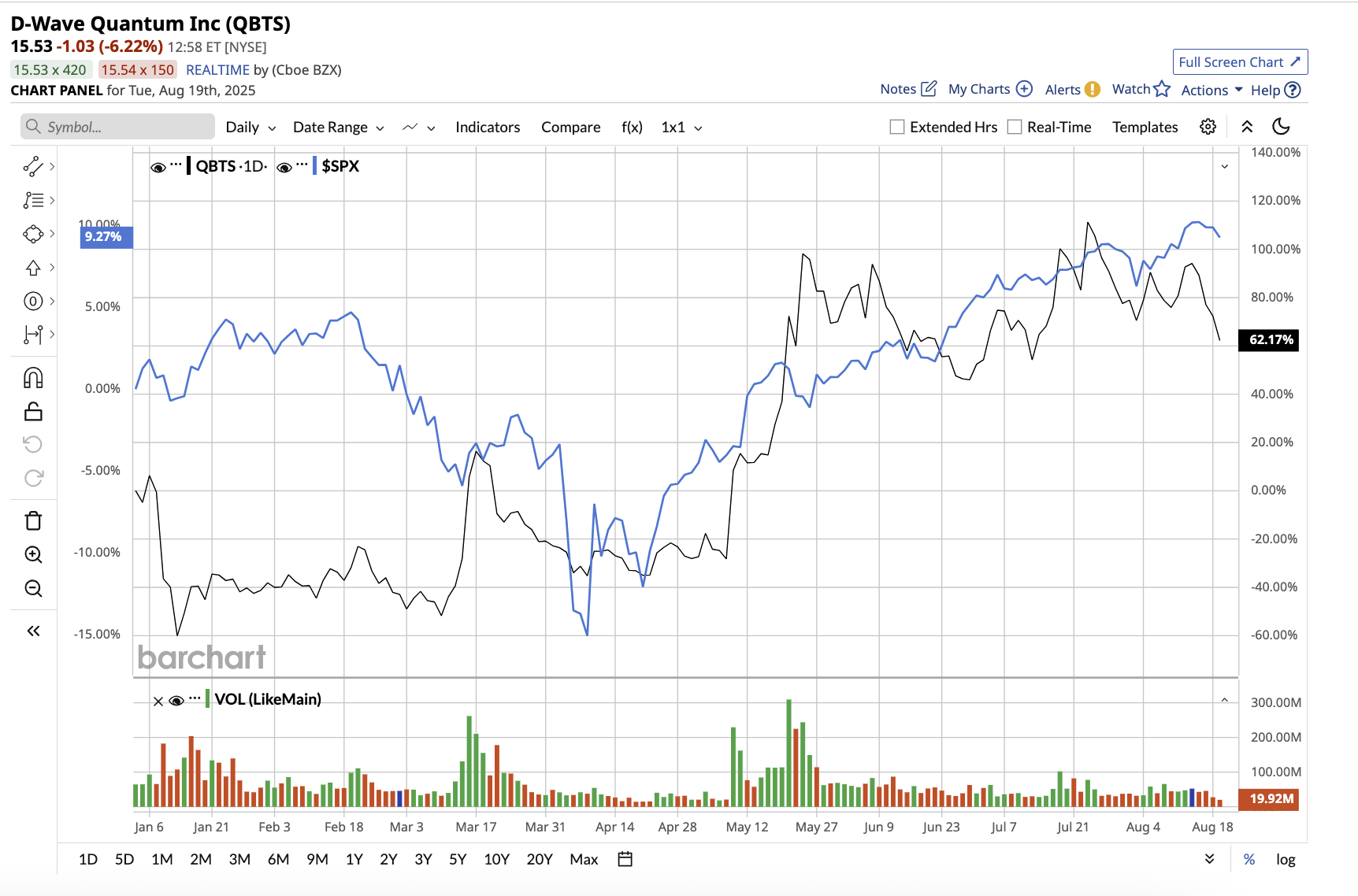

D-Wave stock has surged 84% year-to-date, outperforming the broader market. The stock has also returned an eye-catching 1,567% over the past year.

Customers can access D-Wave’s quantum computers via the Leap cloud platform, which provides real-time access to its most recent machines, such as the Advantage system with over 5,000 qubits.

In the second quarter of fiscal 2025, total revenue came in at $3.1 million, up 42% year-over-year. A key contributor to this increase was $1 million in revenue from the Advantage2 quantum processing unit (QPU) upgrade at the Jülich Supercomputing Center. Bookings surged as well, totaling $1.3 million, a 92% increase from the prior-year quarter. Adjusted gross margin stood at 71.8%, down slightly from 73.1% in the year-ago period.

D-Wave emphasized that its growing sales pipeline is increasingly dominated by large enterprises and Global 2000 companies. Over the last four quarters, D-Wave has collaborated with over 100 revenue-generating customers, including nearly two dozen Forbes Global 2000 firms from the commercial, government, and research sectors. Given its aggressive R&D spending, the adjusted net loss stood at $25.3 million, compared to $20 million a year earlier.

One of the quarter’s highlights was D-Wave’s record cash balance of $819.3 million, which was fueled by $400 million raised from the company’s fourth at-the-market equity program and $99.3 million from warrant exercises, among other things. Despite increased net losses, management emphasized that D-Wave is poised to be the “first independent publicly held quantum computing company to achieve sustained profitability.”

Interestingly, the company believes it can accomplish this with significantly less funding than its competitors, owing to its hybrid business model of quantum cloud services, system sales, and expanding enterprise partnerships. Analysts predict a revenue increase of 178.2% in fiscal 2025, followed by a 55.9% increase to $38.3 million in fiscal 2026.

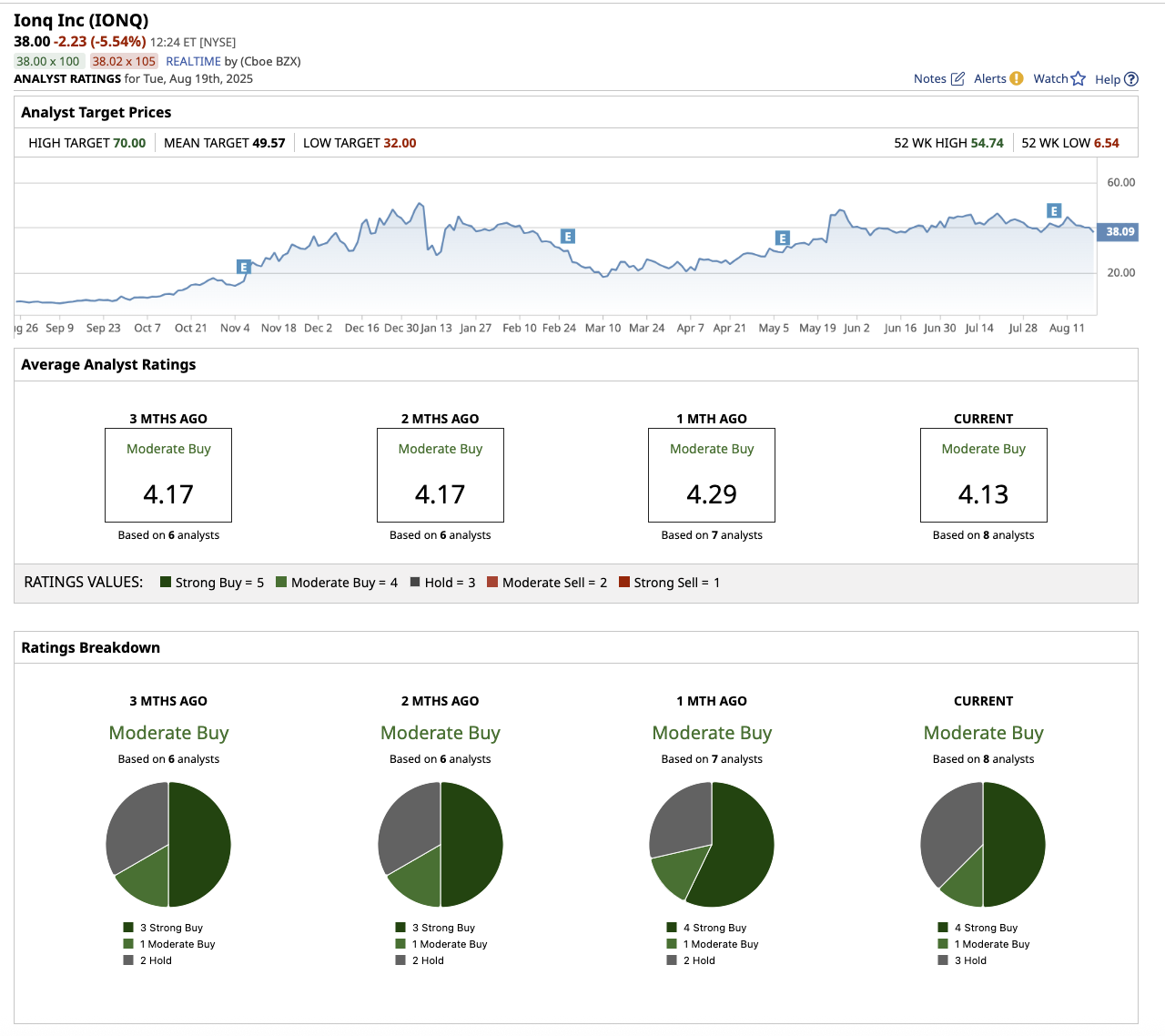

Overall, Wall Street rates D-Wave’s stock a “Strong Buy.” Among the 11 analysts covering the stock, nine rate it a “Strong Buy,” one rates it a “Moderate Buy” and one says it is a “Hold.” The stock’s average target price of $21.20 suggests upside potential of 39% from current levels. Plus, its high-end estimate of $30 suggests it has the potential to rally up to 96% over the next 12 months.