/An%20image%20of%20a%20hand%20holding%20a%20smartphone%20with%20the%20Pinterest%20logo%20and%20app%20background_%20Image%20by%20FellowNeko%20%20via%20Shutterstock_.jpg)

Pinterest (PINS) has had a roller coaster of a year with volatility around its quarterly earnings reports. The volatility has had a lot to do with overpromising and underdelivering, something quite common with companies looking to come out of the shadows of larger competitors, as PINS does in the form of other social media giants like Meta Platforms (META) and Google (GOOGL). The Q2 earnings report at the beginning of August acted as a reality check, as the company was unable to beat EPS expectations despite comfortably winning on the revenue front. The operational challenges and high expectations have brought the stock down in the last couple of months, but this is precisely what makes the stock worth another look.

The recent developments surrounding TikTok’s ownership are expected to disrupt social media giants. Disruptions like these allow smaller, more nimble players to use the opportunity and adjust quickly to changing trends. Pinterest stands on the cusp of such an opportunity, and if recent management news and analyst ratings are anything to go by, the stock is setting itself up for a rally that could help it stand right alongside Magnificent 7 stocks.

About Pinterest Stock

Pinterest is a social media company based in San Francisco, California. Users turn to Pinterest when they seek visual inspiration, such as a unique design for their living room, a recipe, or a new outfit. This allows the company to connect these users to the right businesses, thus generating advertising revenue.

Despite being slightly down in the last 52 weeks, the stock is up nearly 10% for the year to date, a slight underperformance against the S&P 500 Index’s ($SPX) 14% gain.

Pinterest trades at a forward price-earnings ratio of 44.53x, well above that of both Meta Platforms (META) at 25.3x and Alphabet (GOOGL) at 24.7x. However, it is undervalued when considering the price-sales ratio, where it stands at 5.85x compared to META’s 10.89x and GOOGL’s 8.49x.

The fact that investors are willing to pay a higher P/E ratio compared to META and GOOGL suggests the AI investments are expected to bear fruit. Once that starts to trickle down to the bottom line, things will get interesting for Pinterest.

What also makes the stock attractive despite the higher P/E ratio is the fact that it has previously traded much higher. Pinterest’s 5-year average forward P/E ratio stands at 59.48x. Similarly, the P/S ratio is trading at a 45% discount to the 5-year average. The price-cash flow ratio stands at a staggering 85% discount to the 5-year average. Investors in the past have paid much higher multiples for this stock, and with the AI implementations underway, it won’t be a surprise if those multiples make a comeback.

Pinterest Misses EPS targets

On Aug. 7, Pinterest announced its Q2 results, comfortably beating revenue estimates while narrowly missing the EPS target. Q2 revenue was up 17% year over year to $998 million. With free cash flow of $197 million in the second quarter, the company ended the first half of the year with $2.7 billion in cash and cash equivalents.

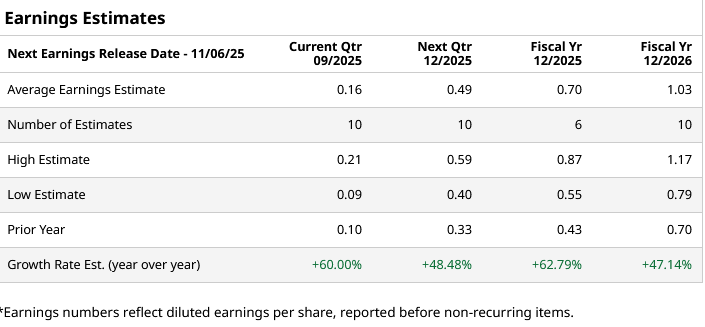

The Q3 revenue guidance was $1.043 billion at the midpoint. This translates to 16% YoY growth. While EPS in the last two quarters have been modest, earnings are about to kick off in the second half of the year, with massive earnings growth expected over the next two quarters. The trend is likely to continue beyond that point as well.

The EPS growth will come on the back of AI initiatives, and the earnings call was full of optimism on that point. The CEO emphasized the integration of large language models to improve user experience, resulting in a 2.3% improvement in the search fulfillment rate. The highlight was the announcement of an Instacart (CART) integration, a step that will make Pinterest ads directly shoppable in a few clicks. Just over two weeks ago, Instacart CFO Emily Reuter joined the board of directors at Pinterest, a clear sign that the two companies are willing to work together in the long run. The company’s monthly active users continue to climb, ending at 578 million by the end of the quarter.

With a growth rate of 11%, Pinterest is reaching a point where comparisons with the bigger social media players will start, and that’s where it can really capitalize and challenge the Magnificent 7 social media giants.

What Do Analysts Expect for Pinterest Stock?

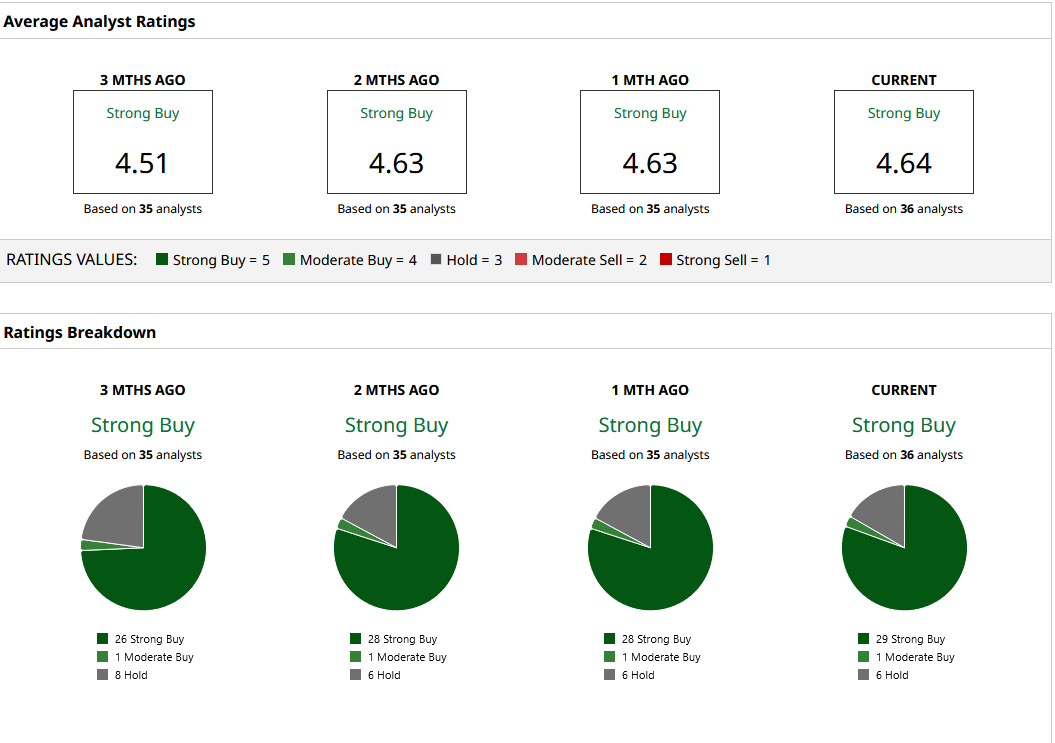

Of the 36 analysts who have assigned a rating to PINS, 29 have a “Strong Buy” rating. This is consistent with the company’s prospects. Just two days ago, Mizuho analysts were the most recent upgrade shares, citing the same theme as many others: artificial intelligence developments broadening the addressable market and increasing monetization.

The mean target price of $43.62 offers 39% upside from current levels. The highest target price of $51 implies about 60% upside. Considering how quickly sentiment around AI stocks can change and how Pinterest earnings are about to take off, it won’t be surprising if the stock rallies way past the highest price target.