/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

Alibaba (BABA) is entering a pivotal week as China's "Super Golden Week" holiday unfolds from Oct. 1-8. This eight-day break is the most significant consumer spending event in China's calendar, with an estimated 2.4 billion journeys expected during the period.

Indicators gauging activity show record-breaking activity, as Alibaba's Amap navigation service registered a record-breaking 360 million daily active users on the holiday's first day.

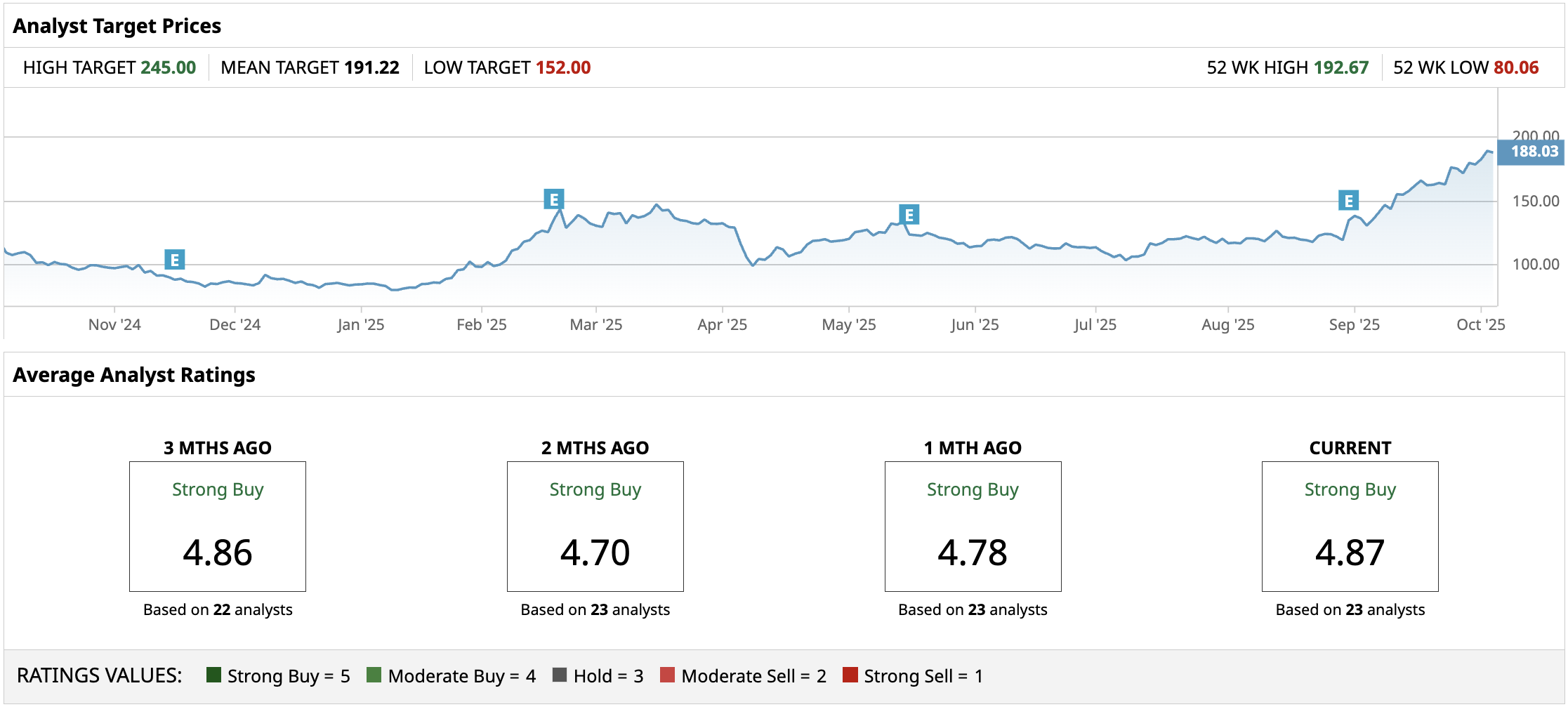

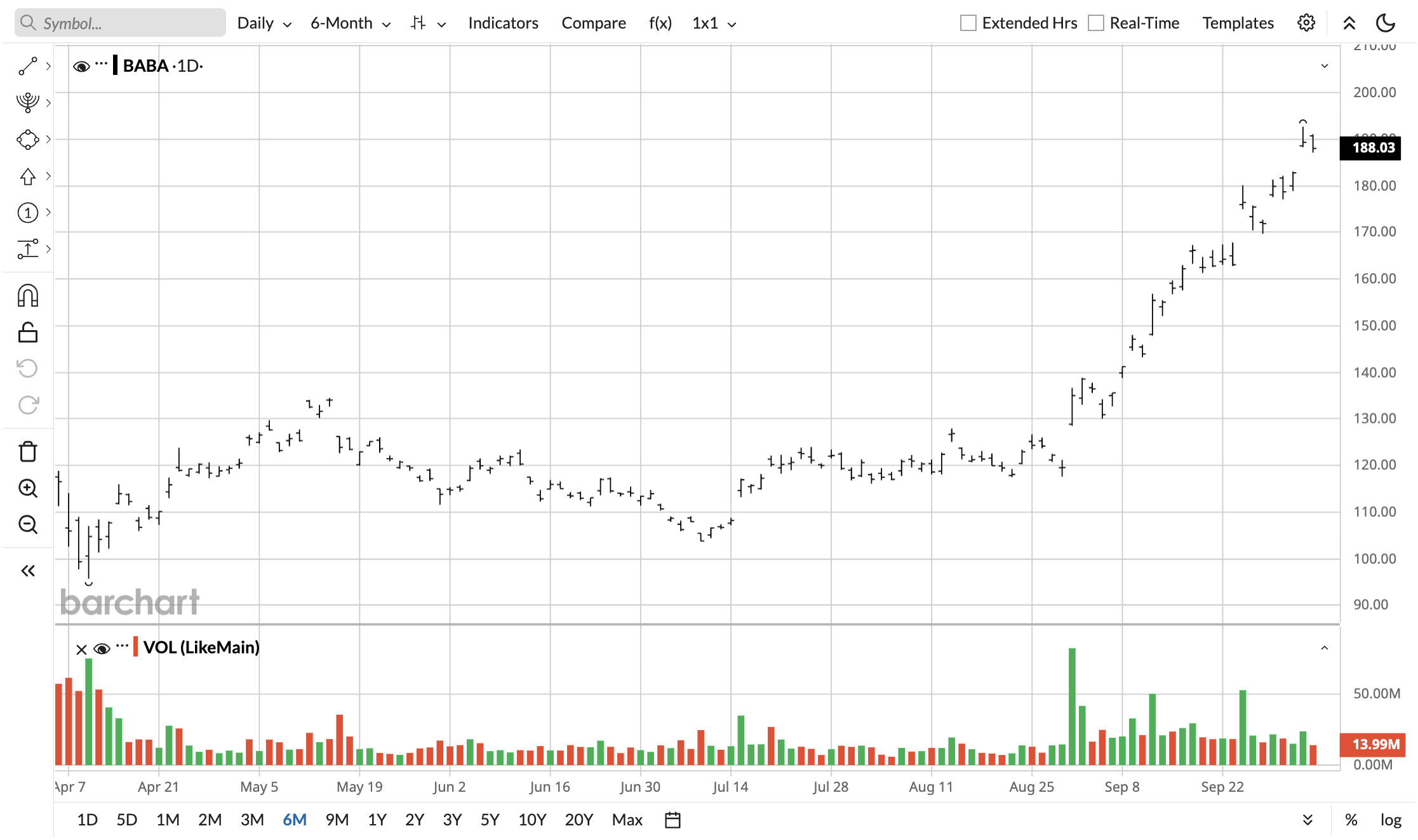

BABA stock has delivered muted gains over the past few years after declining significantly from 2020 to 2022 before trading sideways afterward. It has been recovering quickly in 2025 and is finally pulling off a sustained rally.

China's "Golden Week" Boost

Customer appetite is being validated as Alibaba's ecosystem is seeing record traffic. The previously mentioned mapping navigation platform hit 360 million daily active users on Oct. 1. This is the service's highest single-day usage in history.

Additionally, there is an ongoing travel boom across China, and customers are using AI-powered features to navigate and find help while traveling.

And it's not just mapping. Golden Week 2025 is expected to generate substantial retail activity across Alibaba's e-commerce platforms like Taobao and Tmall. China's Ministry of Transport anticipates 2.4 billion total journeys during the holiday.

Railway travel set records on the first day, and popular tourist destinations sold out accommodations days in advance. This mobility surge directly benefits Alibaba's retail ecosystem, as increased domestic travel historically correlates with heightened shopping activity.

Long-Term AI Tailwind

AI has turned into a long-term tailwind for Alibaba as Alibaba Cloud revenue surged 26% year-over-year (YoY) to RMB 33.4 billion (~$4.7 billion) in calendar Q2 2025. The prior quarter saw growth at 18% YoY.

Cloud computing and AI are now spearheading the company's growth.

AI-specific revenue growth is even more impressive, as management disclosed that it has been growing at triple-digit percentage rates for the past two years.

Alibaba is doubling down on this success by committing another $50 billion to developing AI.

Should You Buy BABA Stock Now?

Alibaba's most significant issue has been growth for a very long time. BABA stock traded at bargain-basement prices as analysts saw no rationale behind paying a premium for a company struggling to grow even at 2% annually.

However, the market now sees AI as Alibaba's panacea.

The heavy investments in AI are translating over into double-digit growth, pushing total revenue growth to 13.14% YoY in Q2. Future quarters may lead to even more growth as Alibaba's Qwen models rank among the best AI models. More importantly, the Chinese market prefers to use domestic models, and Alibaba is a convenient choice.

The current surge seems far from over, as Alibaba has plenty of ground left to make up. BABA stock may surge well beyond previous highs as the market adds a fat AI premium to it, just like it is doing to AI companies in the West.

Analyst optimism is strengthening, with the mean price target at $191.2. This implies almost flat upside, but the momentum is sure to cause analysts to bump up their targets if the holiday season turns out well for Alibaba.