Mortgage rates in the United States have soared in 2022, helping to cool housing demand from home buyers. However, new risks are facing mortgage-backed securities (MBS) holders as well.

The vast majority of residential mortgages in the U.S. are securitized through the agency MBS market, which is the second-largest debt market in the U.S. behind U.S. Treasuries. The total MBS market rose to more than $12 trillion in 2021. Banks alone have added $1.3 trillion in MBS over the last five years.

Today the MBS market is facing a few serious headwinds, including regulatory changes requiring increased trading margin, a widening mortgage/treasury basis, and a Federal Reserve unwinding its balance sheet.

Banks Cut MBS Holdings

According to BMO Capital Markets, total sales of fixed-rate mortgage bonds by government-baked entities like Freddie Mac and Fannie Mae will nearly halve in 2023 to around $300 billion from an estimated $550 billion in 2022.

This will hurt the value of MBS, bundles of mortgage loans whose value largely depends on the housing market's performance.

Banks typically sell MBS to investors in the secondary market, taking a slice or "discount" as a profit margin. Amid rising risks in the past year, they have cut their MBS exposure.

Specifically, they have slashed their holdings by roughly $100 billion to $2.8 trillion as of November 2022, according to Ethan Heisler, the strategic advisor at bond rating agency KBRA.

As the Fed continues to raise interest rates, prices in the $8.7 trillion agency or government-backed MBS market could fall further, prompting financial institutions to trim their balance sheet to stem losses, analysts said.

Historic Volatility

The market is grappling with historic uncertainty surrounding Fed rates, but also about the extent to which the Fed will continue to unwind its $2 trillion fixed-income balance sheet. Currently, $35 billion of MBS is scheduled to roll off the balance sheet each month.

"There is a lot of uncertainty about the Fed," said Heisler. "I started my career in 1981 when Chairman Volcker was in office, and rates were 20%. There was a lot of volatility surrounding Fed policy. We are back to those days.”

Moreover, “No one really knows what will happen with inflation, how high rates will have to go up before the economy starts showing signs of strain,” he added.

John Coleman, senior vice president at fixed-income brokerage RJ O’Brien, said the Fed’s quantitative tightening (QT) is causing headaches for market participants as fears grow it will sell more MBS than initially thought, further depressing prices.

“Investors are in a conundrum," said Coleman. "That is why you continue to see prices trending so low."

Meanwhile, the QT program has triggered a liquidity crunch with analysts saying that while MBS are cheap, they will likely get cheaper, encouraging buyers to remain on the sidelines.

Stumbling Housing Market

Calls that the $44 trillion housing market will contract further are adding spice to an already heady cocktail.

In a recent research note, Bright MLS said housing prices could fall another 10% next year as an affordability crisis offsets low inventory levels. Home sales could reach a nine-year low of 4.87 million, it added.

Still, Coleman doesn't expect housing price declines will mirror those of the late-2000s mortgage debacle when they plunged as much as 30%.

“Most people that own homes have some amount of equity, with their home value greater than the loan to repay so they have a better buffer,” said Coleman. “This is unlike the 2008-2009 crisis where all of a sudden people were facing negative equity.”

New TBA Futures to Hedge Risk

In October, CME Group introduced new 30-year UMBS TBA futures to help market participants pare their MBS risk.

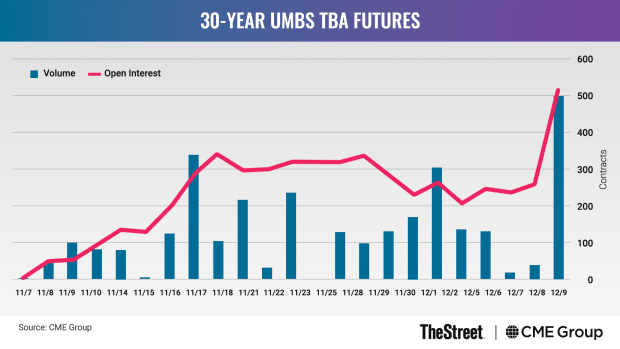

So far, trading has been strong with volumes nearing 300 contracts per day and open interest surpassing 500 contracts, according to Eric Leininger, executive director of financial research and product development at CME Group.

The new futures, for which 5.5% and 6%-coupons were rolled out on December 12, provide participants, notably non-banks with typically high financing costs, with a chance to lower their margin costs.

“Non-banks can be divided into two business lines, loan originators and servicers," Leininger explained. "Servicers typically hedge risks with a treasury future, paying margin to CME Group. But originators usually sell TBAs. Instead of doing that, why not do so through TBA futures? In this way, they can have long and short CME futures products so their overall margin requirements and fees come down."

Added Leininger: "That's really important in this market because as interest rates go higher a lot of hedging and margin will be required for non-banks."

Diverse Use Case

Investors holding MBS pools who may be concerned about the physical securities underlying them can also use TBAs to cut their risk.

For instance, "if you have $1 billion of MBS and you want to take 10% of that risk off the table, you can sell $100 million of TBAs to do so without having to sell the securities," Coleman noted.

"To do this before TBAs existed, people could sell a treasury or swap future," he continued. "But the problem is that while those instruments are somewhat correlated to the mortgage market. They are not actual MBS futures. TBAs are a better and more accurate hedging tool."

As the Treasury versus MBS spreads have widened (at one point reaching 150 bps), other investors may seek to profit from this gap.

"If you are a pension fund, you may want to benefit from these wide spreads, not with securities (such as MBS), but with mortgages," said Coleman. "If you have 50% of your portfolio in treasuries and say 20% in mortgages, you can sell treasuries and buy TBA futures to increase your exposure without trading in and out of physical securities," he explained further.

Volatility a Concern

In the OpenMarkets Roundtable discussion above, Heisler cites volatility as the market-wide concern he is watching most and could affect the mortgage market in 2023.

“Who would have imagined seeing the one-month – 10-year as an inverted curve?” he said, referring to the treasury yield curve covering short- to long-term expirations. “We’ve not seen anything close to this kind of market for this length of time. I think it paralyzes investors from making longer-term decisions.”